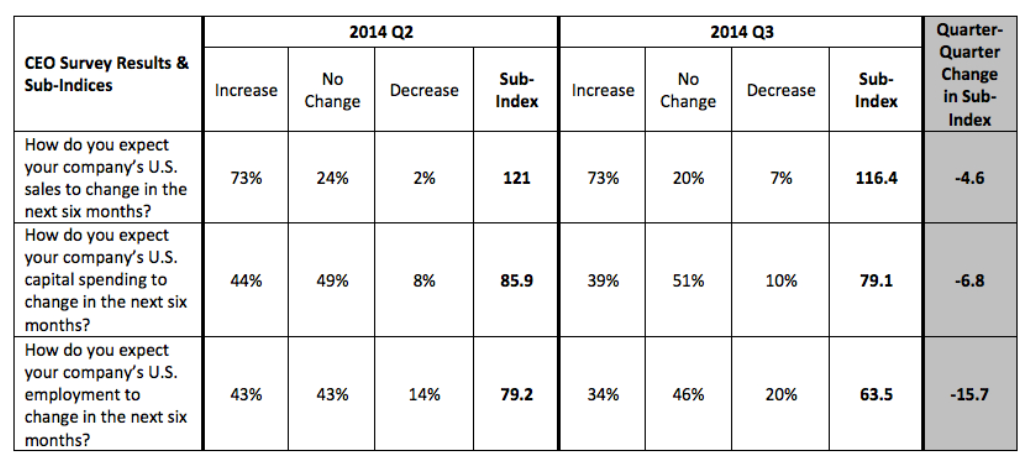

The Business Roundtable’s third-quarter 2014 CEO Economic Outlook Index signal that chief executives expect growth to slow in the six months ahead. The real risk here is that they see a decline in the coming periods for capital spending, hiring and even sales.

Tuesday’s report indicated that the CEO Economic Outlook Index fell in the third quarter of 2014 to 86.4 from 95.4 in the second quarter of 2014. The long-term average of the index is 80.2.

The CEO Economic Outlook Index aims to provide a picture of the future direction of the U.S. economy. Data are collected on CEO views and expectations for sales, capital spending and hiring. Unfortunately, of the three views, the hiring plans are expected to decline the most.

CEOs now expect 2014 gross domestic product growth of 2.4%, which is in-line with last quarter’s estimate of 2.3%. Another key point was that almost 90% of CEOs said that tax reform would encourage additional investment or cause them to expand their U.S. operations.

READ ALSO: Which CEOs Use Social Media?

The third-quarter 2014 survey was completed between August 11 and August 29, 2014, and the recorded responses were from 135 member CEOs — 65% of the total Business Roundtable membership. Tuesday’s CEO Outlook report said:

While some U.S. economic indicators are improving moderately, the results from our survey of CEOs seem to reflect an underperforming U.S. economy held back by policy uncertainty and growing conflicts around the world… The U.S. economy continues to perform below its potential. While there are a number of economic issues facing our country, growth remains the top priority. We believe Congress and the Administration must focus on policies that drive economic growth, including tax reform, immigration reform, trade expansion and long-term fiscal stability.

Travel Cards Are Getting Too Good To Ignore (sponsored)

Credit card companies are pulling out all the stops, with the issuers are offering insane travel rewards and perks.

We’re talking huge sign-up bonuses, points on every purchase, and benefits like lounge access, travel credits, and free hotel nights. For travelers, these rewards can add up to thousands of dollars in flights, upgrades, and luxury experiences every year.

It’s like getting paid to travel — and it’s available to qualified borrowers who know where to look.

We’ve rounded up some of the best travel credit cards on the market. Click here to see the list. Don’t miss these offers — they won’t be this good forever.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.