Economy

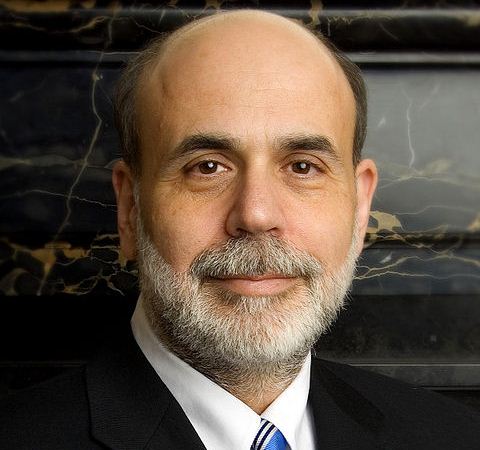

The Real Reason No FOMC Bond Tapering Came from Bernanke

Published:

Last Updated:

We provided live coverage on the matter for about two hours before, during, and after the FOMC announcement, the Fed forecasts, and then in the Ben Bernanke press conference. The long and short of the matter is that the reason that there was not a bond purchase tapering announcement is because the overall members inside the meeting have actually lowered their growth targets ahead on GDP and have marginally increased their unemployment targets since the June forecasts. Inflation is also not being seen as a bogeyman at any point from now out to 2016.

US and global investors will have to content with low rates and some quantitative easing longer than expected. The “central tendency” of Fed members was for a lower range of GDP growth projections, as follows versus the June expectations:

While we have seen gains in jobs, the FOMC does not seem content at all about any great improvement in jobs. The news looks better for this year and next, but higher unemployment is likely to keep rates very low. The new rates under a “central tendency” were as follows versus the June projections:

Inflation was also kept at bay in the forecasts. In fact, There is a very low viewpoint that the inflation targets will remain under the 2% targets. We will have to give it time to see if that holds true or not. Here is a chart in the full FOMC projections.

Now if you would like a light-hearted conspiracy theory on why no tapering has come, that is simple enough. You could argue that if Ben Bernanke is truly out as the Fed Chairman, perhaps any change in policies this late in the game are being left for the new Chairman starting in early 2014.

Another common sense approach is rather simple, and one that comes with a conflict of interest. If Bernanke ends bond buying or if he starts to hike Fed Funds… That drives up borrowing costs for everyone. It also would drive up borrowing costs for the government and then would drive up the cost of carrying our trillions of dollars of debt.

A full snapshot of the FOMC new September outlooks versus June is below.

Retirement can be daunting, but it doesn’t need to be.

Imagine having an expert in your corner to help you with your financial goals. Someone to help you determine if you’re ahead, behind, or right on track. With SmartAsset, that’s not just a dream—it’s reality. This free tool connects you with pre-screened financial advisors who work in your best interests. It’s quick, it’s easy, so take the leap today and start planning smarter!

Don’t waste another minute; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.