Any time a nation has higher revenues, it sounds great for its credit ratings and financial footing. The question to ask in the case of Puerto Rico is if higher monthly revenues actually will be enough to move the needle at a time where the nation needs serious help on its finance.

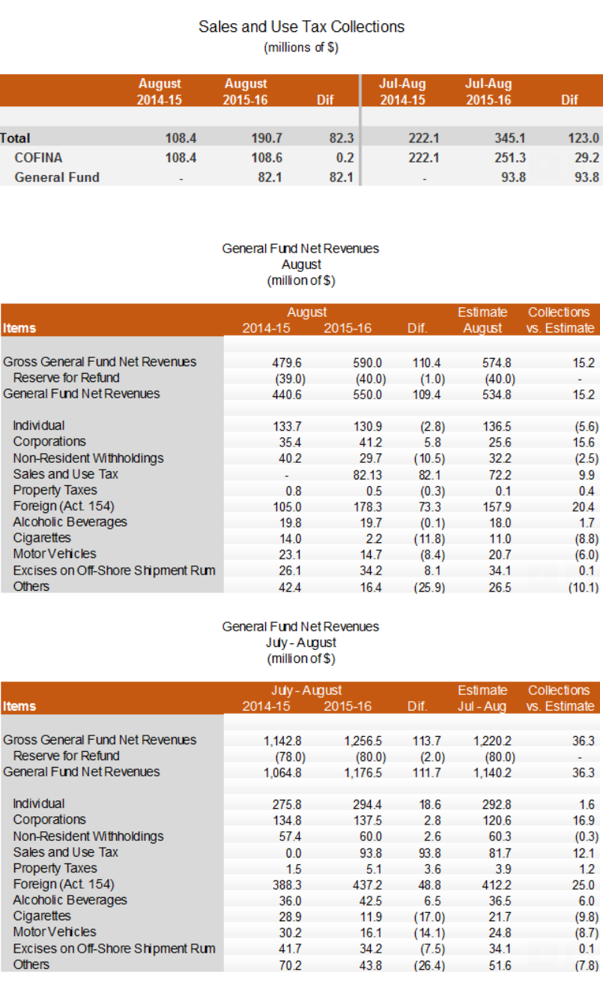

Puerto Rico’s Treasury Secretary Juan Zaragoza Gomez has confirmed that sales and use tax (SUT) revenues collections were $190.7 million in August of 2015. This was said to be $22.2 million above estimates. Puerto Rico’s general fund revenues were shown to be $550 million, which is $109.4 million higher than the prior August report and was up $15.2 million compared to prior estimates.

July was said to be the first month that the new 10.5% state SUT rate was in effect. Collections were $22.2 million above estimates, and that was said to be a positive surprise of 13.2%.

Another issue in this is that the report noted that the August 2015 estimates did take into account a possible effect of purchases made in advance of the rate increase. A higher capture rate collected at ports and oversight measures related to debt collection efforts were cited as meaningful improvements.

Whether this will be enough to make a difference remains to be seen. Of Puerto Rico’s general fund net revenues of $550.0 million in August 2015, that $109.4 million gain showed that collections were $15.2 million above estimates. The report noted:

- Fiscal year-to-date collections exceeded collections on a year-over-year basis.

- Individual income taxes and nonresident withholdings reflected decreases of $2.8 million and $10.5 million, respectively.

- Corporate income taxes reflected a $5.8 million increase.

- Foreign excise tax was the main revenue driver, with $178.3 million, or 32.4% of total collections in August 2015. In the year-over-year comparison, this category reflected a $73.3 million increase as a result of the specific effect of one transaction by one corporation.

- Revenues for other consumption excise taxes, such as for alcoholic beverages, were similar on a year-over-year comparison. Cigarette excise taxes reflected a decrease due to changes in the composition of the companies in the market; this is expected to return to normal in the coming months.

- Motor vehicle taxes were down $8.4 million — mostly by the fact that several companies have claimed certain tax credits.

ALSO READ: 8 Buybacks and Dividends Just Too Big to Ignore

Several tables from the Treasury report are included below.

Are You Still Paying With a Debit Card?

The average American spends $17,274 on debit cards a year, and it’s a HUGE mistake. First, debit cards don’t have the same fraud protections as credit cards. Once your money is gone, it’s gone. But more importantly you can actually get something back from this spending every time you swipe.

Issuers are handing out wild bonuses right now. With some you can earn up to 5% back on every purchase. That’s like getting a 5% discount on everything you buy!

Our top pick is kind of hard to imagine. Not only does it pay up to 5% back, it also includes a $200 cash back reward in the first six months, a 0% intro APR, and…. $0 annual fee. It’s quite literally free money for any one that uses a card regularly. Click here to learn more!

Flywheel Publishing has partnered with CardRatings to provide coverage of credit card products. Flywheel Publishing and CardRatings may receive a commission from card issuers.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.