Economy

IMF States the Obvious: US Importers to Bear Weight of Tariffs

Published:

Last Updated:

As most economists and observers have said since the first Trump tariffs were imposed last August, the International Monetary Fund (IMF) repeated in a Thursday blog post: “Consumers in the US and China are unequivocally the losers from trade tensions.”

U.S. importers have paid the vast majority of the tariffs on goods imported from China. Changes in the prices of goods since tariffs have been imposed at the border account for virtually all the increase in the price of imported goods.

Importers have borne some of the costs on the $110 billion list of items subject to the tariffs on Chinese imports while the rest (such as tariffs on washing machines) have been passed on to U.S. consumers. The IMF suggests that further increases in tariffs will “likely be similarly passed through to consumers.”

The IMF expects only a small impact on inflation from future increases, and tariff hikes “could lead to broader effects through an increase in prices of domestic competitors.”

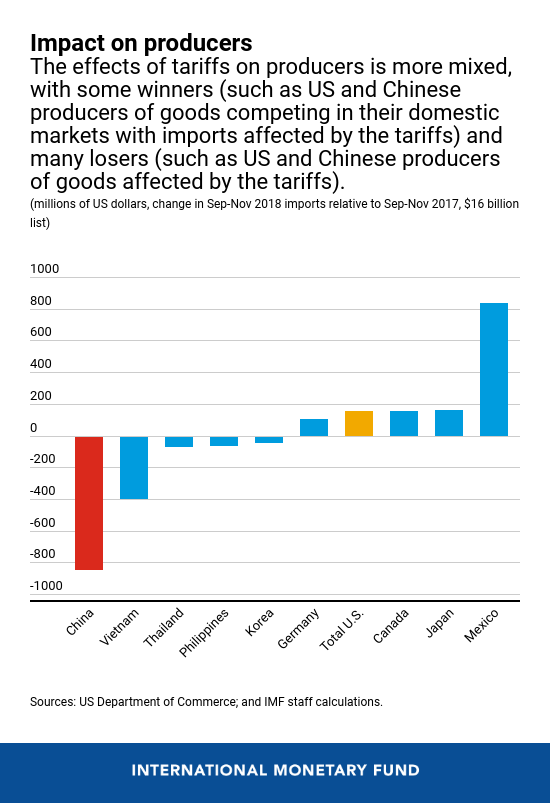

The effect on goods producers is more mixed. The IMF said that some U.S. and Chinese producers of goods that compete with imported goods hit by tariffs in domestic markets along with competing third-country producers are “potential winners.” But U.S. and Chinese producers of finished goods subject to tariffs and producers using those goods as intermediate inputs to make finished goods are “potential losers.” The following chart indicates the effect of the tariffs on several countries with which the U.S. trades goods.

The U.S.-China trade war has had only a minor impact on the trade balance between the two countries. According to the IMF, the U.S. trade deficit with China increased as U.S. imports rose, probably as a result of importers front-loading their inventories. The U.S. trade deficit with China declined by a “small” amount in the first three months of 2019.

If the United States goes ahead with imposing tariffs on an additional $200 billion worth of Chinese goods, the value of global gross domestic product will decline by 0.3% this year.

The IMF also notes that a failure to resolve the dispute between China and the United States could escalate into other industries (for example, the auto industry), creating a further negative effect on business and financial market sentiment generating added negativity to emerging market bond spreads and currencies, further slowing investment and trade.

Finally, the IMF concludes: “[H]igher trade barriers would disrupt global supply chains and slow the spread of new technologies, ultimately lowering global productivity and welfare. More import restrictions would also make tradable consumer goods less affordable, harming low-income households disproportionately.” 2019 is, the IMF says, a “delicate year for the global economy.”

The thought of burdening your family with a financial disaster is most Americans’ nightmare. However, recent studies show that over 100 million Americans still don’t have proper life insurance in the event they pass away.

Life insurance can bring peace of mind – ensuring your loved ones are safeguarded against unforeseen expenses and debts. With premiums often lower than expected and a variety of plans tailored to different life stages and health conditions, securing a policy is more accessible than ever.

A quick, no-obligation quote can provide valuable insight into what’s available and what might best suit your family’s needs. Life insurance is a simple step you can take today to help secure peace of mind for your loved ones tomorrow.

Click here to learn how to get a quote in just a few minutes.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.