As of the end of the second quarter of this year, U.S. student loan debt outstanding amounted to $1.48 trillion, a total more than five times the amount borrowed in 2003. That total is spread among approximately 43 million borrowers (compared with 19 million in 2003) and represents an average balance per borrower of $33,500, approaching double the average balance in 2003.

The median student loan, however, is much lower, at just under $18,000. About a third of borrowers have balances of less than $10,000, while 20% have balances greater than $50,000. Just 7% have balances exceeding $100,000.

The data was posted on the Federal Reserve Bank of New York’s Liberty Street Economics blog last week. The Fed economists attributed the explosion in student borrowing to two things: many more borrowers and rising college costs. Student borrowing rose during the Great Recession partly due to a tight job market that encouraged more students to go to college. College costs rose by about 2% to 3%, adding to the increased borrowing, while the average balance rose by about 5%.

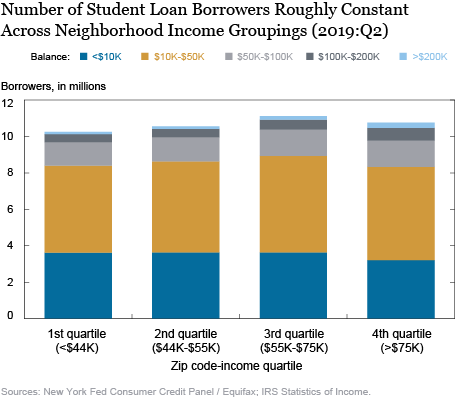

The researchers grouped anonymized credit reports and loan data and classified borrowers into quartiles based on the average adjusted gross income in their zip codes. Individual incomes are not available on credit reports.

The following chart shows that the number of borrowers was roughly the same across the quartiles. That’s largely due to the design of federal student loan programs that “distributes loans to borrowers across the income spectrum without regard to creditworthiness.”

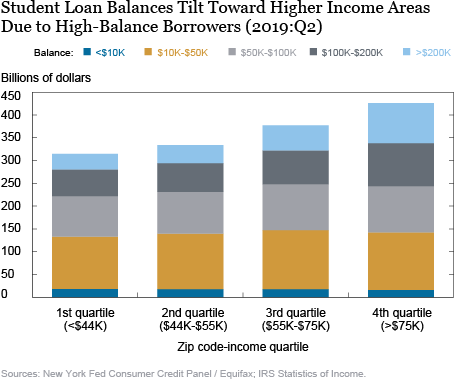

That equality is eroded when loan balances are totaled by quartile. Borrowers in the two lower-income quartiles have balances of around $650 billion while borrowers in the upper two quartiles have borrowed more than $800 billion.

The Fed researchers note that average balances are about $9,000 higher in the fourth quartile than in the first, but income levels are three times higher in the fourth quartile than in the first. As a percentage of income, balances in the first quartile reflect about 22% of a borrower’s income, while in the fourth quartile, balances reflect about 8% of an individual’s income.

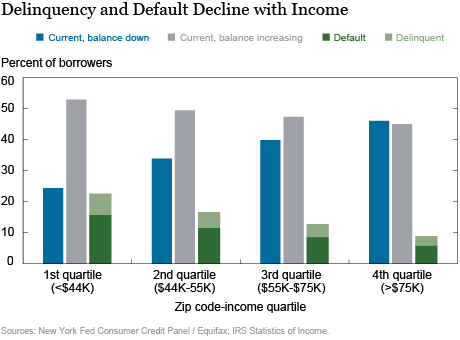

The natural result is that borrowers in the lower-income groups have a harder time making repayments and, consequently, have higher delinquency and rates. Even higher income borrowers struggle to lower their balances though, as the following graphic indicates. The gray bars show the percentage of borrowers who are current with their payments, but whose balances are increasing. The reasons for the rising balances could be that borrowers are still in school or have recently graduated, or they make payments that aren’t large enough to offset accruing interest.

A New York Fed study in 2017, noting that homeownership was positively associated with educational attainment, linked high student loan debt to lower homeownership levels among borrowers in their early 30s. The implications are serious and the researchers noted, “[T]he way we finance higher education, with an increased reliance on student debt, may have important implications for the housing market and the distribution of wealth.”

Policy proposals to cancel some or all student loan debt have come from both Democrats and Republicans as the country heads toward the 2020 presidential election. The Trump administration’s plan caps monthly payments at 12.5% of discretionary income and any balance remaining after 15 years (for undergraduate loans) or 30 years (for graduate student loans) would be forgiven.

Senator Elizabeth Warren would cancel up to $50,000 in student debt for every borrower, with the actual amount based on household income. Senator Bernie Sanders would forgive every dollar of the $1.48 trillion that is federally guaranteed (about 90% of the outstanding balance). Private loans would be purchased by the federal government from the lenders and then forgiven. Both plans also propose to make public colleges tuition-free.

For more information on student debt, see 24/7 Wall St.’s analysis of student debt levels in all 50 states.

Get Ready To Retire (Sponsored)

Start by taking a quick retirement quiz from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes, or less.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St.