Economy

Millions of Government Workers Could Lose Their Jobs in the COVID-19 Recession

Published:

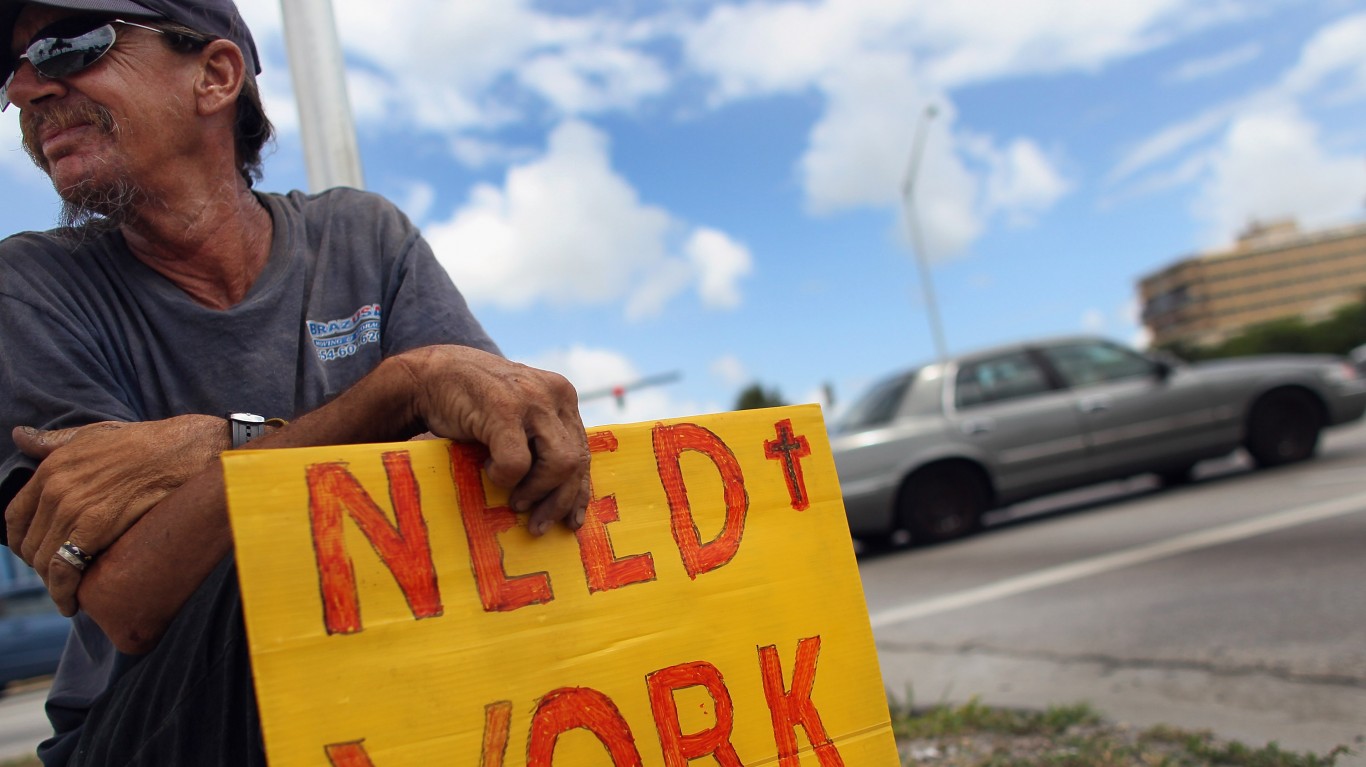

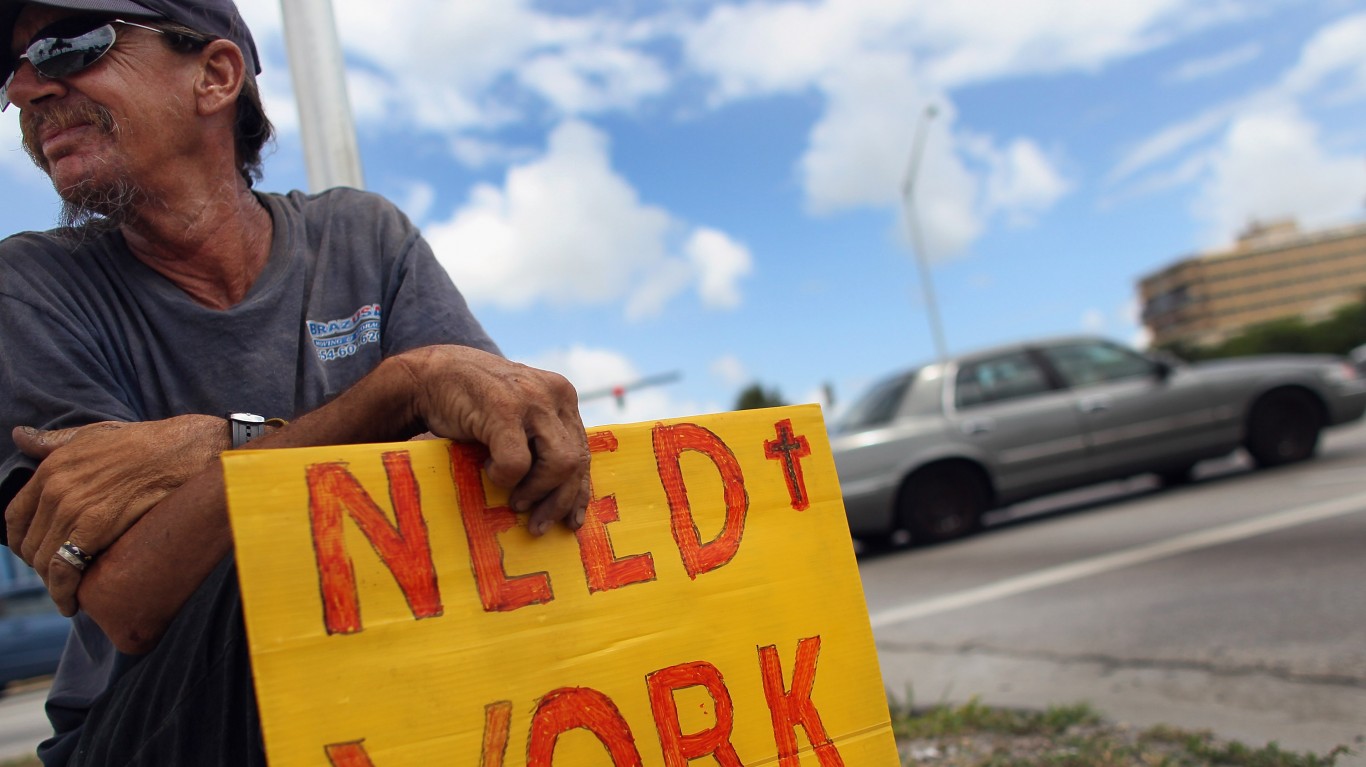

If there is one type of job that is supposed to be considered “safe” and “essential” it would probably be a government job. What if government jobs in this instant recession are now likely to face job cuts after millions of private sector workers have become unemployed?

The COVID-19 pandemic caught even the most prepared and healthy organizations off balance. The economy went from having record low unemployment to losing more than 20 million jobs in the course of only four weeks, and almost all of those were private sector jobs. There are likely hundreds or thousands of state and local jobs at risk near-term, and perhaps millions of jobs could see cuts, furloughs, rotations or other cuts if the current recession lasts very long.

Most federal level jobs are probably safe at this time, but the instant riches-to-rags economy is already swinging a wrecking ball into the budgets of states, counties, cities and other municipalities and agencies. This is where the greatest risk happens to be for government jobs, and the bad news at this level has only just started.

The recent $2.2 trillion financial rescue package called the CARES Act included $150 billion in the Coronavirus Relief Fund for direct aid to state and local governments. Unfortunately, that sum of money is either already spoken for or will be gone faster than it can be fathomed. Many states have been asking for federal aid to deal with the unprecedented waves of unemployment payments being made as the jobless claims are so massive.

State-level and local-level tax revenues are already suffering just two months into the bad news cycle. When consumers are only buying groceries and essential items, it creates tax revenue shortfalls all the way down the line for government budgets. When property values fall, that means lower property taxes and that is bad for states, counties and schools. Lower toll road use means lower transportation revenues, and far less driving means lower revenue from gasoline taxes. And millions of newly unemployed workers and millions more seeing pay cuts means that state and other income taxes are already coming in at much lower levels.

Add up all the shortfalls in the economy and the translation is that the states, cities, counties and other taxing authorities are already bringing in far less money than what was expected in the 2020 and 2021 budgets. The weakest Leading Economic Indicators report in 60 years signals much more bad news is on the way.

Unlike the federal government, states, municipalities and other local-level government agencies do not own printing presses like the U.S. Treasury to create money. This leaves local government options of raising taxes, issuing more bonds, tapping credit lines, and using cost-cuts such as layoffs, furloughs, cutting hours, and other spending cuts.

As for other cost cuts, states and local governments will have to be creative. Reports are still in the early stages for state and local governmental job cuts, but it’s a safe bet that the pressure on payrolls will grow almost as fast as it did in the private sector.

The website governmentjobs.org cites a U.S. Census figure that there are over 3 million federal government employees, 5.3 million state government employees, and 14 million local government employees. That’s over 22 million jobs in all, but the combined 19.3 million for states and local jobs would be where the largest at-risk jobs are.

It was just on April 20, 2020 that Fitch Ratings downgraded the State of New Jersey to ‘A-‘ from ‘A’ on its Issuer Default Rating of general obligation bonds. Fitch downgraded its ratings to on other state obligations linked to New Jersey’s Issuer Default Rating and to the state’s qualified bond program and school bond credit enhancement program down to ‘BBB+’ from ‘A-‘ and its rating outlook was revised to Negative from Stable implies that a further credit rating downgrade is more likely than a rating upgrade. Fitch’s press release did not discuss formal layoffs, but it showed potential pension system cuts:

The governor’s budget proposed an additional $279 million contribution to the pension system in the fourth quarter of fiscal 2020; Fitch is uncertain if that additional contribution will be made. The state did make its third quarterly payment to the pension system on time and the appropriated fourth quarter payment is due by June 30, 2020.

New Jersey’s governor has warned that public employee cuts were coming that could be historic at the state, county and local levels without additional federal money. The state of Pennsylvania has already reportedly laid off close to 9,000 employees. And multiple levels of state and local jobs in Michigan have already been cut. North Carolina’s Department of Transportation has been reported to have layoffs for temporary and contract workers.

To support the notion that vast amounts of more funds are going to be needed for the states and municipalities, NBC News cited that state and local governments might need as much as three-quarters of a trillion ($750 billion). Another report from the Congressional Research Service in April noted that the economic shock would hit state and local government budgets very hard.

Government workers might not be at-risk of having to file for unemployment benefits this week or this month, but job losses at the state and local levels are likely coming without a miracle cure for COVID-19 and without a cure for the economy.

Credit card companies are pulling out all the stops, with the issuers are offering insane travel rewards and perks.

We’re talking huge sign-up bonuses, points on every purchase, and benefits like lounge access, travel credits, and free hotel nights. For travelers, these rewards can add up to thousands of dollars in flights, upgrades, and luxury experiences every year.

It’s like getting paid to travel — and it’s available to qualified borrowers who know where to look.

We’ve rounded up some of the best travel credit cards on the market. Click here to see the list. Don’t miss these offers — they won’t be this good forever.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.