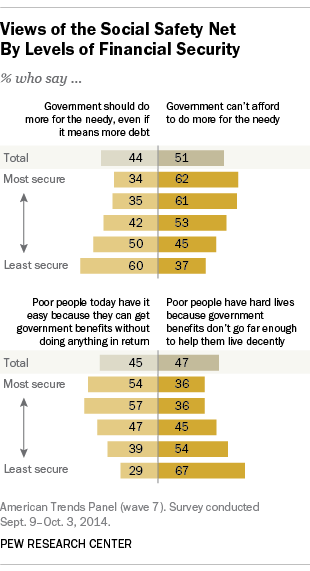

Who are the least financially secure Americans? According to the Pew Research Center, they are most likely to be unmarried, non-white women who have a health condition that limits their ability to work. They also have less education and are younger than more financially secure Americans. That is what Pew discovered in a recently published study called “The Politics of Financial Insecurity,” which included the chart below.

The Pew study was conducted just ahead of the November 2014 elections and was focused on finding the level of political engagement among Americans all along the financial spectrum. The study found that more financially secure Americans are registered to vote (94%) than the less-secure Americans are (54%). Not only that, more financially secure Americans are more likely to vote and — wait for it — most are going to vote for Republican candidates. We know, you’re shocked, shocked.

ALSO READ: The Poorest County in Each State

Pew does not lay the lack of political engagement entirely at the feet of financial insecurity:

Many other factors, some of which are related to financial situation (such as educational achievement), also affect an individual’s level of interest and participation in politics. But financial stress has a significant independent impact on political choices and engagement, perhaps by limiting the resources needed to participate effectively and the time and cognitive focus available for political activity.

And in case you were wondering why some Republican-controlled states are trying to limit voting rights, here’s your answer: the Pew study noted that 42% of all Americans preferred Democratic candidates in the 2014 elections, compared with 34% who preferred Republican candidates.

ALSO READ: The Worst States for Black Americans

Get Ready To Retire (Sponsored)

Start by taking a quick retirement quiz from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes, or less.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Get started right here.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.