As Thursday morning dawned in the western United States, almost 25,000 firefighters will be working on 70 fires, 42 of which are characterized as large and uncontained. Since these fires started, they have burned nearly 4 million acres. So far this year, more than 44,000 wildfires have burned nearly 7.5 million acres.

Over the past two years, more than 96% of all acres burned were located in 15 states, according to a new report on wildfire risk from CoreLogic. Those states are Alaska, Arizona, California, Colorado, Florida, Idaho, Montana, New Mexico, Nevada, Oklahoma, Oregon, Texas, Utah, Washington and Wyoming.

As Americans move closer to the frontiers (called the wildland-urban interface or WUI), they are moving closer to the forests, brush and grasses that provide fuel for destructive fires. Combined with higher temperatures and lower humidity, wildfire risk is rising all across the country, but the risk remains greatest in the wide-open spaces of the West.

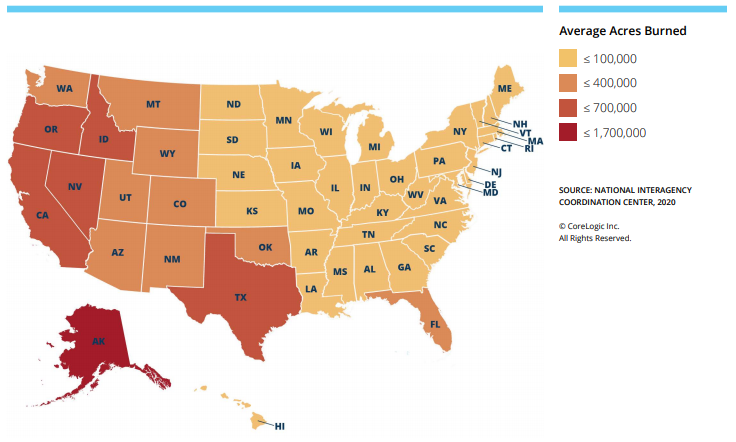

The following map from CoreLogic’s September 2020 Wildfire Report shows the average land area burned over the past 20 years in every state. With the exception of Florida, the most at-risk states are located in the West or Southwest, with Alaska seeing the highest average acreage burned over the 20-year period.

According to CoreLogic’s analysis, the total number of single-family homes at risk from a wildfire totaled about 31 million. Of those, 28.5 million are a low risk and 1.98 million face moderate, high or extreme risk from wildfires. More than 14,000 multifamily residences also face moderate to extreme risk from wildfires.

The total reconstruction cost value (RCV) of single-family homes facing moderate risk is $105.6 billion, while the RCV of homes determined to face high risk is $312 billion and the RCV of homes at extreme risk is $220.6 billion. The total for these three risk levels is $638.1 billion. For multifamily residences, the RCV for homes at moderate to extreme risk levels is $6.2 billion.

RCV is not the same as replacement cost. Homeowners may be underinsured if their policy is based on a replacement value rather than a reconstruction value, according to CoreLogic.

Another factor for homeowners to keep in mind is the time required to rebuild. Northern California’s 2017 Tubbs fire destroyed 3,043 housing units. As of June, less than half (1,282) had been completely rebuilt.

It’s Your Money, Your Future—Own It (sponsor)

Are you ahead, or behind on retirement? For families with more than $500,000 saved for retirement, finding a financial advisor who puts your interest first can be the difference, and today it’s easier than ever. SmartAsset’s free tool matches you with up to three fiduciary financial advisors who serve your area in minutes. Each advisor has been carefully vetted and must act in your best interests. Start your search now.

If you’ve saved and built a substantial nest egg for you and your family, don’t delay; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.