Economy

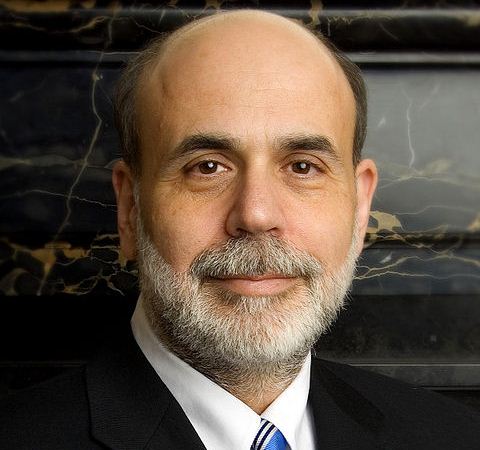

Ben Bernanke Delivers Calming Testimony on QE End and Tapering to Congress

Published:

Last Updated:

Federal Reserve Chairman Ben Bernanke is testifying in his semiannual report to the Congress on Wednesday. The stock, bond, commodity and currency markets are trying to find anything new or any hints of wavering from Bernanke’s comments last week. The long and short of the matter is that Ben Bernanke is trying to calm the minds and tempers of financial market participants with the notion that quantitative easing and bond buying will not end any time soon. At the same time, he is outlining the start of tapering and an eventual exit.

Some of Bernanke’s points continue to remain static. He said:

The economic recovery has continued at a moderate pace in recent quarters despite the strong headwinds created by federal fiscal policy. … With unemployment still high and declining only gradually, and with inflation running below the Committee’s longer-run objective, a highly accommodative monetary policy will remain appropriate for the foreseeable future.

Other points are as follows:

FULL BERNANKE PREPARED REMARKS

With the markets having much time before the open, the S&P 500 is up three points and the DJIA is up less than 10 points. We also have the yield on the 10-year Treasury note at 2.51%, and gold is up more than $4 at $1,295 per ounce.

The average American spends $17,274 on debit cards a year, and it’s a HUGE mistake. First, debit cards don’t have the same fraud protections as credit cards. Once your money is gone, it’s gone. But more importantly you can actually get something back from this spending every time you swipe.

Issuers are handing out wild bonuses right now. With some you can earn up to 5% back on every purchase. That’s like getting a 5% discount on everything you buy!

Our top pick is kind of hard to imagine. Not only does it pay up to 5% back, it also includes a $200 cash back reward in the first six months, a 0% intro APR, and…. $0 annual fee. It’s quite literally free money for any one that uses a card regularly. Click here to learn more!

Flywheel Publishing has partnered with CardRatings to provide coverage of credit card products. Flywheel Publishing and CardRatings may receive a commission from card issuers.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.