Economy

Social Security Is Running Out of Money: Here Are 11 Questions Everyone Must Ask

Published:

Last Updated:

As we noted in our coverage of the 2019 annual report of the trustees of the Social Security and Medicare funds released on Monday, the Old Age and Survivors Insurance (OASI) that most Americans depend on for some or all of their retirement income will exhaust its funds in 2034 and, unless Congress and the president act to top up the funds, full retirement benefits will not be paid beginning in 2035.

The impact on most Americans will be severe. In a report from the Federal Reserve Bank published in February, the researchers found that more than 80% of the wealth in both defined benefit pension plans and defined contribution plans (401(k)s) was held by the top 25% of the U.S. wealth distribution. The bottom half of the distribution holds just 4%. That half is the most threatened by a drop in Social Security benefits: “[I]n the bottom half of the wealth distribution, Social Security dominates employer-sponsored retirement plans by a wide margin.”

The OASI fund depends on contributions from people who are currently working and paying Social Security taxes and interest on the balance being carried forward in the fund. Over its 84-year history, Social Security taxes have collected $21.9 trillion tax receipts and paid out $19 trillion in benefits. The remaining $2.9 trillion will begin to be drawn on beginning in 2020, according to the new trustees report. By 2035, that fund will be exhausted and tax receipts will not cover the benefits for current retirees.

No. However, unless the Congress acts to boost the withholding for Social Security, you will receive less than you would be entitled to under the current retirement benefit. The trustees estimate all Social Security retirement benefits will be reduced by 25%.

Under current law, you can begin collecting Social Security benefits when you reach the age of 62, or earlier under certain conditions. Your eligibility for full benefits depends on the year you were born. If you were born in 1953 or before, you are eligible for full benefits when you reach 66. If you were born in 1954, for example, you become eligible when you reach 66 years and two months of age. For every birth year between 1955 and 1960 or later, the eligibility age increases by two months until reaching 67 for people born in that later period. Under current law, you must begin collecting benefits when you reach 70 years of age.

The Social Security Administration (SSA) calculates your 35 highest-paid years and then adjusts for inflation. For example, if you earned $14,500 in 1982, that works out to an inflation-adjusted total of $37,320 in 2018 dollars and the SSA will use the 2018 value to compute your benefit.

Not exactly. You can choose to begin collecting benefits when you reach 62; however, that benefit is permanently lower than the amount you would receive if you wait until you reach 67, the age at which you would receive full benefits. The catch though is no one knows now what the full benefit will be in 2035 under the current projections. What is known is that taking Social Security benefits beginning at age 62 permanently reduces your benefits (under current law) by about 25%.

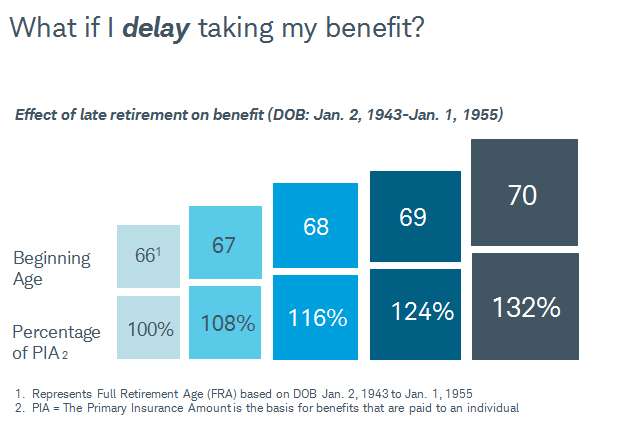

For each year that you wait beyond the year you are eligible for full benefits, you receive a credit of 8%. If you were eligible to receive the full benefit in 2017, for example, when you reached 66 but decided to wait until your 70th year to begin collecting your benefit, your monthly benefit would be 132% of your full benefit at age 66.

.

The monthly benefit is recalculated every year. As of March 2019, the estimated average Social Security monthly benefit for all retired workers is $1,461. The maximum benefit in 2019 for someone who waited to receive benefits until reaching full retirement age is $2,861. The SSA has a retirement benefits estimator you can use to get an idea of what your benefit would be at different ages under current law.

That depends on how long you expect to live. The SSA has an average life expectancy calculator based on gender and current age. If, for example, you are a male born in 1960, the average life expectancy today is 83.1 years. If you live to age 70, your life expectancy rises to 86. There are also other considerations, such as where you choose to live. Here are the best places to retire in every state.

You can begin collecting benefits at age 62 and still continue to work and pay into the Social Security system. Until you reach full retirement age the amount you earn reduces your benefit by $1 for every $2 you earn up to a maximum of $1,470 a month. The limit rises each year until you reach full retirement age, at which time there is no limit on how much income you earn and still receive your full retirement benefit. The withheld benefits are not lost but are paid back over a period of 15 years. The SSA’s rules on this are complicated, so going to the official source is recommended. Avoid making these other mistakes that can wreck your retirement plans.

If you have “substantial” income in addition to your Social Security retirement benefits, you may have to pay federal income tax on up to 85% of the benefits. For a married couple filing a joint return with earned income of $32,000 to $44,000, 50% of the retirement benefit may be taxed. For income greater than $44,000, 85% of retirement benefits may be taxed. If you have investments, here are some strategies to help lower your taxes.

Under current law, a surviving spouse who has reached full retirement age is eligible to receive 100% of your benefit. There are a variety of other survivor-related benefits outlined by the SSA.

What can be done to eliminate the threat to full Social Security benefits after the next 15 years? That’s a matter for public discussion and federal legislative action. Proposals are likely to include partial privatization of Social Security, something President George W. Bush tried (and failed) to push through in 2005, as well as lifting the current cap on contributions from high-income earners (currently $132,900) and reducing benefits slightly (not 25% as the new report estimates). Most likely is a Rube Goldberg solution that satisfies no one but has enough public and legislative support to protect the half of Americans who need Social Security the most.

Are you ready for retirement? Planning for retirement can be overwhelming, that’s why it could be a good idea to speak to a fiduciary financial advisor about your goals today.

Start by taking this retirement quiz right here from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes. Smart Asset is now matching over 50,000 people a month.

Click here now to get started.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.