Economy

Rebuilding the Employment Security System for the Rust Belt That Created It

Published:

Last Updated:

By John C. Austin and Richard Kazis of the Metropolitan Policy Program at the Brookings Institution

Industrial transformation, brought on by global trade, new digital technologies, and changes in the structure of work, have hit Rust Belt communities hard. Some places, such as Pittsburgh and Kalamazoo, have gone through painful transitions and come out the other side. However, the majority of the Rust Belt’s older industrial cities continue to struggle with job loss and weak economic growth.

The collapse of the region’s labor-intensive manufacturing-based economy took its toll on the employment-based safety net protections that Midwestern employers and unions forged after World War II. Today, employer-based systems of health insurance, pensions, and unemployment insurance serve fewer and fewer Midwestern workers.

For Rust Belt workers and communities today and in the future, economic security policies must become more flexible and suited to a fast-changing economy. This will require balancing support for technological innovation with concerted efforts to reduce the costs of dislocation for people and places bearing the brunt of change.

The Midwest Built America’s Employment-Based Security System

In the years following World War II, the manufacturing industries of the industrial Midwest, together with their unions, hammered out a set of economic rules and policies that became the foundation for America’s subsequent economic prosperity and security.

Wage controls imposed during World War II set the stage for this system. Unable to increase worker pay, employers began to offer pensions and health insurance to attract and retain workers. The federal government assisted by exempting health insurance benefits from taxation for companies and individuals.

The transformation accelerated in the wake of the 1950 General Motors-United Auto Workers contract. Dubbed the “Treaty of Detroit,” it traded labor peace for wage gains based on productivity and cost-of-living increases. Large employers shared prosperity with their workers by providing them with health insurance, pensions, and other benefits. State and federal unemployment insurance policies that took shape during the Great Depression worked well for an economy in which periodic layoffs were temporary and skills were fairly transferable from one labor-intensive manufacturing sector to another.

The resulting system spread across the nation, in both union and non-union settings. The percentage of Americans covered by private pensions jumped from 3.7 million in 1940 to 19 million in 1960—nearly 30 percent of the labor force. By 1975, 40 million Americans were covered by private pension plans. The pattern of employer-provided health insurance coverage forged in Midwest industries became almost universal, rising from 10 percent in 1940 to just under 30 percent in 1946, reaching 80 percent of all workers by 1964.

Public sector employment systems, too, began to copy the agreements negotiated in the region’s private industries. In 1951, Wisconsin created the nation’s first stable statewide pension system for public employees and became the first state to allow public workers to participate in Social Security. Other states soon followed suit.

The Midwest’s Economic Decline Eroded Employment-Based Economic Security

By the 1970s, global competition facilitated by technology-based innovations in communications and transportation began to challenge U.S. manufacturing dominance—and the employment-based safety net that had matured with it. In successive waves of industrial restructuring, employers shuttered inefficient factories, moved production to cheaper locales, automated where possible, and pushed costs and risks onto employees and suppliers.

The wider impact on employer-provided benefits and the safety net protecting workers was devastating. The number of working-age Americans without health insurance jumped from 24 million to 37 million between 2001 and 2010, before the Affordable Care Act. Employer-provided defined benefit pension plans largely disappeared in the private sector, replaced by defined contribution 401(k) plans that shifted the burden for funding retirement onto workers. By 2015, only 5 percent of Fortune 500 firms offered defined benefit pension plans, down from 50 percent in 1998. Public employee agreements were harder to dismantle, but the underfunding of these state and local plans hit $1.4 trillion in 2016. Access to unemployment insurance (UI) diminished: In 2016, only 27 percent of all unemployed workers qualified for and received UI benefits, the lowest proportion in 40 years.

The Disruption Will Continue

As employers adapted to survive, their strategies to cut costs, enhance productivity, and shift risk heightened the instability of many Americans’ employment arrangements. They also set the stage for more disruption in the years ahead—change that will continue to hit Midwestern workers and communities particularly hard.

First, improvements in process automation, robotics, and machine learning are destabilizing employment. The McKinsey Global Institute projects that as many as one-third of U.S. workers may need to change occupations and acquire new skills by 2030, as robotics and artificial intelligence eliminate routine and repetitive jobs and create new jobs that require more and different skills.

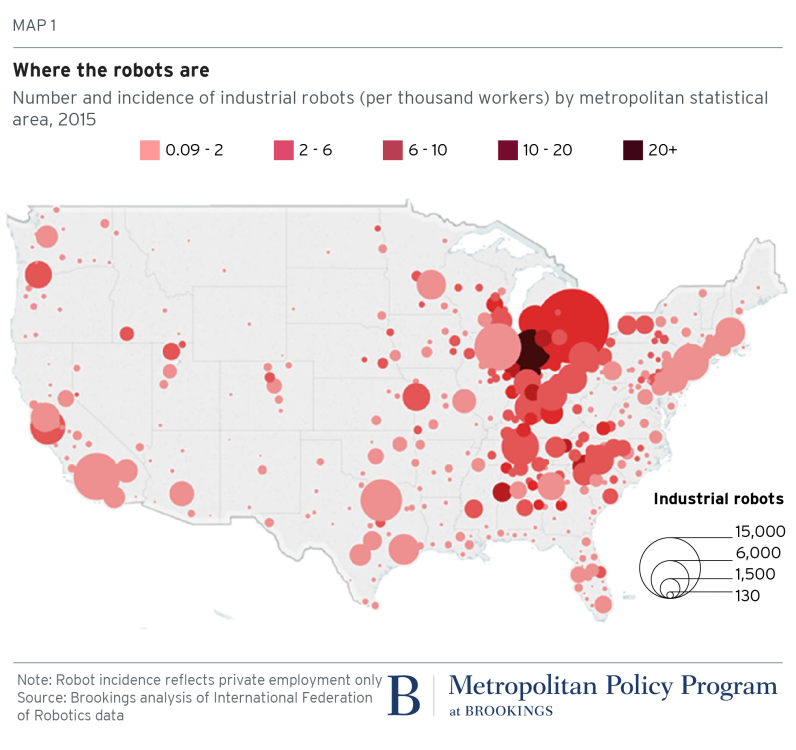

The Midwest is at the epicenter of these shifts. Auto manufacturing uses half of all industrial robots in this country. Robots on the shop floor are concentrated in about 10 Midwestern and Southern states, led by Michigan, Ohio, and Indiana.

Second, low educational attainment among the region’s industrial workforce could exacerbate employment dislocation due to automation and digitalization. A comparatively high proportion of Rust Belt working-age adults have only a high school diploma. Such workers may face greater difficulty making the transition to new kinds of occupations that demand higher-order cognitive skills.

A third destabilizing shift is the movement away from long-term, stable, full-time jobs toward contingent, alternative work arrangements. According to one study, nearly all net employment growth between 2005 and 2015 came from contingent work. In 2015, the Government Accountability Office estimated that contingent workers, including independent contractors and freelancers, part-time workers, on-call workers, temp firm employees, and self-employed workers, accounted for 40 percent of the U.S. workforce, up from 30 percent 10 years earlier.

Toward a Modernized Economic Security System

As our colleagues Mark Muro and Robert Maxim have outlined, America needs a new economic security system that is de-coupled from the once-dominant model of full-time, long-term employment with a single employer. This is particularly the case for Rust Belt workers. Policymakers seeking to rebuild economic security in the Midwest and across the nation should follow these principles:

Policymakers and advocates are advancing a number of proposals that could be scaled to build a modern economic security regime:

Portability: Health care and pension benefits should be portable, universal, tied to individual employees, and delinked from full-time work and single employers. Benefits should be pro-rated for part-time employees based on hours worked. To finance this, some have suggested a Social Security-like mechanism of payroll deductions. Others have proposed more modest multi-employer or sectoral plans like those in the construction industry. Senator Mark Warner (D-VA) has proposed legislation to fund a set of pilots testing different approaches with different mechanisms.

Pro-ration of benefits: Too many benefits are tied to full or almost full-time work with a single employer. Work-related benefits that can reduce family stress and keep people in the workforce—including paid sick leave, family leave, and vacation days—should be extended to part-time employees on a pro-rated basis based on hours worked for a given employer.

Unemployment insurance reform: Eligibility requirements should be made more flexible so that more individuals can access unemployment insurance, including intermittent workers, those with low and variable wages, part-time workers not working enough hours, and entrepreneurs starting their own businesses. Experiments should combine benefit receipt with training, work preparation, and support for pursuing postsecondary credentials.

More aggressive adjustment assistance: Current Trade Adjustment Assistance is too modest, short-term, and tied to specific industries affected by trade. It is not nearly as strategic and proactive as labor market adjustment policies in other advanced industrial countries. More generous relocation assistance can support worker mobility and help people go where the jobs are. Retraining opportunities and support for programs with proven labor market value can help those needing to make significant mid-career changes.

Rust Belt communities, industries, and workers created and benefited greatly from the old system in its prime—and they have arguably suffered the most from its collapse. In turn, they have the most to gain from a needed remaking of employment security and safety net policies that recognize and respond to today’s economic realities. To the degree that these new policies put solid ground beneath more people in Rust Belt communities, they can help shift the political conversation in these places from one based on nostalgia, anxiety, and resentment to one lifted up by greater hope and optimism.

This post was originally published at the Brookings Institution website on August 7, 2018.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.