Ahead of this week’s G-20 meeting of central bankers and finance ministers in Fukuoka, Japan, International Monetary Fund (IMF) managing director Christine Lagarde encouraged them to embrace “trade, innovation and openness.” That means reducing trade tensions and eliminating other “stumbling blocks” to help put the global economy on a path to “higher and more sustainable growth.”

Lagarde notes that a recently adopted “more patient” attitude from the U.S. Federal Reserve and the European Central Bank, along with added fiscal stimulus in China, have helped ease financial worries and lifted capital flows to developing nations. U.S. Fed Chair Jerome Powell said Tuesday that the Fed will do what it can to sustain the country’s economic expansion.

The coast is far from clear, though. For one thing, it is uncertain how lasting the recent uptick will last. What, for instance, would be the impact of a no-deal Brexit on confidence? Is the sharp drop in crude oil prices a cause or an effect of low economic activity?

A second stumbling block is the shakiness of the global economy. Rising corporate debt levels may “trigger disruptive capital flows” away from emerging markets. As we’ve also noted, at least one securities analyst sees current equity price movements that are eerily similar to the pre-crash summer of 2008.

The IMF sees a longer-run GDP loss to the United States of around 0.3% and to China of about 0.4%. Including tit-for-tat exports imposed in 2018, the loss to global real GDP in 2020 amounts to about 0.5%, or $455 billion.

Calling the U.S.-China tariffs “self-inflicted wounds that must be avoided,” Lagarde says they should be removed immediately and that further barriers to free trade must be avoided. She also noted that by raising the cost of goods to consumers, “protectionist measures” are “disproportionately harming low-income households.”

Diagnosing the problems is important, but fixing them needs the G-20 to resolve current trade tensions and modernize the existing international trade system while at the same time recognizing “that high public debt and low interest rates have left many countries with limited policy room for maneuver.”

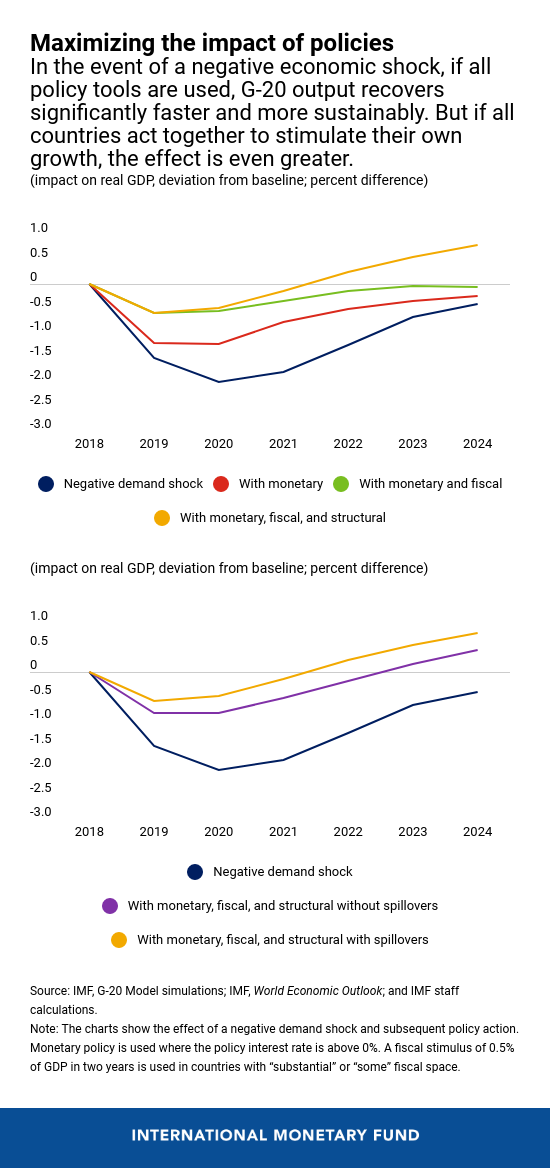

Referring to an IMF simulation of the impact of a negative shock to the global economy that results in using all available policy tools, Lagarde comments that “G-20 output recovers significantly faster and more sustainably.” Here’s the graphical representation.

Lagarde’s comments and the full IMF G-20 Surveillance Note for the Fukuoka meeting are available at the IMF’s website.

More U.S. economists are now warning about the impact of the trade war between the United States and China, and the Organisation for Economic Co-operation and Development (OECD), too, has warned about rising uncertainty weighing on trade and investment.

It’s Your Money, Your Future—Own It (sponsor)

Are you ahead, or behind on retirement? For families with more than $500,000 saved for retirement, finding a financial advisor who puts your interest first can be the difference, and today it’s easier than ever. SmartAsset’s free tool matches you with up to three fiduciary financial advisors who serve your area in minutes. Each advisor has been carefully vetted and must act in your best interests. Start your search now.

If you’ve saved and built a substantial nest egg for you and your family, don’t delay; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St.