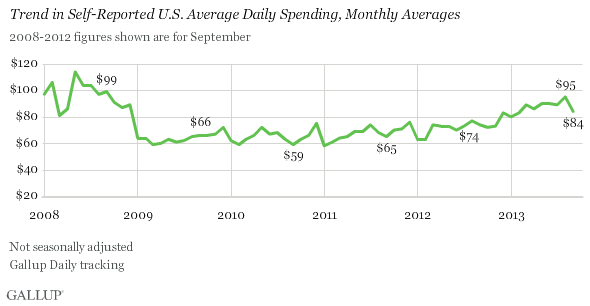

After posting a five-year high in July, consumer spending pulled back in September, according to the latest Gallup self-reporting survey on Americans’ spending habits. The August daily average of $95 fell to $84 in September. The survey asks consumers to say how much they spent, excluding major purchases like houses and cars and routine household bills, and it offers an estimate of discretionary spending.

Gallup noted that September spending typically drops from the August average, but this year’s decline of $11 is considerably larger than usual. In each of the past three years, spending has dropped $3 to $4 in September compared with August.

A spending drop of 9.3% was noted among households with annual income of $90,000 or more. The drop among households with lower annual income was an even larger at 12.1%. According to Gallup, the drop was greatest among households with incomes between $60,000 and $90,000, where August spending of $122 fell to $87, nearly 29%.

As Gallup notes, the spending pullback is connected to Americans’ worries about the overall economy and the then-pending shutdown of the federal government. The longer the shutdown continues, the greater is the chance that October spending will post another sharp decline. Add in the fast-approaching debt limit debate and the situation could turn materially worse.

Because consumer spending accounts for more than two-thirds of U.S. gross domestic product (GDP), the country’s economic recovery could well stall again as it did in 2011 when Republicans and Democrats did not agree until the eleventh hour on raising the federal debt ceiling.

Travel Cards Are Getting Too Good To Ignore (sponsored)

Credit card companies are pulling out all the stops, with the issuers are offering insane travel rewards and perks.

We’re talking huge sign-up bonuses, points on every purchase, and benefits like lounge access, travel credits, and free hotel nights. For travelers, these rewards can add up to thousands of dollars in flights, upgrades, and luxury experiences every year.

It’s like getting paid to travel — and it’s available to qualified borrowers who know where to look.

We’ve rounded up some of the best travel credit cards on the market. Click here to see the list. Don’t miss these offers — they won’t be this good forever.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.