Economy

US May Trade Deficit Widens to 2019 High Despite Tariffs

Published:

Last Updated:

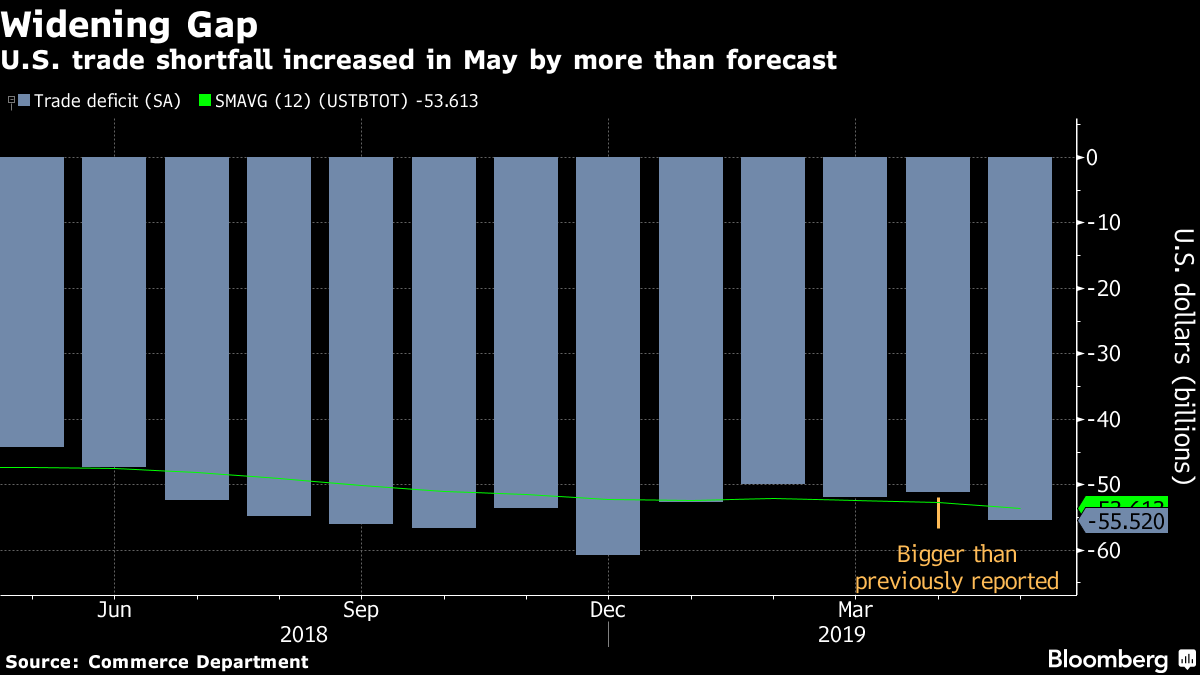

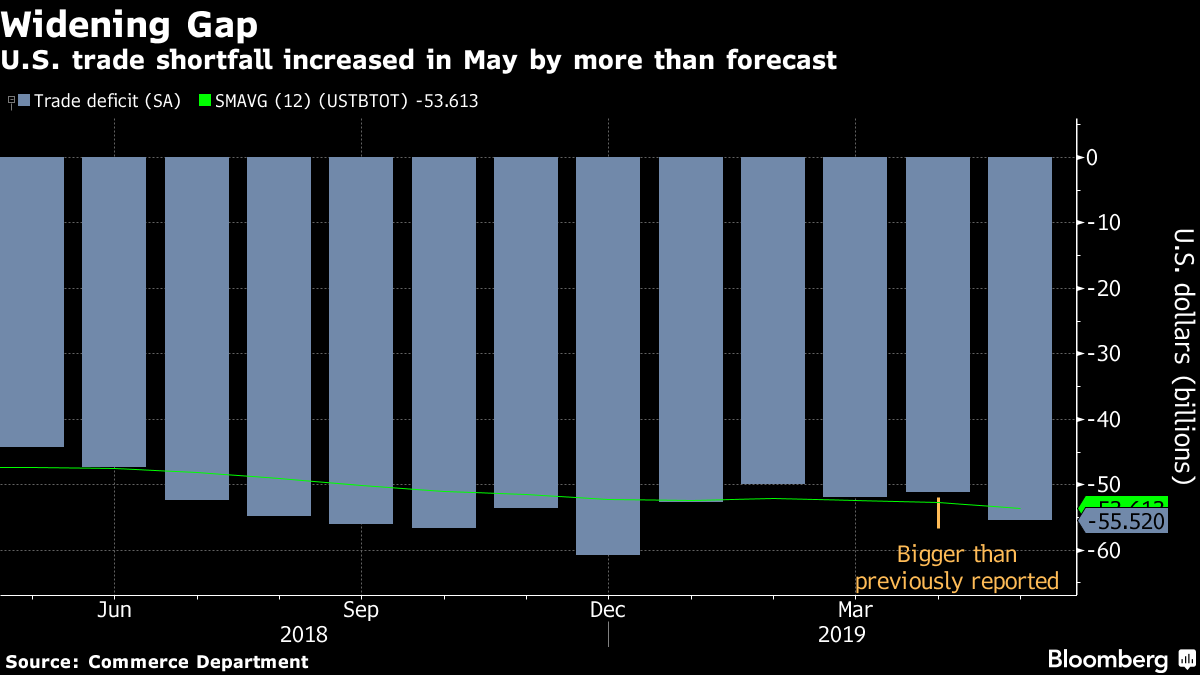

The U.S. trade deficit in goods grew to a total of $55.5 billion in May, according to Wednesday’s report from the U.S. Bureau of Economic Analysis (BEA). That’s wider than the consensus estimate of $53.5 billion and the upwardly revised April estimate of $51.2 billion.

The trade balance with China rose from $26.9 billion in April to $30.1 billion, and the U.S. deficit with China now totals $137.08 billion for the first five months of the year. Imports from China rose from $34.8 billion in April to $39.27 billion in May, while exports to China rose from $7.9 billion in April to $9.07 billion in May.

The volatility in exports and imports with China are largely the result of the tariffs the two countries are leveling on one another’s goods. Rising imports from and exports to China may indicate that companies front-loaded orders to get ahead of the Trump administration’s now-postponed increase in tariffs on all Chinese goods.

Overall, U.S. exports rose by 2% in May to $210.6 billion but were offset by an increase of 3.3% in imports to $266.2 billion.

Civilian aircraft exports rose by $500 million in May and telecom equipment exports rose by $400 million. The largest increase in exports came in soybeans, up by $700 million in the month.

Exports of services rose by $300 million in May, including $100 million increases in each of maintenance and repair services, travel and transport.

Imports of automobiles and parts rose by $2.3 billion, and passenger car imports rose by $1.3 billion. Oil imports also rose by $1.3 billion, and semiconductor imports rose by $500 million. Computer and computer accessories imports rose by $400 million and $300 million, respectively.

Adjusted for inflation (based on 2012 dollars), the trade deficit increased by $4.8 billion to $87.0 billion. Inflation-adjusted exports rose by $4.6 billion to $150.5 billion and imports rose by $9.3 billion to $237.5 billion. Inflation-adjusted oil imports hit an eight-month high of $10.7 billion due largely to rising imports from Canada.

The following chart from Bloomberg shows the U.S. trade deficit over the past 12 months.

The thought of burdening your family with a financial disaster is most Americans’ nightmare. However, recent studies show that over 100 million Americans still don’t have proper life insurance in the event they pass away.

Life insurance can bring peace of mind – ensuring your loved ones are safeguarded against unforeseen expenses and debts. With premiums often lower than expected and a variety of plans tailored to different life stages and health conditions, securing a policy is more accessible than ever.

A quick, no-obligation quote can provide valuable insight into what’s available and what might best suit your family’s needs. Life insurance is a simple step you can take today to help secure peace of mind for your loved ones tomorrow.

Click here to learn how to get a quote in just a few minutes.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.