Economy

CBO Outlook Targets First Higher Budget Deficit Since Recession

Published:

Last Updated:

A better economy and offering more and more benefits to more and more people was supposed to engender a better government spending picture, wasn’t it? The Congressional Budget Office (CBO) has released a portion of its 2016 to 2026 outlook, and the end result is that the federal budget deficit will increase in relation to the size of the economy in 2016.

What stands out about this prediction is that, if the CBO is accurate, this would be the first increase in the budget deficit since 2009.

In the new CBO outlook, the group warns that if current laws generally remained unchanged then the budget deficit would grow over the next 10 years. It also noted that by 2026 it would be considerably larger than its average over the past 50 years.

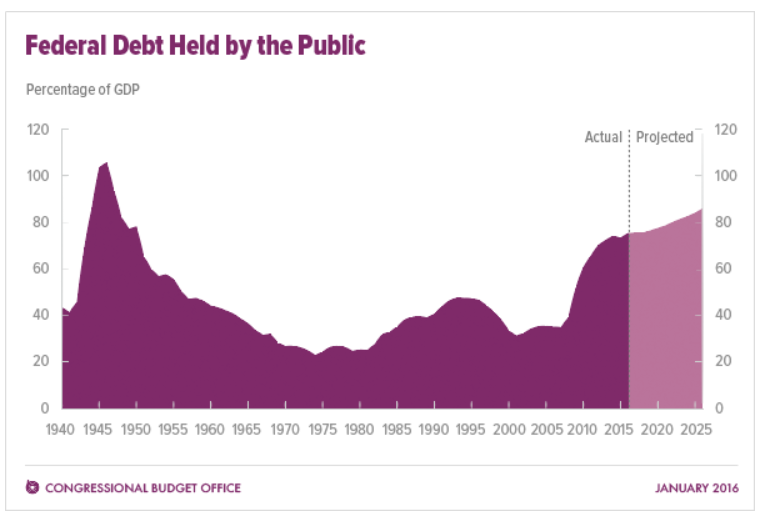

Another warning from the CBO is that the debt held by the public also would grow significantly from its already high level. The U.S. National Debt clock showed that debt at $18.903 trillion as of 11:00 a.m. Eastern time on Monday, January 19, 2016.

Another risk is here in that the CBO said that it anticipates that the U.S. economy will expand solidly this year and next year. But what if the slower and slower GDP picture makes these expectations wrong? The CBO’s summary said:

Increases in demand for goods and services are expected to reduce the quantity of underused labor and capital, or “slack,” in the economy—thereby encouraging greater participation in the labor force by reducing the unemployment rate and pushing up compensation. That reduction in slack will also push up inflation and interest rates. Over the following years, CBO projects, output will grow at a more modest pace, constrained by relatively slow growth in the nation’s supply of labor. Nevertheless, in those later years, output is anticipated to grow more quickly than it has during the past decade.

The CBO did summarize in dollars just how bad it sees the budget deficit for 2016, as its first increase after six years of decline. Its preliminary report said:

The 2016 deficit will be $544 billion, CBO estimates, $105 billion more than the deficit recorded last year (see Summary Table 1). At 2.9 percent of gross domestic product (GDP), the expected shortfall for 2016 will mark the first time that the deficit has risen in relation to the size of the economy since peaking at 9.8 percent in 2009. About $43 billion of this year’s increase in the deficit results from a shift in the timing of some payments that the government would ordinarily have made in fiscal year 2017, but that will instead be made in fiscal year 2016, because October 1, 2016—the first day of fiscal year 2017—falls on a weekend.1 If not for that shift, the projected deficit in 2016 would be $500 billion, or 2.7 percent of GDP.

The 2016 deficit that CBO currently projects is $130 billion higher than the one that the agency projected in August 2015.2 That increase is largely attributable to legislation enacted since August—in particular, the retroactive extension of a number of provisions that reduce corporate and individual income taxes.

The CBO image below should show how big the debt situation will get from 2016 to 2026 under the current outlook.

If you’re like many Americans and keep your money ‘safe’ in a checking or savings account, think again. The average yield on a savings account is a paltry .4% today, and inflation is much higher. Checking accounts are even worse.

Every day you don’t move to a high-yield savings account that beats inflation, you lose more and more value.

But there is good news. To win qualified customers, some accounts are paying 9-10x this national average. That’s an incredible way to keep your money safe, and get paid at the same time. Our top pick for high yield savings accounts includes other one time cash bonuses, and is FDIC insured.

Click here to see how much more you could be earning on your savings today. It takes just a few minutes and your money could be working for you.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.