No one can argue that technological progress hasn’t changed the lives of billions of people around the world. Rather than slowing down, the pace of technological change appears to be quickening.

Over the next decade or so, research and development in areas such as artificial intelligence and machine learning suggest that more automation is on track to replace many people who perform routine tasks, while at the same time providing more opportunities for people who have the skills to take advantage of the changes.

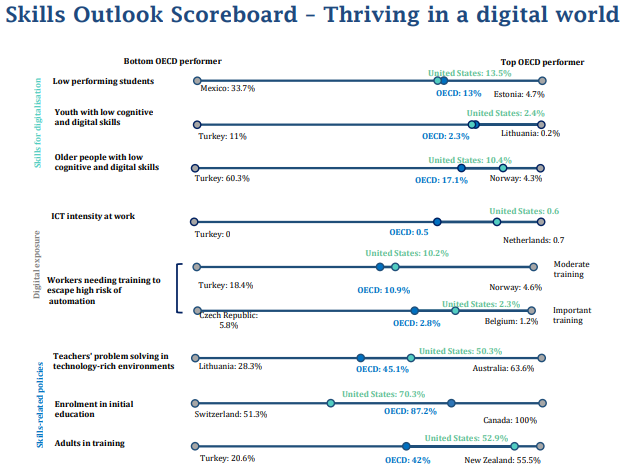

The Organization for Economic Cooperation and Development (OECD) on Thursday published its Skills Outlook, showing that some countries are better prepared than others to respond to the impending changes. The OECD has developed a skills scoreboard that illustrates where a country stands on eight different measures of preparedness grouped into three categories: skills for digitalization, developing skills that prepare workers for the digital world, and government policies related to gaining the requisite skills.

The skills scoreboard for the United States is a mixed bag. The nation scores in the top quarter among OECD countries for its policies on lifelong learning. However, U.S. scores on policies related to early education fall into the lower quarter. Here’s the OECD chart on how the United States performs on each measure.

According to the OECD report, only a few countries, including Belgium, Denmark, Finland, the Netherlands, Norway and Sweden, are ahead in terms of the “skills and effective lifelong learning systems needed to thrive in the digital world.”

The U.S. score of 70.3% for the percentage of Americans enrolled in initial training programs is far behind Canada’s 100% score. The OECD average is 87.2%. The U.S. scoreboard shows that “the United States [has] an average level of skill proficiency relative to other OECD countries but the share of young people lacking basic skills is high.”

The OECD estimates that 10.2% of American workers currently toil in jobs at high risk of automation and need “moderate training to transit to safer occupations with low or medium risk of automation.” A much smaller percentage, 2.3%, need “important training to avoid the risk of automation.”

Another bright note is that fully half of U.S. teachers demonstrate a high level of skill in “problem-solving in a technology-rich environment.” The OECD average is 45.1%.

OECD Secretary-General Angel Gurría commented, “To help people, governments will need to find the right balance between policies fostering flexibility, labor mobility and job stability. Businesses have also a key role to play in ensuring that employees upskill and reskill, adapting to the changing demands of the labor market.”

Traditional education systems need to evolve into lifelong learning systems, the OECD report notes, so that adult workers can “reskill and upskill throughout their careers to keep up with changes in the labor market.”

Currently, however, low-skilled adults in OECD countries who are the most likely to be affected by automation trail high-skilled adults by 40 percentage points in participation in skills training. OECD data indicates that more than half of jobs (54%) at high risk of automation will require workers to receive either moderate (less than a year) or intense (more than a year) of training in order to qualify for safer jobs.

100 Million Americans Are Missing This Crucial Retirement Tool

The thought of burdening your family with a financial disaster is most Americans’ nightmare. However, recent studies show that over 100 million Americans still don’t have proper life insurance in the event they pass away.

Life insurance can bring peace of mind – ensuring your loved ones are safeguarded against unforeseen expenses and debts. With premiums often lower than expected and a variety of plans tailored to different life stages and health conditions, securing a policy is more accessible than ever.

A quick, no-obligation quote can provide valuable insight into what’s available and what might best suit your family’s needs. Life insurance is a simple step you can take today to help secure peace of mind for your loved ones tomorrow.

Click here to learn how to get a quote in just a few minutes.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.