Economy

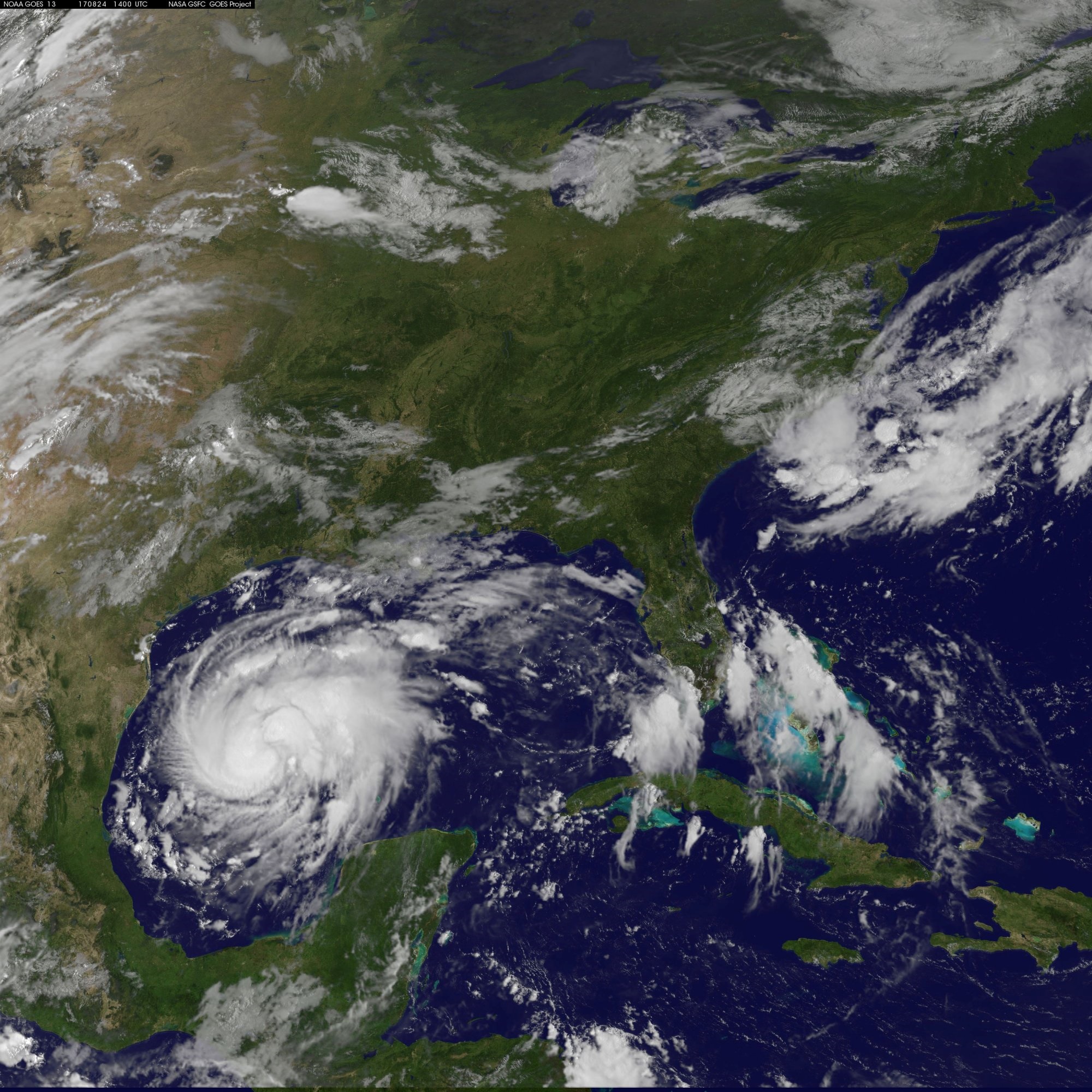

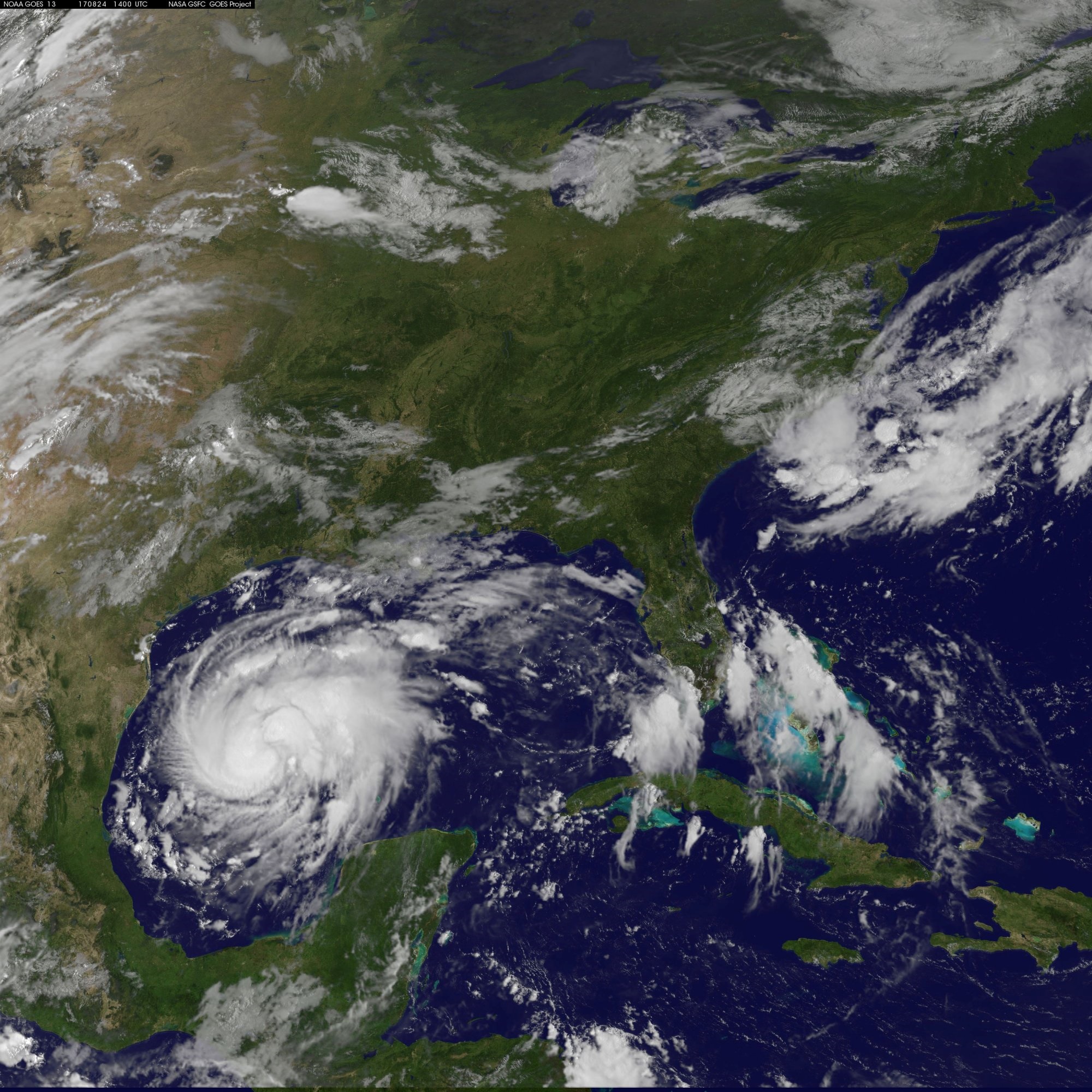

Could Hurricane Season Take Q3 GDP Growth To Zero?

Published:

Last Updated:

Goldman Sachs has speculated that Hurricane Harvey may shave 1% off national GDP growth for the third quarter. Imagine what the results will be if another, larger hurricane decimates an area as large as most of the state of Florida, and particularly several of its large cities. The GDP growth rate for the current quarter could be driven down close to zero when combined with Hurricane Harvey

According to CNBC:

Costs from the Category 3 storm that hammered Texas last month will eclipse those associated with 2012’s Hurricane Sandy, the bank’s analysts wrote in a research note. Using a model that examined the 35 largest hurricanes to strike the U.S. in the aftermath of World War II, Goldman found that major natural disasters correlated closely with a “temporary slowdown” in key economic gauges.

“Modeling these effects, we estimate that hurricane-related disruptions could reduce 3Q GDP growth by as much as 1 percentage point,” Goldman’s analysts wrote, adding that the main impact would be felt in consumer spending, business inventories, housing and the energy sectors.

Hurricane Harvey’s damage, when property destruction and economic damage are taken into effect, could be as high as $100 billion. While this number does not relate directly to GDP, it does reflect some of the magnitudes of the economic impact. Some businesses will not reopen for weeks. Insurance payouts are beyond calculation. At some point, the storm will help the economy via activity which includes construction and car sales. However, that will be spread out well into the months at the end of this year and into 2018

Hurricane Irma’s costs are expected to be well above Harvey’s. Credit Suisse put the number at $200 billion if Irma remained a Category 5 storm. It has hit Florida’s coast at a Category 4 level. That will not create much of a buffer against destruction, damage, and disruption.

If GDP is expected to be 2.5% in the current quarter, and that is the consensus figure, between Harvey and Irma, the numbers will fall toward zero

Let’s face it: If your money is just sitting in a checking account, you’re losing value every single day. With most checking accounts offering little to no interest, the cash you worked so hard to save is gradually being eroded by inflation.

However, by moving that money into a high-yield savings account, you can put your cash to work, growing steadily with little to no effort on your part. In just a few clicks, you can set up a high-yield savings account and start earning interest immediately.

There are plenty of reputable banks and online platforms that offer competitive rates, and many of them come with zero fees and no minimum balance requirements. Click here to see if you’re earning the best possible rate on your money!

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.