In the scheme of things, as far as the size of the economy and the massive amounts of credit capital that wash around the financial markets like a huge ocean, $10 billion a month does not mean a thing. Neither does $20 billion, probably, or even more. Most economists believe that the Federal Reserve will cut its monthly purchases of various kinds of paper by $10 billion. The action may influence the psychology of the markets, but there is really nothing in the change at all.

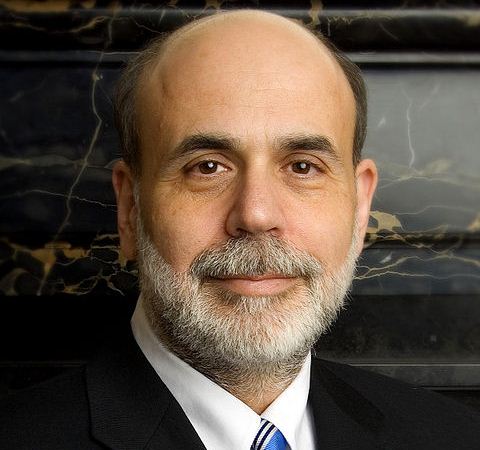

Among the reasons for a decision to cut the bond program is the pressure brought on Chairman Ben Bernanke by his fellow Fed members on the central bank’s board and the presidents of the Fed’s 12 regional “branches.” Ever more of them have pressed Bernanke in public. He probably believes it is time to bow to the changing consensus. There is no reason for him to be implacable in his final months on the job.

Another reason that the $10 billion means so little is that the plan to buy less could be replaced by a plan to buy more. The economy may not keep the course of improvement. Among the things that could push it off track are the fights in Washington over federal government spending. Reuters recently reported:

“It is an important milestone … juxtaposed against five years ago, when the Fed began the huge expansion of its balance sheet,” said Carl Tannenbaum, chief economist at Northern Trust in Chicago. “This is going to be the first step, potentially, in a very, very long walk.”

It is not only the change of direction in the wake that could become different; it is the pace, which could break into a run at any moment.

The consensus among economists and experts on the history and actions of the Fed is that the world’s equity and bond markets will shudder if the Fed changes its $85 billion addiction. The Dow Jones Industrial Average might drop a few hundreds points over several days. Overseas markets could be hurt even more seriously.

Just a few years ago, the Fed took unprecedented actions to drive interest rates toward zero. Apparently, the end of that is beginning. Yet one or two quarters of a future, dangerous move into a new recession will change the plans again — very quickly.

Are You Ahead, or Behind on Retirement? (sponsor)

If you’re one of the over 4 Million Americans set to retire this year, you may want to pay attention.

Finding a financial advisor who puts your interest first can be the difference between a rich retirement and barely getting by, and today it’s easier than ever. SmartAsset’s free tool matches you with up to three fiduciary financial advisors that serve your area in minutes. Each advisor has been carefully vetted, and must act in your best interests. Start your search now.

Don’t waste another minute; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.