Another month has started, and another report from the Federal Reserve is out to give investors new reason to cheer or shudder from much of the same observations that have been known for weeks now. Wednesday brought the so-called Beige Book from the Federal Reserve and it was prepared by the San Francisco Federal Reserve. We would highlight here that the data was collected on or before August 26, 2013.

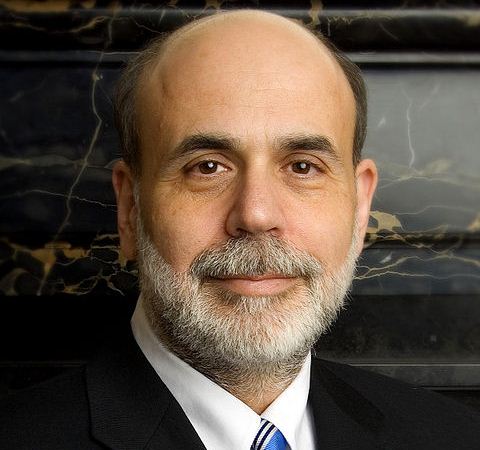

This is likely going to be one of the last Beige Books under the Ben Bernanke-led regime and 24/7 Wall St. wants to signal one key issue here for the Federal Reserve in the years ahead. We do not think that the public, whether a Main Street consumer or a well-to-do Wall Street professional, can really differentiate between the constant uses of “moderate” versus “modest” in the references. Sure, there is a slight variation when the two terms are used together or in comparison, but it is actually much closer than comparing the terms “decimated” and “destroyed” which are now improperly interchanged by the media and public.

The combined reports from the twelve Federal Reserve districts showed that the broad economy continued to expand at a modest to moderate pace in the period of early-July through late-August. Before you get too excited, some eight of the Fed districts characterized growth as moderate. Of the other four districts, it was modest growth reported by Boston, Atlanta, and San Francisco. Chicago indicated that its general business activity had improved.

Some general comments were as follows:

- Consumer spending was said to be up with strong demand for automobiles and housing-related goods.

- Travel and tourism sector expanded in most areas.

- Nonfinancial services demand for professional and transportation services increased slightly.

- Manufacturing expanded modestly.

- Residential real estate activity increased moderately in most Districts, with demand for nonresidential real estate gaining in total.

- Lending activity was mixed, with lending standards largely unchanged even while credit quality improved.

- Demand for agricultural products was strong during the reporting period even with conditions and production in some areas weak due to extreme weather.

- Demand for natural resource products was stable or up slightly, and extraction increased in anticipation of further demand growth.

- Hiring “held steady or increased modestly relative to the prior reporting period” for most occupations and industries. Wage pressures continued to be modest overall.

- Upward price pressures remained subdued, and prices increased slightly during the reporting period.

Here is the full Beige Book if you want to see a region by region breakdown. We would point out that the so-called Beige Book is no secret codename. it has often been called The Tan Book historically. The reason for its name is simply the color of its cover.

Take Charge of Your Retirement In Just A Few Minutes (Sponsor)

Retirement planning doesn’t have to feel overwhelming. The key is finding expert guidance—and SmartAsset’s simple quiz makes it easier than ever for you to connect with a vetted financial advisor.

Here’s how it works:

- Answer a Few Simple Questions. Tell us a bit about your goals and preferences—it only takes a few minutes!

- Get Matched with Vetted Advisors Our smart tool matches you with up to three pre-screened, vetted advisors who serve your area and are held to a fiduciary standard to act in your best interests. Click here to begin

- Choose Your Fit Review their profiles, schedule an introductory call (or meet in person), and select the advisor who feel is right for you.

Why wait? Start building the retirement you’ve always dreamed of. Click here to get started today!

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.