While 2020 has been a year of economic disaster, it is hard to imagine that the stock market has somehow been able to climb back to almost hitting highs again on the S&P 500. The good news is that some of the economic reports are continuing to show improvements. The bad news is that the improvements are rather small considering how deep the economic losses have been over the first half of 2020.

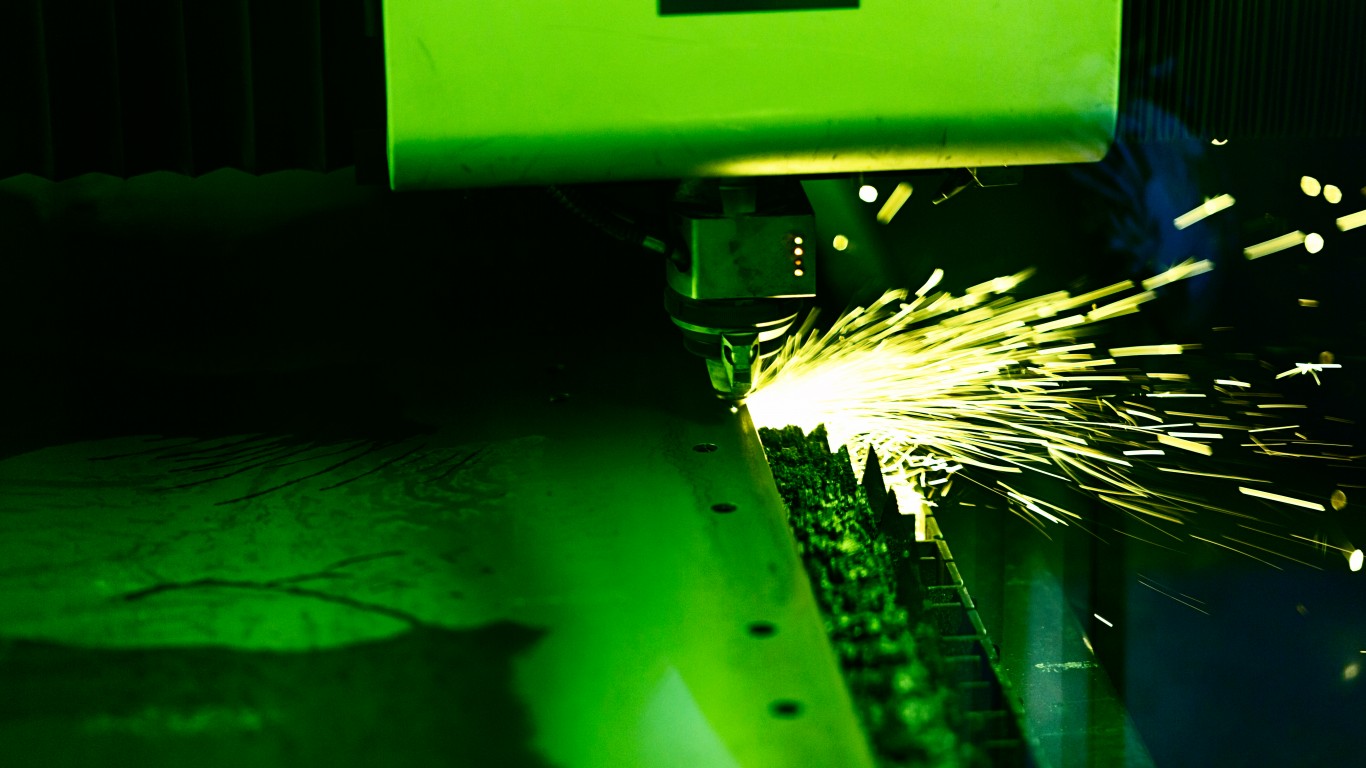

Industrial production rose by 3.0% in the month of July. That is versus a 5.7% gain in June. The Federal Reserve report more or less matched consensus expectations. Industrial production is still down by more than 8% below the pre-pandemic levels of February.

Manufacturing output rose by 3.4% in the month of July. That is after rising by 7.4% in June.

According to the Federal Reserve, most major industrial groups saw gains. Unfortunately, those gains mostly appeared to be smaller gains than what were seen in June.

Factory production outside of autos increased by 1.6% in July. Motor vehicles and parts was a serious winner with a 28.3% gain, but mining rose by just 0.8% and output from utilities was up 3.3% in July versus just a 2.0% gain in June.

While the U.S. is not considered to be a manufacturing-dominated economy any longer, the factories and plants we do have seem to be awash in capacity. The Fed’s report on capacity utilization was 70.6% in July versus a revised 68.5% in June. The capacity utilization rate in the manufacturing was down at 69.2%, versus 75.2% for utilities and versus 73.5% for mining.

Stocks had digested the production news and some slight gains in retail sales and on tepid sentiment gains by improving from the lows seen on Friday morning. That said, with less than 45 minutes of trading the Dow was down just 0.1% at $27,871 and the S&P 500 was down 0.2% at 3,367. The yield on the 10-year Treasury note was down less than 1 basis point at 0.71%.

Travel Cards Are Getting Too Good To Ignore

Credit card companies are pulling out all the stops, with the issuers are offering insane travel rewards and perks.

We’re talking huge sign-up bonuses, points on every purchase, and benefits like lounge access, travel credits, and free hotel nights. For travelers, these rewards can add up to thousands of dollars in flights, upgrades, and luxury experiences every year.

It’s like getting paid to travel — and it’s available to qualified borrowers who know where to look.

We’ve rounded up some of the best travel credit cards on the market. Click here to see the list. Don’t miss these offers — they won’t be this good forever.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.