Economy

Are US Companies Avoiding Over $700 Billion in Taxes on Overseas Profits?

Published:

Last Updated:

It is no secret at all that major U.S. companies keep billions of dollars locked up overseas. What is debated often is how much this money should be taxed, or if it should be taxed, here in the United States. Whether you call this tax avoidance or you consider it good business may depend on your politics or your position in the business world. The numbers that a report from the U.S. Public Interest Research Group show are massive, showing that just 58 of the Fortune 500 companies would owe $212 billion in additional federal taxes if profits were not officially booked offshore.

This report was not compiled by 24/7 Wall St. Readers should know going in that this a very one-sided report, and its name of Offshore Shell Games may sum up the group’s angle. The report was compiled by the Citizens for Tax Justice, the Institute on Taxation and Economic Policy, and the U.S. PIRG Education Fund. It aims to show the use of offshore tax havens as a means of avoiding up to $717.8 billion in U.S. taxes.

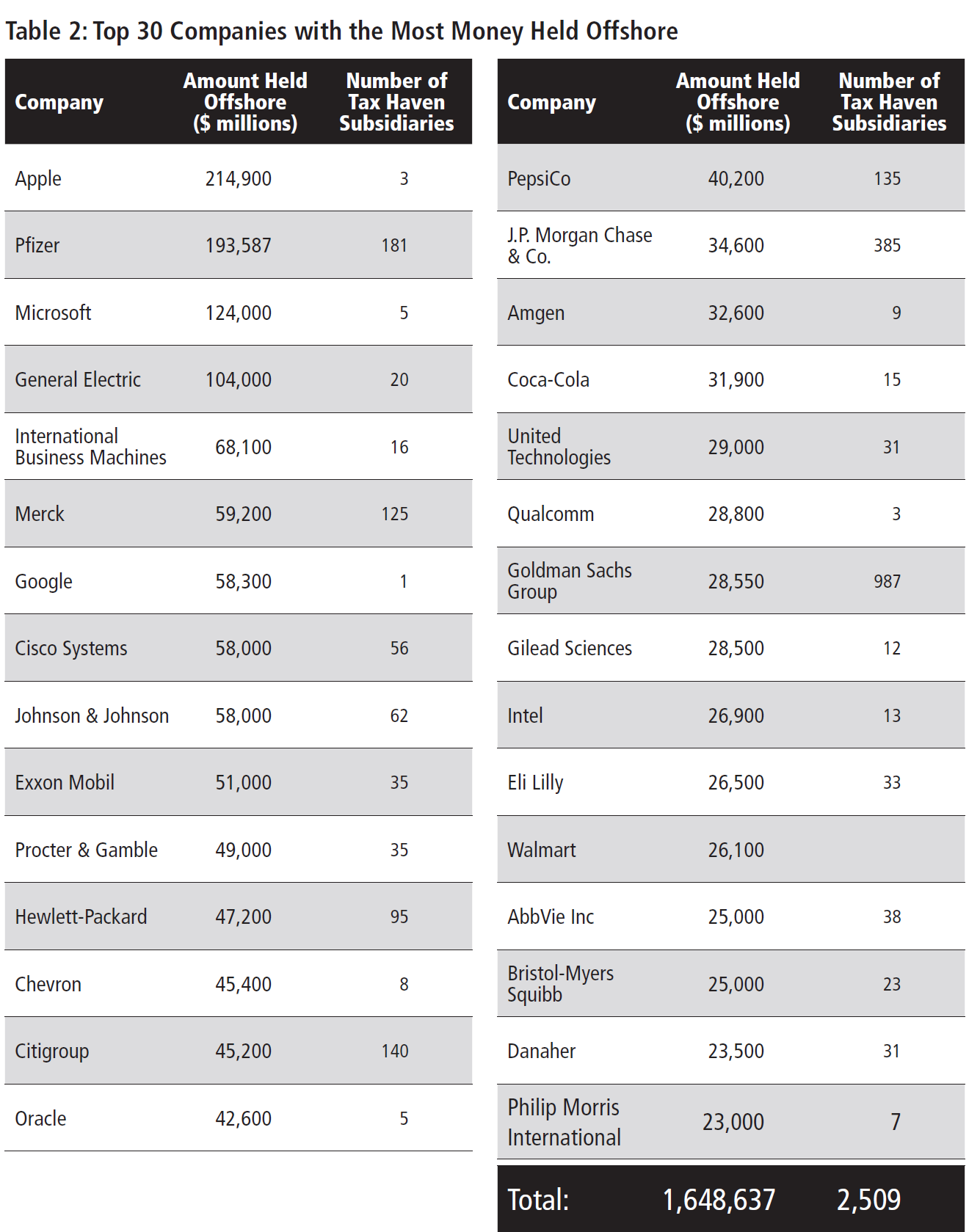

This report shows that Fortune 500 companies are holding nearly $2.5 trillion in accumulated profits offshore for tax purposes. According to Offshore Shell Games, just 30 of the Fortune 500 companies account for 66%, or a whopping sum of $1.65 trillion, of these offshore profits.

One issue pointed out here is that just 58 Fortune 500 companies disclose what they would expect to pay in U.S. taxes if those profits were not officially booked offshore. The report says:

In total, these 58 companies would owe $212 billion in additional federal taxes. … If we assume that average tax rate of 6.2 percent applies to all 298 Fortune 500 companies with offshore earnings, they would owe a 28.8 percent rate upon repatriation of these earnings, meaning they would collectively owe $717.8 billion in additional federal taxes if the money were repatriated at once.

What stands out here is that Offshore Shell Games goes on to show which companies are the “worst offenders” of them all. In an effort to streamline these, we have altered the order for largest sums first, and we have tried to include what the Offshore Shell Games showed for foreign subsidiaries. They show the following:

Here is how the report starts off:

U.S.-based multinational corporations are allowed to play by a different set of rules than small and domestic businesses or individuals when it comes to paying taxes. Corporate lobbyists and their congressional allies have riddled the U.S. tax code with loopholes and exceptions that enable tax attorneys and corporate accountants to book U.S. earned profits to subsidiaries located in offshore tax haven countries with minimal or no taxes. The most transparent and galling aspect of this is that often, a company’s operational presence in a tax haven may be nothing more than a mailbox. Overall, multinational corporations use tax havens to avoid an estimated $100 billion in federal income taxes each year.

Offshore Shell Games also points out that most of America’s largest corporations maintain subsidiaries in offshore tax havens. At least 367 companies (73% of the Fortune 500) operate one or more subsidiaries in tax haven countries, with at least 10,366 tax haven subsidiaries combined.

Up front, in the Acknowledgments, the review shows that the authors bear responsibility for any factual errors and that the recommendations are those of the U.S. Public Interest Research Group Education Fund, Citizens for Tax Justice and the Institute on Taxation and Economic Policy.

Again, Offshore Shell Games is an outside report that is very much of one-sided view of taxes on international profits. One of the report’s tables (see below) shows the top 30 companies with the most money held offshore.

Credit card companies are pulling out all the stops, with the issuers are offering insane travel rewards and perks.

We’re talking huge sign-up bonuses, points on every purchase, and benefits like lounge access, travel credits, and free hotel nights. For travelers, these rewards can add up to thousands of dollars in flights, upgrades, and luxury experiences every year.

It’s like getting paid to travel — and it’s available to qualified borrowers who know where to look.

We’ve rounded up some of the best travel credit cards on the market. Click here to see the list. Don’t miss these offers — they won’t be this good forever.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.