The FAO said that the lower prices are due to current “abundant supplies.” The organization notes, however, that increased demand from Asia could put an end to the price declines.

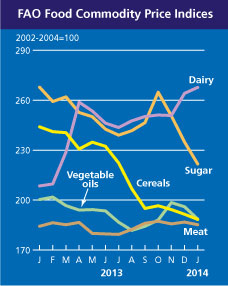

Prices for cereals, sugars, oils, and meat fell last month. Dairy prices rose because of demand from China, North Africa, the Middle East, and the Russian Federation. Sugar and oil prices dropped 5.6% and 3.8%, respectively, from December prices, and cereal prices fell 23% compared with January 2013.

The FAO projects that world cereal production in 2013 will reach 2.5 million metric tons, up 8.5% from 2012. The booming production would boost world cereal stockpiles to 573 million metric tons, up 13.5% from the previous year.

Prospects for crop production and prices in 2014 are favorable as well. Futures prices for corn were down about 40% year-over-year in January. Wheat prices were down about 25%. Index funds have cut their participation in the wheat market from 32% of open interest to around 16% over the past four months, while open interest in corn and soybeans has remained steady.

Just a couple of years ago, food prices were rising because of continuing drought in the United States and higher demand for corn as a feedstock to produce ethanol. That led to higher wheat prices when wheat was directed to animal feed to replace corn. The markets have sorted themselves out, and the outlook for food production and food prices now seems to be favoring consumers again.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.