It is really hard to get excited about anything in Greece and the peripheral nations. That has been the mantra for years now, even before the U.S. recession. But maybe all bad things can come to an end too. The preliminary gross domestic product (GDP) report shows that the economy contracted less than expected. This might even allow for some small resumption of GDP growth in 2014, and the key stocks have been trying to factor in that the worst may have been seen.

The Hellenic Statistical Authority (ELSTAT) announced that GDP in the fourth quarter of 2013 in volume terms decreased by 2.6%, in comparison with the fourth quarter of 2012. That is based on a 2005 reference, but the figure in current terms was down by 6.3%. The reference report of -2.6% GDP was the smallest drop since the first quarter of 2010.

If you tally up the numbers, this means that Greece’s economy only fell by 3.7% for all of 2013. Greece had forecast a drop of 4% in its GDP. The last time the reference year’s growth was seen in any quarter was the second quarter of 2008. Sadly, one-quarter of its GDP has been wiped out since then.

Unemployment reached a peak of 28%, but even that may be starting to stabilize. The Hellenic Statistical Authority reported on Thursday:

The seasonally adjusted unemployment rate in November 2013 was 28.0% compared to 26.3% in November 2012 and 27.7% in October 2013. The number of employed amounted to 3,550,679 persons. Τhe number of unemployed amounted to 1,382,062 while the number of inactive to 3,376,643.

So, is this screaming good news yet? Hardly. The problem is that markets do not wait for the good news. They will try to anticipate good news months out into the future.

National Bank of Greece S.A. (NYSE: NBG) is one of the true trading barometers for Greece, and its New York ADRs are indicated around $5.02, against an adjusted 52-week range of $2.85 to $24.70. This ADR trades more than 3 million shares per day.

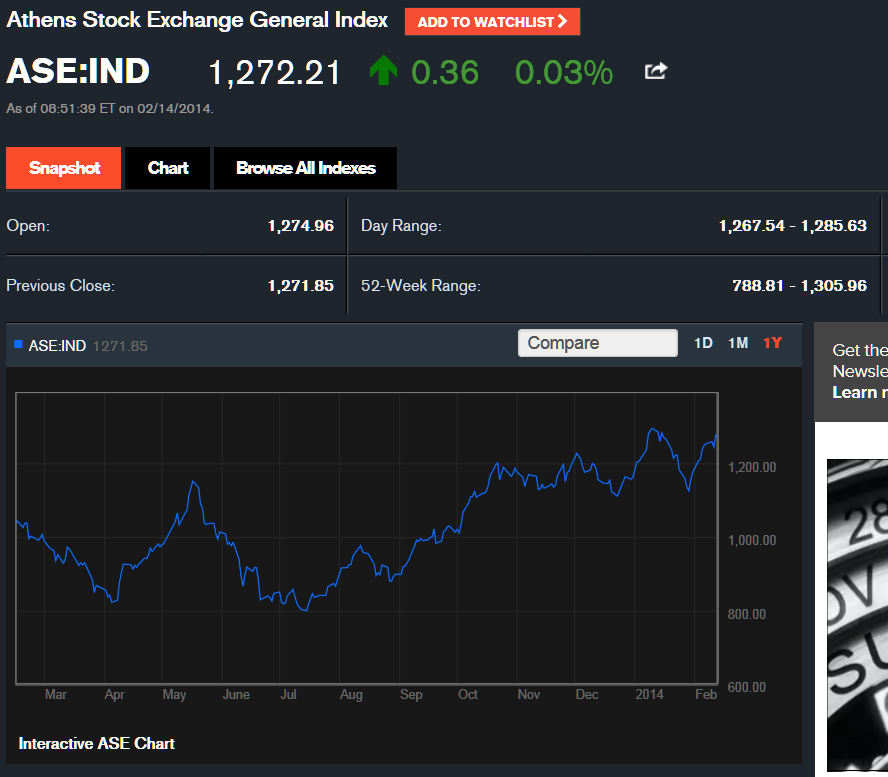

The Athens Stock Exchange General Index has so far not decided that this is the end of the bad news. At least that is what the reaction shows. This index was up marginally in late Friday trading, but had dipped into negative territory earlier in the day. Perhaps the issue is that Greece’s market snapshot below shows that the market is already trying to price in better news, and the chart is signaling another double-top, which has yet to be overcome.

The Global X FTSE Greece 20 ETF (NYSEMKT: GREK) is trading around $23.69, versus a 52-week range of $14.11 to $24.68. That exchange traded fund has also been trying to factor in good news, if you look at how it has performed. Trading volume there averages about 180,000 shares per day.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.