From The Fiscal Times

Even as Americans are racking up ever-higher levels of credit card debt and student loans, they’re claiming that paying down what they owe is their top financial priority.

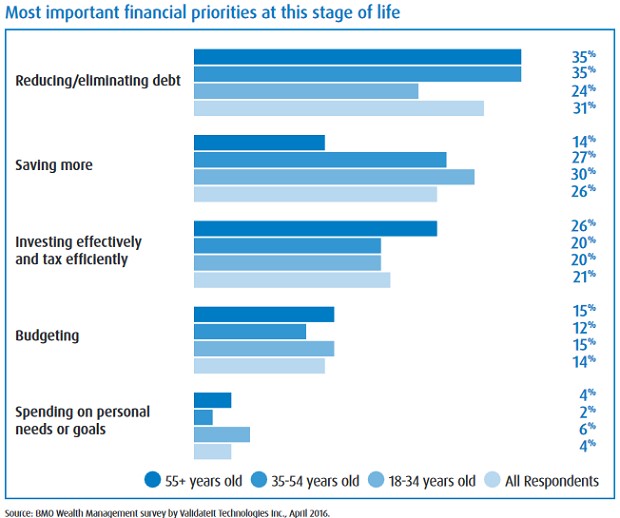

A new survey from BMO Group finds that 31 percent of Americans cite debt repayment as their top financial priority, followed by saving more (26 percent) and investing efficiently (21 percent).

Some respondents admitted to being worried that their debt could hurt their ability to achieve future financial goals. Among those surveyed, 24 percent said they were concerned they had more debt than they could repay, and 14 percent were worried about their ability to maintain a good credit score.

Consumers owe more than $3.6 trillion in debt, thanks to credit card bills, student debt, auto loans and mortgages, according to the Federal Reserve. While a willingness by consumers to borrow money (and banks to lend it) is generally good news for the economy, the growing levels of debt could pose future personal finance problems.

Statistics show that Americans are taking some steps to reduce their debt loads, such as refinancing their mortgages or signing up for income-based repayment plans for federal loans. They’re also chipping away at credit card debt, but not quickly enough.

Americans paid down nearly $27 billion in credit card debt in the first quarter of the year, according to CardHub. While that may sound impressive, it’s the lowest debt repayment for a quarter since 2008, and it’s just a drop in the bucket against the $71 billion collectively charged in the quarter.

Related: Home Prices Hit an All-Time High: Is This Another Bubble?

Related: An Obscure, Outrageous Reason Your Property Taxes Are So High

Related: Junk-rated US Municipalities Shine Brighter With Record Low Rates

100 Million Americans Are Missing This Crucial Retirement Tool

The thought of burdening your family with a financial disaster is most Americans’ nightmare. However, recent studies show that over 100 million Americans still don’t have proper life insurance in the event they pass away.

Life insurance can bring peace of mind – ensuring your loved ones are safeguarded against unforeseen expenses and debts. With premiums often lower than expected and a variety of plans tailored to different life stages and health conditions, securing a policy is more accessible than ever.

A quick, no-obligation quote can provide valuable insight into what’s available and what might best suit your family’s needs. Life insurance is a simple step you can take today to help secure peace of mind for your loved ones tomorrow.

Click here to learn how to get a quote in just a few minutes.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.