This post may contain links from our sponsors and affiliates, and Flywheel Publishing may receive

compensation for actions taken through them.

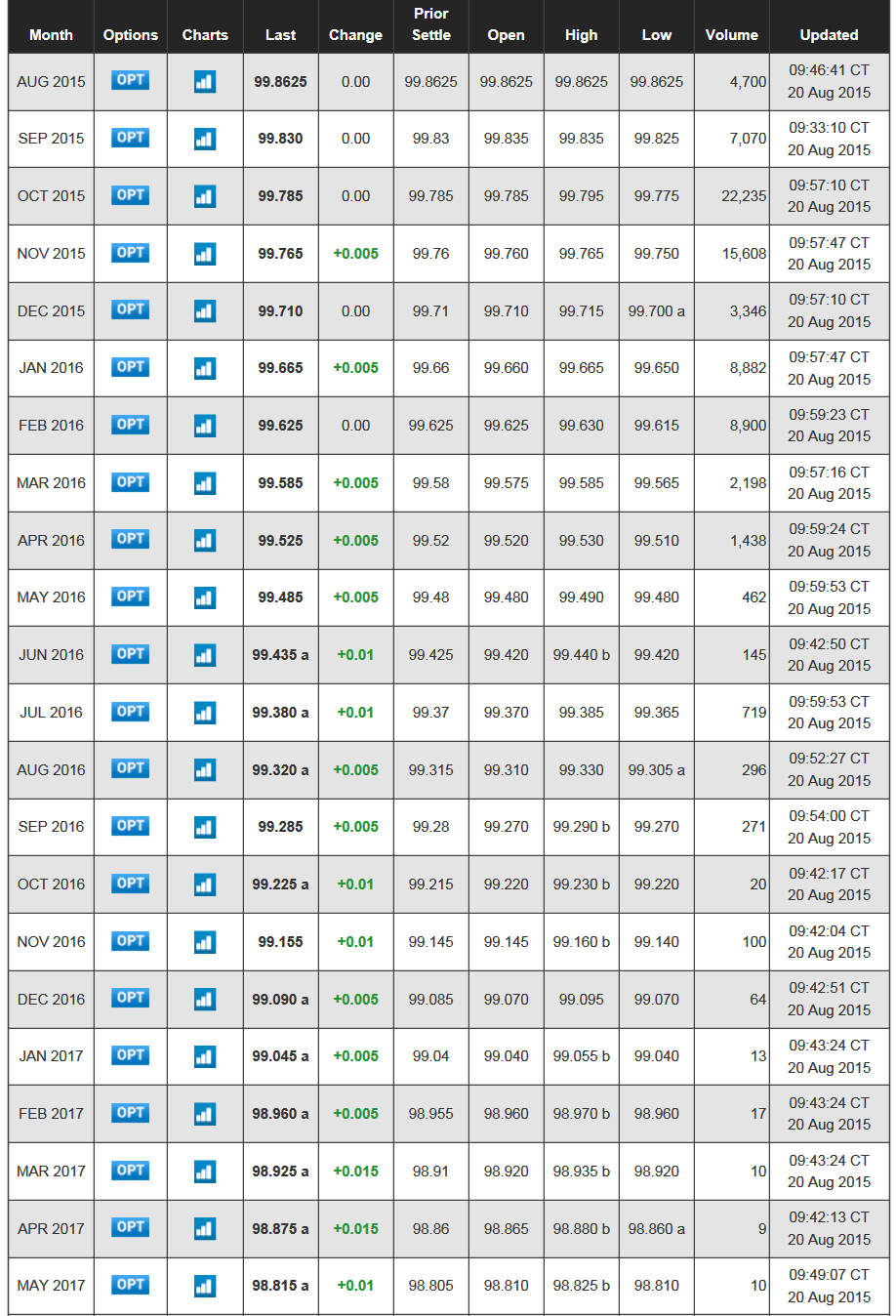

There are many indicators that the investment community, business owners and consumers might use to judge the future of interest rates. Now that fed funds have been at a targeted range of 0.00% to 0.25%, and are expected to rise soon, many use the 30-day fed funds futures as a tool to decide when interest rates actually will rise and by how much.

Fed funds futures are far from a perfect tool for determining when interest rates will rise. For years now, they have indicated that fed funds would rise at some point in the next year or so — at least until 2015.

The unofficial hope, or fundamental call, has been for a September 2015 rate hike as the start. The fed funds futures had been looking at October 2015 as the month, but that has now moved farther out again. There is still a chance this could happen of course.

Prior to the release of the FOMC’s minutes on Wednesday (for the end of July meeting), November 2015 was the real month that a 100% chance of fed funds rising to 0.25% was priced in. That is now no longer the case, even though there is still a good chance as the contract price rose to 99.765 from 99.735 before the minutes came out.

With the exception of early in July, December 2015 fed funds futures had been calling for a 100% chance of fed funds being 0.25% by then. That remains the case at a contract of 99.71.

ALSO READ: How Obamacare Increased Insurance Coverage in Every State

What investors need to consider here is that the fed funds futures are now not even calling for a fed funds rate of 0.50% until all the way out in May of 2016. A 100% chance of 0.75% fed funds is now not even priced in until October of 2016, and a 1.00% fed funds is now not seen with a 100% price-in on futures until February 2017 — and 1.50% is not priced in until January of 2018.

Again, many tools are used for predicting what interest rates will rise to. What is impressive about fed funds futures themselves is that real money is being bet each day to generate these figures.

ALSO READ: 7 Countries Near Bankruptcy

Credit Card Companies Are Doing Something Nuts

Credit card companies are at war. The biggest issuers are handing out free rewards and benefits to win the best customers.

It’s possible to find cards paying unlimited 1.5%, 2%, and even more today. That’s free money for qualified borrowers, and the type of thing that would be crazy to pass up. Those rewards can add up to thousands of dollars every year in free money, and include other benefits as well.

We’ve assembled some of the best credit cards for users today. Don’t miss these offers because they won’t be this good forever.

Flywheel Publishing has partnered with CardRatings for our coverage of credit card products. Flywheel Publishing and CardRatings may receive a commission from card issuers.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.