There is something to the market adage “Sell in May and go away,” and it’s not just that traders and people in general are taking vacations over the summer and business tends to slow down. As the heat increases, it has been shown that the economy cools off.

An analysis of the American Time Use Survey found that on days with a maximum temperature above 85 degrees Fahrenheit, workers with higher climate exposure cut their working day by as much as an hour.

Heat also has been linked to a significant reduction in income per capita in the United States, with average daily income declining 1.5% for each 1.8 degrees that daily average temperatures exceed 59 degrees. Geoffrey Heal and Jisung Park pointed out in their review of research on climate and human health that this means that a day measuring at 84 degrees reduces the country’s annual income by 0.065%, and 20 such days a year would reduce income by 1.2%, equivalent to a minor recession.

A sizable portion of the U.S. labor force is exposed to extreme weather, with 5 million people working in the transport sector, 7 million in construction and 1.3 million on farms.

Overall, 58% of U.S. workers are hourly employees and many of the new jobs that have been added to the economy post-recession are part-time positions or in industries like construction that are affected by extreme weather.

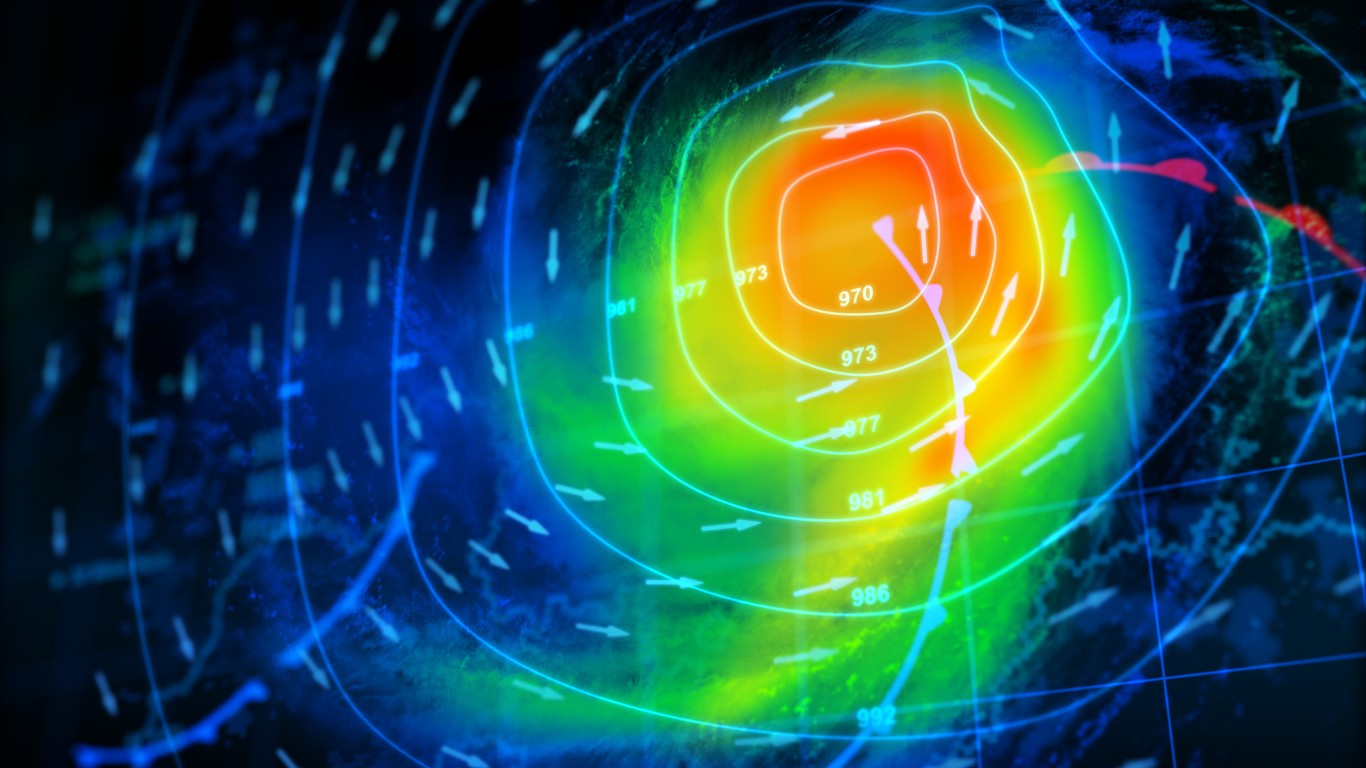

This is concerning because extreme weather is on the rise. Since 1980, the United States has experienced 246 billion-dollar disasters, of which 44% have occurred in the past 10 years alone. Such events also have become more expensive, costing the economy more than $1.1 trillion since 2005 and $500 billion in just the past five years.

So far, this summer’s extreme weather has had little impact on the markets, except for price fluctuation on some agricultural products, especially corn and soybeans. However, as economic data is released this month and next, it’s incredibly possible that a negative impact from this summer will be seen.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St.