Median family income rose 2.9% for American households in 2014. For households in the 95th percentile, the increase was double that at 5.8%. Median wealth rose 12%, and wealth increased by 17% at the 95th percentile. While income and wealth are rising, they are rising fastest for those Americans at the top of the income and wealth distributions.

The data were reported Tuesday by the University of Michigan’s Panel Study of Income Dynamics (PSID), a longitudinal study begun in 1968 that tracks employment, income, wealth, health, childbearing and development, and education, among other data points. The PSID data were collected in 2015 and covers the period between 2012 and 2015.

According to the PSID, average spending in 2015 was $43,400, up 2.6% since 2013. Some 41% of spending is directed toward housing.

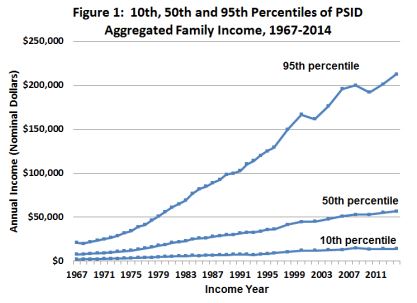

Since 1967, the 95th percentile of the income distribution has seen much larger increases than the median or the 10th percentile. The data are based on aggregated income, which includes no adjustment for inflation or taxes. Between 2012 and 2014 inflation was 3.1%. The following chart from this year’s report makes this abundantly clear:

The PSID also collects information related to health insurance and the health status of family members. The percentage of adults who lacked health insurance fell from 13% in 2013 to 8% in 2015.

David Johnson, director of the PSID, said:

Because of the longitudinal nature of the PSID, we can evaluate families who have been the top income earners for decades, and whether they remain the top income earners today. … There’s a big interest in what’s called ‘intergenerational mobility’—how your family was doing when you were a kid compared to how your family is doing now that you are grown up. These data can tell us how much the life chances of the nation’s youth are shaped by their parents’ and grandparents’ economic status.

Highlights from the 2015 study are available at the PSID website.

Cash Back Credit Cards Have Never Been This Good

Credit card companies are at war, handing out free rewards and benefits to win the best customers. A good cash back card can be worth thousands of dollars a year in free money, not to mention other perks like travel, insurance, and access to fancy lounges. See our top picks for the best credit cards today. You won’t want to miss some of these offers.

Flywheel Publishing has partnered with CardRatings for our coverage of credit card products. Flywheel Publishing and CardRatings may receive a commission from card issuers.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.