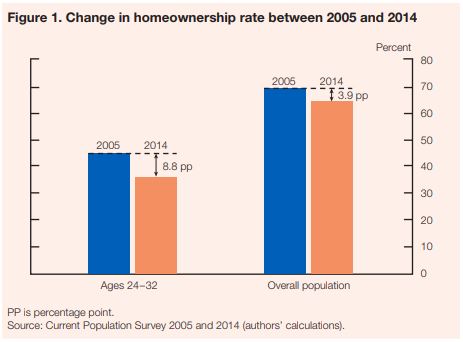

Between 2005 and 2014, the homeownership rate among Americans in an age range of 24 to 32 dropped by 8.8 percentage points, more than double the drop in the number of Americans in the age group. At the same time, outstanding student loan balances have doubled in real terms, from an average debt per capita among Americans in that age group of $5,000 to $10,000. Total student loan debt runs to about $1.4 trillion.

A soon-to-be published study cited in the premier issue of a new publication from the Federal Reserve called Consumer & Community Context found that roughly 20% of the decline in homeownership among young adults is down to the increase in their student debt.

Rising student loan debt in the 10-year period to 2014 reduced the homeownership rate among young adults by two percentage points, implying that just over 20% of the 8.9% drop in the group’s homeownership rate can be attributed to increased student loan debt: “This represents over 400,000 young individuals who would have owned a home in 2014 had it not been for the rise in debt.”

Rising student loan debt affects consumers’ ability to buy homes in many ways. The study highlights the impact of student debt on a consumer’s credit score: Higher student loan debt early in life leads to a lower credit score later in life, other things equal.

The study also found that increased student loan debt causes borrowers to be more likely to default on their student loan debt, loading a major negative effect on their credit scores and affecting their ability to qualify for a mortgage. In addition to restricting homeownership, credit scores affect consumers ability to get car loans, credit cards and other types of credit.

Finally, the authors note that an investment in postsecondary education pays off in the long run, “burdensome student loan debt levels may be lessening” the benefits. Policymakers would do well to consider policies that reduce tuition costs by raising investment in public institutions and that ease the burden of student loan payments through a “more expansive use” of repayments based on a debtor’s income.

Are You Still Paying With a Debit Card?

The average American spends $17,274 on debit cards a year, and it’s a HUGE mistake. First, debit cards don’t have the same fraud protections as credit cards. Once your money is gone, it’s gone. But more importantly you can actually get something back from this spending every time you swipe.

Issuers are handing out wild bonuses right now. With some you can earn up to 5% back on every purchase. That’s like getting a 5% discount on everything you buy!

Our top pick is kind of hard to imagine. Not only does it pay up to 5% back, it also includes a $200 cash back reward in the first six months, a 0% intro APR, and…. $0 annual fee. It’s quite literally free money for any one that uses a card regularly. Click here to learn more!

Flywheel Publishing has partnered with CardRatings to provide coverage of credit card products. Flywheel Publishing and CardRatings may receive a commission from card issuers.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.