The International Monetary Fund (IMF) has released its 2014 Article IV Consultation with the United States of America. The Article IV highlighted five themes that the IMF feels would strengthen the recovery in the United States and would improve the country’s long-term outlook.

These include raising productivity growth and labor participation, confronting poverty and keeping public debt on a sustained downward path. What will really stand out in this report is the call to manage the exit from zero policy rates, and securing a safer financial system — including a higher minimum wage.

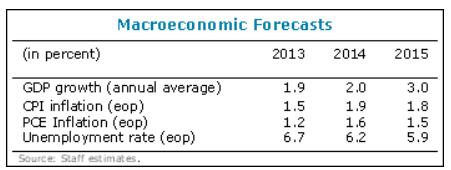

The IMF signaled that recent data suggests that a meaningful rebound is underway and growth for the remainder of this year and 2015 should exceed potential. Growth (in gross domestic product) is now projected at 2% for 2014 and 3% in 2015.

Monday’s report said:

To achieve these goals and fortify the country’s economic future the policy focus should be to undertake more proactive labor market policies that lower long-term unemployment and raise participation; increase the minimum wage while strengthening the Earned Income Tax Credit; invest in infrastructure; improve the tax structure and raise revenues; fundamentally reform social security; and lower the growth of health care costs.

The IMF addressed U.S. monetary policy by noting that longer-term Treasury yields have been compressed to very low levels. It said:

This sets up the risk, even with a successful and well-communicated increase in interest rates, for significant swings in market flows and prices in the months ahead. If such volatility were to unfold, it would have implications that would reach far beyond U.S. borders, potentially straining those countries with weaker fundamentals which could then have second round effects for U.S. growth.

ALSO READ: Ten States With the Slowest Growing Economies

One highly debated issue is on the minimum wage. The IMF is forecasting that the U.S. minimum wage should be increased. On this matter it said:

This would help raise incomes for millions of working poor and would have strong complementarities with the suggested improvements in the EITC, working in tandem to ensure a meaningful increase in after-tax earnings for the nation’s poorest households.

This IMF table below shows its new expectations ahead.

It’s Your Money, Your Future—Own It (sponsor)

Retirement can be daunting, but it doesn’t need to be.

Imagine having an expert in your corner to help you with your financial goals. Someone to help you determine if you’re ahead, behind, or right on track. With SmartAsset, that’s not just a dream—it’s reality. This free tool connects you with pre-screened financial advisors who work in your best interests. It’s quick, it’s easy, so take the leap today and start planning smarter!

Don’t waste another minute; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.