The CBO also forecasts a further drop in the deficit for fiscal year 2015, which begins on October 1, 2014. The deficit is forecast at $478 billion, or 2.6% of GDP. The CBO estimates that federal debt held by the public will equal 74% of GDP at the end of the 2014 fiscal year and grow to 79% of GDP by 2024.

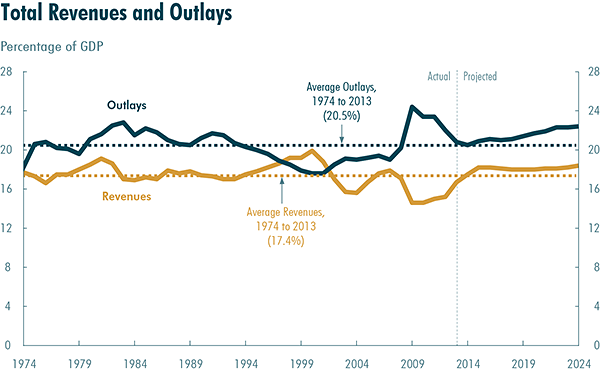

Federal revenues are expected to grow 9% in 2014 to $3 trillion, or 17.5% of GDP. That is slightly higher than the 40-year average. Revenues are forecast to be higher again in 2015, after which they are expected to grow at the same pace as output and average 18.1% of GDP. Here is the CBO’s chart:

After 2015, the annual deficit is forecast to grow because “revenues are expected to grow at roughly the same pace as GDP whereas spending is expected to grow more rapidly than GDP.” The CBO explains:

In CBO’s baseline, spending is boosted by the aging of the population, the expansion of federal subsidies for health insurance, rising health care costs per beneficiary, and mounting interest costs on federal debt. By contrast, all federal spending apart from outlays for Social Security, major health care programs, and net interest payments is projected to drop to its lowest percentage of GDP since 1940 (the earliest year for which comparable data have been reported).

The outlook also calls for unemployment in the United States to remain above 6% until late 2016. GDP is expected to grow at a rate of about 3% annually through 2017, after which “economic growth will diminish to a pace that is well below the average seen over the past several decades.” Inflation (as measured by the price index for personal consumption expenditures) is expected to remain at or below 2% for the next decade, while interest rates are expected to rise to an average of 3.7% in the period between 2018 and 2024 as the economy improves. The CBO also expects rates on 10-year Treasury notes to average 5% during those years.

It’s Your Money, Your Future—Own It (sponsor)

Retirement can be daunting, but it doesn’t need to be.

Imagine having an expert in your corner to help you with your financial goals. Someone to help you determine if you’re ahead, behind, or right on track. With SmartAsset, that’s not just a dream—it’s reality. This free tool connects you with pre-screened financial advisors who work in your best interests. It’s quick, it’s easy, so take the leap today and start planning smarter!

Don’t waste another minute; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.