Whether an investor, a business owner or an average working person, every single one of us has to worry about the broad economic trends. We can all remember the pain of the Great Recession. In fact, the recession was only a good thing for those few institutions and individuals with the excess capital and foresight to bet against the economy. One key barometer of the economy is how everyday people are managing their finances from month to month.

According to the June 20 release of the S&P Experian Bankcard Default Index, the bank card default rate increased by 18 basis points in May over April to 3.53%. What matters here is that the national bank card default rate was a 48-month high.

It’s not all bad news on the credit front. Auto loan defaults decreased five basis points to 0.85%, and the first mortgage default rate also dropped by five basis points from April to 0.64%. And in broader credit trends, four of the five major cities saw their default rates decrease in May.

While this was an 18-basis-point increase in credit card defaults from April, it was a 42-basis-point jump from May of 2016. May also marked the seventh consecutive month of rising defaults in credit cards.

Whether credit lending standards have loosened too much remains up for debate. When comparing the bank card default rate among the four Censes divisions, S&P/Experian showed that the default rate in the South is considerably higher than the other three Census divisions. The East South Central Census Region (Kentucky, Tennessee, Alabama and Mississippi) had the highest bank card default rate. Those states were also pointed out as having some of the lowest median household incomes.

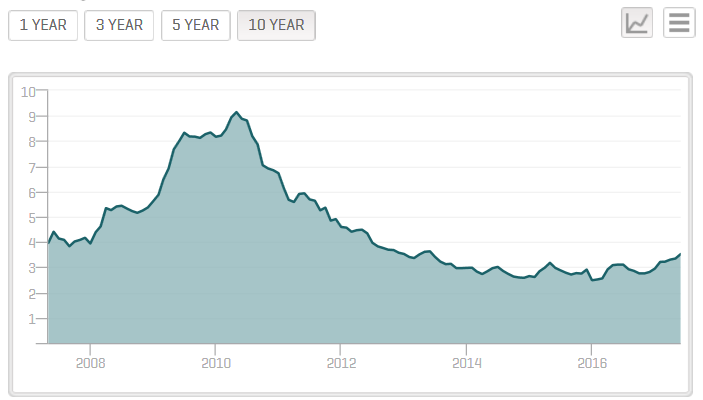

One key question is how all this compares to the years prior to the Great Recession. The credit card default rate was 3.96% in April of 2007 and rose to 4.41% in May of 2007, before dipping back down marginally in the rest of 2007. By April of 2008, that default rate in bank cards was 5.34%, and it went up to an 8.33% bankcard default rate by June of 2009 — three months after the stock market bottomed.

The peak default rate on bank-issued credit cards was 9.15% in April of 2010, and the lowest trough was a mere 2.49% default rate in December of 2015. All in all, credit default trends should be far from alarming. The ultimate verdict here on consumer credit and what it means to the broad economy will be on what happens to delinquencies and to eventual defaults in the stronger parts of the United States.

David M. Blitzer, Managing Director & Chairman of the Index Committee at S&P Dow Jones Indices, said of May’s credit disparity addressed this as “easy come, easy go.” He said:

Bank cards where borrowing money requires simply swiping a credit card are experiencing rising defaults, while defaults on other kinds of consumer credit which depend on paperwork are flat or down. Default rates on bank cards are at the highest level since May 2013, four years ago. In the past, default rates began to climb around the same time the growth of bank card credit outstanding began to slow. The year-over-year growth of bank card credit outstanding peaked at 6.8% last November and was at 5.7% in April, the latest figure available. Bank card defaults rose from 2.81% in November to 3.35% in April, and up to 3.53% in May.

Blitzer also differentiated how credit cards look rather different from auto and mortgage loans. He even noted that some of the subprime car loan risks have started to improve. He said:

Default rates for auto loans have drifted down in the last four months. At the beginning of the year there were reports of a sub-prime crisis in auto loans; these concerns seem to be behind us. The default rate on first mortgage remains at 1%, lower than the pre-crisis period. Rising home prices and increases in the equity mortgage borrowers have in their home are helping lower default rates. One factor in the difference between rising bank card defaults and stable defaults on mortgages and autos may be the difference in interest rates: about 4% on mortgages and 4.4% on auto loans, compared to 12% to 18% on bank card loans.

Experian uses a massive pool of banks and mortgage companies to compile its data. It covers approximately $11 trillion in outstanding loans, and that data is sourced from 11,500 lenders.

The Average American Has No Idea How Much Money You Can Make Today (Sponsor)

The last few years made people forget how much banks and CD’s can pay. Meanwhile, interest rates have spiked and many can afford to pay you much more, but most are keeping yields low and hoping you won’t notice.

But there is good news. To win qualified customers, some accounts are paying almost 10x the national average! That’s an incredible way to keep your money safe and earn more at the same time. Our top pick for high yield savings accounts includes other benefits as well. You can earn up to 3.80% with a Checking & Savings Account today Sign up and get up to $300 with direct deposit. No account fees. FDIC Insured.

Click here to see how much more you could be earning on your savings today. It takes just a few minutes to open an account to make your money work for you.

Our top pick for high yield savings accounts includes other benefits as well. You can earn up to 4.00% with a Checking & Savings Account from Sofi. Sign up and get up to $300 with direct deposit. No account fees. FDIC Insured.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.