Some labor leaders in the city want wages to rise to a minimum of $15 an hour immediately while some business groups are concerned that higher wages will drive some jobs out of Los Angeles. Sources told the Los Angeles Times that Garcetti’s plan would raise wages to $10.25 immediately, and then by $1.50 an hour in each of the next two years. After that the wage increase would be tied to the consumer price index for Los Angeles.

The National Employment Law Project (NELP) cited a statement signed by 600 economists which includes the following text:

In recent years there have been important developments in the academic literature on the effect of increases in the minimum wage on employment, with the weight of evidence now showing that increases in the minimum wage have had little or no negative effect on the employment of minimum-wage workers, even during times of weakness in the labor market. Research suggests that a minimum-wage increase could have a small stimulative effect on the economy as low-wage workers spend their additional earnings, raising demand and job growth, and providing some help on the jobs front.

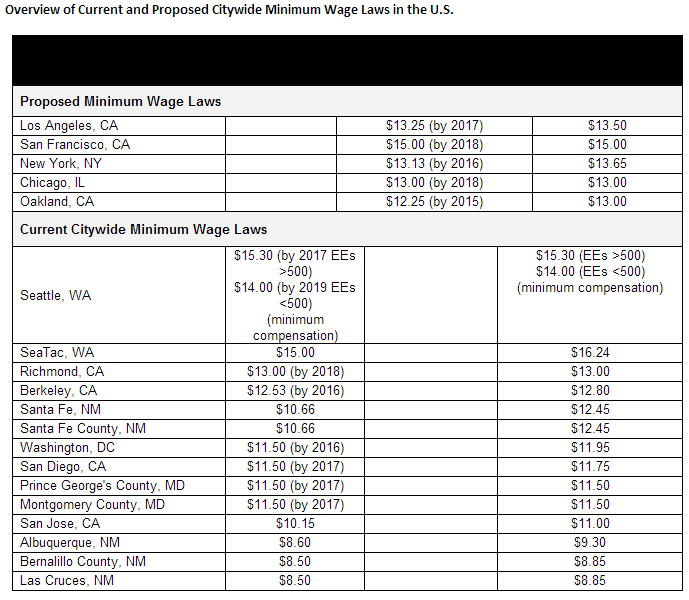

The chart below show the cities that are currently considering increasing the minimum wage and the jurisdictions that already have.

ALSO READ: America’s Disappearing Jobs

Credit Card Companies Are Doing Something Nuts

Credit card companies are at war. The biggest issuers are handing out free rewards and benefits to win the best customers.

It’s possible to find cards paying unlimited 1.5%, 2%, and even more today. That’s free money for qualified borrowers, and the type of thing that would be crazy to pass up. Those rewards can add up to thousands of dollars every year in free money, and include other benefits as well.

We’ve assembled some of the best credit cards for users today. Don’t miss these offers because they won’t be this good forever.

Flywheel Publishing has partnered with CardRatings for our coverage of credit card products. Flywheel Publishing and CardRatings may receive a commission from card issuers.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.