Economy

Economic Confidence Collapses Most Since Lehman Bros. Debacle -- Gallup

Published:

Last Updated:

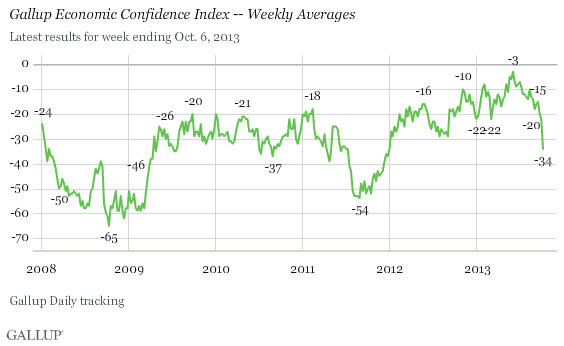

Americans’ confidence in the economy last week fell the most since the week of September 15, 2008, when Lehman Brothers collapsed and set off the global economic crisis. The Gallup economic confidence index plunged to -34 in the week ending October 6, down 12 points from the previous week. The index is at its lowest point since late 2011.

Americans’ confidence in the economy last week fell the most since the week of September 15, 2008, when Lehman Brothers collapsed and set off the global economic crisis. The Gallup economic confidence index plunged to -34 in the week ending October 6, down 12 points from the previous week. The index is at its lowest point since late 2011.

That cannot be a surprise. The shutdown of most federal government offices and the threat that the United States may default on its federal debt combine to send shivers down all but the most implacable spines. In July 2011, during the last impending threat of a U.S. default, the Gallup economic confidence index fell eight points.

While the collapse is serious, Gallup notes that index readings have recovered relatively quickly once the threat passes:

[E]conomic confidence bounced back within several months of the 2011 debt crisis and the downgrading of the U.S. credit rating. Likewise, confidence rebounded within weeks of the sequestration spending cuts that took effect in early March 2013. This suggests that these fiscal debates may not affect consumer confidence in the same long-term negative way that hits to the economy — like the 2008-2009 economic recession — do.

The economic confidence index is comprised of two components: a current conditions index and an index on the outlook for the U.S. economy. Last week, 43% of those surveyed said current conditions are poor, and 67% said the outlook is getting worse. The outlook index now stands at -39, down 17 points from the previous week.

Gallup concludes:

[T]he current budget debate and government shutdown clearly show that partisan brinksmanship and the uncertainty it causes on Wall Street can negatively affect consumer confidence. Thus, Congress’ inability to reach a compromise to end the government shutdown and raise the debt ceiling could negatively affect U.S. stock prices, America’s credit rating, and, ultimately, the nation’s economic recovery.

The last few years made people forget how much banks and CD’s can pay. Meanwhile, interest rates have spiked and many can afford to pay you much more, but most are keeping yields low and hoping you won’t notice.

But there is good news. To win qualified customers, some accounts are paying almost 10x the national average! That’s an incredible way to keep your money safe and earn more at the same time. Our top pick for high yield savings accounts includes other benefits as well. You can earn up to 3.80% with a Checking & Savings Account today Sign up and get up to $300 with direct deposit. No account fees. FDIC Insured.

Click here to see how much more you could be earning on your savings today. It takes just a few minutes to open an account to make your money work for you.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.