The bond market and stock market have both been anxiously awaiting the announcement from the FOMC and a conference from Ben Bernanke after the Fed’s two-day meeting. Perhaps the markets have been waiting too much for the information. It was in 2012 that the parameters were set for 6.5% unemployment, stable growth, and inflation not expected to remain above 0.5% higher than the 2.0% Fed-driven inflation target. Inflation is tame, unemployment is over a point above the target, and the real underlying recovery remains weak by most measurements. So all of the talk of tapering bond purchases seemed premature even though the voices behind the scenes kept getting louder.

The statement showed that the vote was 10-2 to keep the current policy static. The Fed will keep $85 billion in purchases, but said that this could change ahead if the economic situation requires more or less stimulus. Esther George dissented and James Bullard joined in as a dissenting vote.

The start of the statement remains one that is full of caution with optimism: “Information received since the Federal Open Market Committee met in May suggests that economic activity has been expanding at a moderate pace. Labor market conditions have shown further improvement in recent months, on balance, but the unemployment rate remains elevated. Household spending and business fixed investment advanced, and the housing sector has strengthened further, but fiscal policy is restraining economic growth. Partly reflecting transitory influences, inflation has been running below the Committee’s longer-run objective, but longer-term inflation expectations have remained stable.”

Here are some basic notes:

- the Committee decided to continue purchasing additional agency mortgage-backed securities at a pace of $40 billion per month and longer-term Treasury securities at a pace of $45 billion per month.

- maintaining its existing policy of reinvesting principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities and of rolling over maturing Treasury securities at auction.

- economic growth will proceed at a moderate pace and the unemployment rate will gradually decline toward levels the Committee judges consistent with its dual mandate.

- The Committee will continue its purchases of Treasury and agency mortgage-backed securities, and employ its other policy tools as appropriate, until the outlook for the labor market has improved substantially in a context of price stability. The Committee is prepared to increase or reduce the pace of its purchases to maintain appropriate policy accommodation as the outlook for the labor market or inflation changes.

- Committee decided to keep the target range for the federal funds rate at 0 to 1/4 percent and currently anticipates that this exceptionally low range for the federal funds rate will be appropriate at least as long as the unemployment rate remains above 6-1/2 percent, inflation between one and two years ahead is projected to be no more than a half percentage point above the Committee’s 2 percent longer-run goal.

- When the Committee decides to begin to remove policy accommodation, it will take a balanced approach consistent with its longer-run goals of maximum employment and inflation of 2 percent.

Here are the full economic projections out to 2015 from the Fed, and we have some forecasts here:

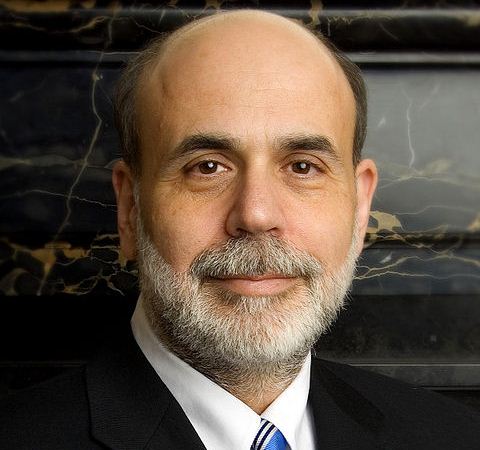

Ben Bernanke’s press conference is where investors will likely be paying the most attention this afternoon.

Ahead of the meeting, volatility has returned as the DJIA had been up or down by over 100 points in roughly three-quarters of the last month’s worth of trading session. Shortly before the FOMC statement was released the market levels were as follows:

- S&P 500 down 1.59 at 1,650

- DJIA down almost 20 points at 15,298

- 10-Year Treasury yield up basis points at 2.212%

- Gold up $5.70 at $1,372.40

- WTI NYMEX Crude -$0.06 at $98.38

It’s Your Money, Your Future—Own It (sponsor)

Are you ahead, or behind on retirement? For families with more than $500,000 saved for retirement, finding a financial advisor who puts your interest first can be the difference, and today it’s easier than ever. SmartAsset’s free tool matches you with up to three fiduciary financial advisors who serve your area in minutes. Each advisor has been carefully vetted and must act in your best interests. Start your search now.

If you’ve saved and built a substantial nest egg for you and your family, don’t delay; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.