Economy

Consumer Expectations Fell 10 Times Faster Last Week Than in Prior 2 Weeks

Published:

Last Updated:

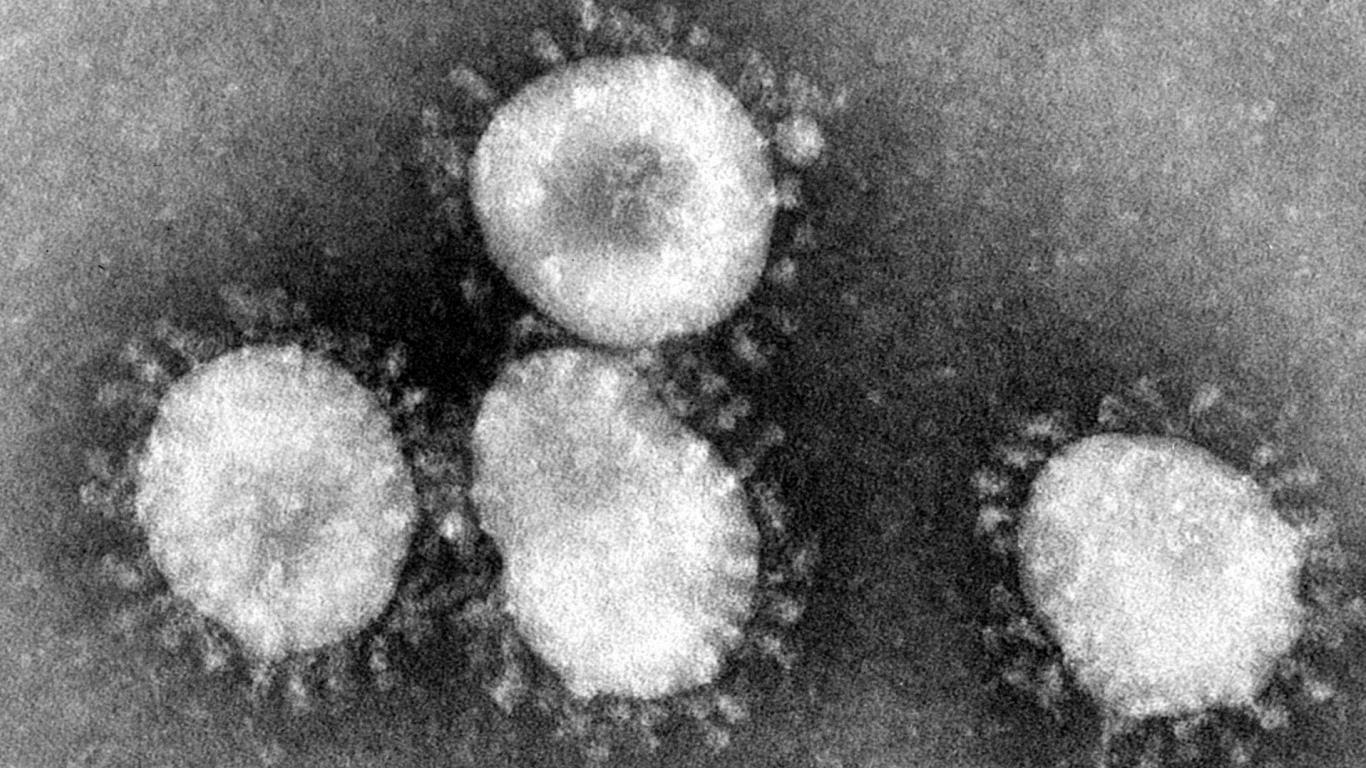

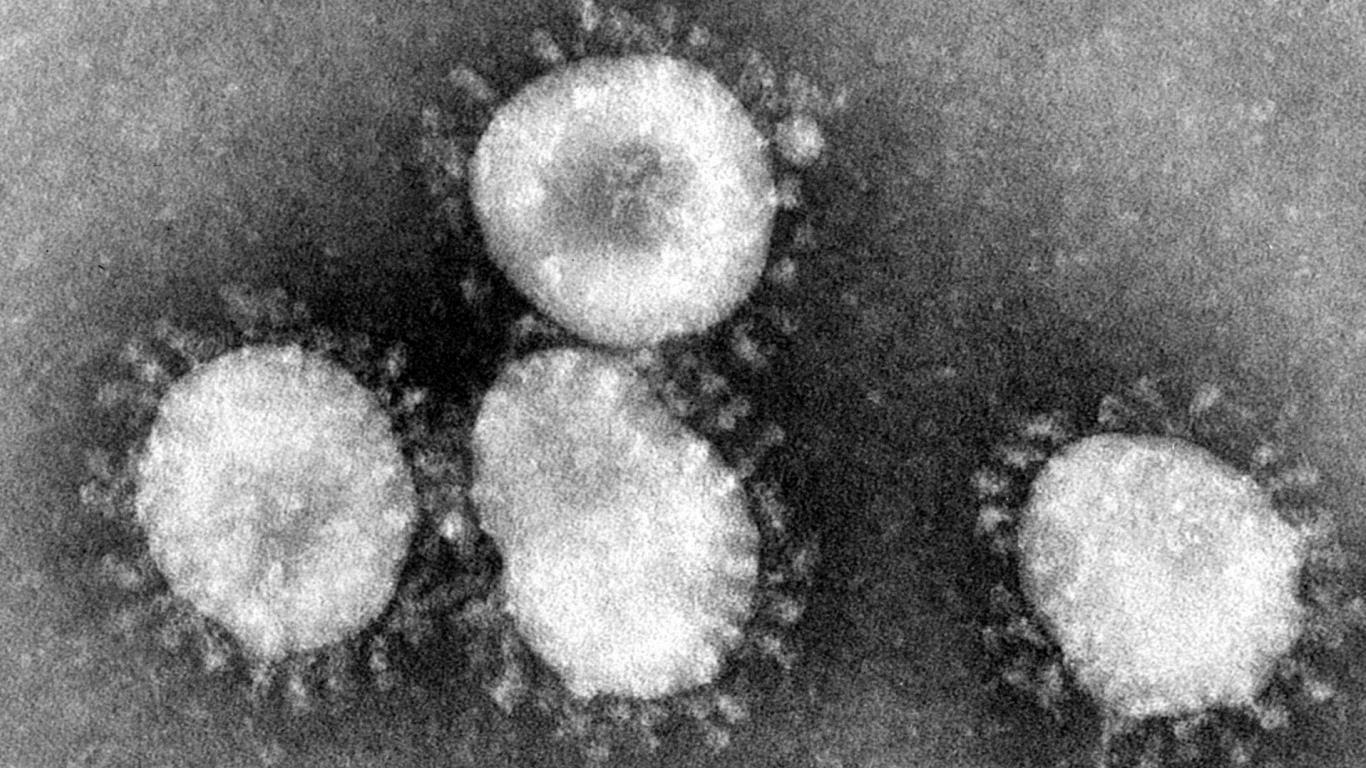

Consumer research firm Morning Consult reported Monday morning that its consumer sentiment index fell from 114.8 on February 24 to 112.2 on March 2. Based on its daily surveys, this is the seventh consecutive day that the consumer sentiment has declined. Escalating concerns related to the coronavirus outbreak are weighing heavily on American consumers’ outlook.

Of the index’s two components, consumer expectations of future business conditions have plunged. Between February 9 and February 23, the index slipped by an average of 0.08 points a day. Since February 24, the index has plunged 10 times faster, dropping by a daily average of 0.8 points per day. This component of the consumer sentiment index peaked at 116.5 on February 13.

The current conditions component of the sentiment index peaked at 114.9 on February 17 and has declined in two weeks to 112.4. The firm commented: “The fall in consumers’ expectations has yet to translate into a sustained decrease in their assessment of their current financial conditions, which suggests that the coronavirus outbreak has yet to impact U.S. labor markets.”

The index scores are based on the firm’s daily survey of some 7,500 U.S. adults and are significantly higher than it was at this time last year. Morning Consult asks the same questions of its survey respondents as does the University of Michigan’s twice-monthly Survey of Consumers. The difference is in the number and method of the survey. The Michigan sentiment index is based on 600 telephone interviews with U.S. adults, while Morning Consult’s results are based on an ongoing survey comprising 7,500 daily interviews and 210,000 monthly interviews, all conducted online.

Comparing the decline and possible recovery time from the current coronavirus worry, Morning Consult compares it to the downturn in consumer confidence when the U.S.-China trade war heated up late last spring and summer and the federal government shutdown that began in December 2018 and ran into January 2019. The firm notes that the “fallout from the coronavirus is different [from] those prior periods because there is not a clear policy response to alleviate consumers’ concerns.”

According to Morning Consult, the Federal Reserve and business officials are paying attention to consumer confidence as they try to chart a course through this latest black swan event. There are more tools in the box than cutting interest rates.

The last few years made people forget how much banks and CD’s can pay. Meanwhile, interest rates have spiked and many can afford to pay you much more, but most are keeping yields low and hoping you won’t notice.

But there is good news. To win qualified customers, some accounts are paying almost 10x the national average! That’s an incredible way to keep your money safe and earn more at the same time. Our top pick for high yield savings accounts includes other benefits as well. You can earn up to 3.80% with a Checking & Savings Account today Sign up and get up to $300 with direct deposit. No account fees. FDIC Insured.

Click here to see how much more you could be earning on your savings today. It takes just a few minutes to open an account to make your money work for you.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.