Economy

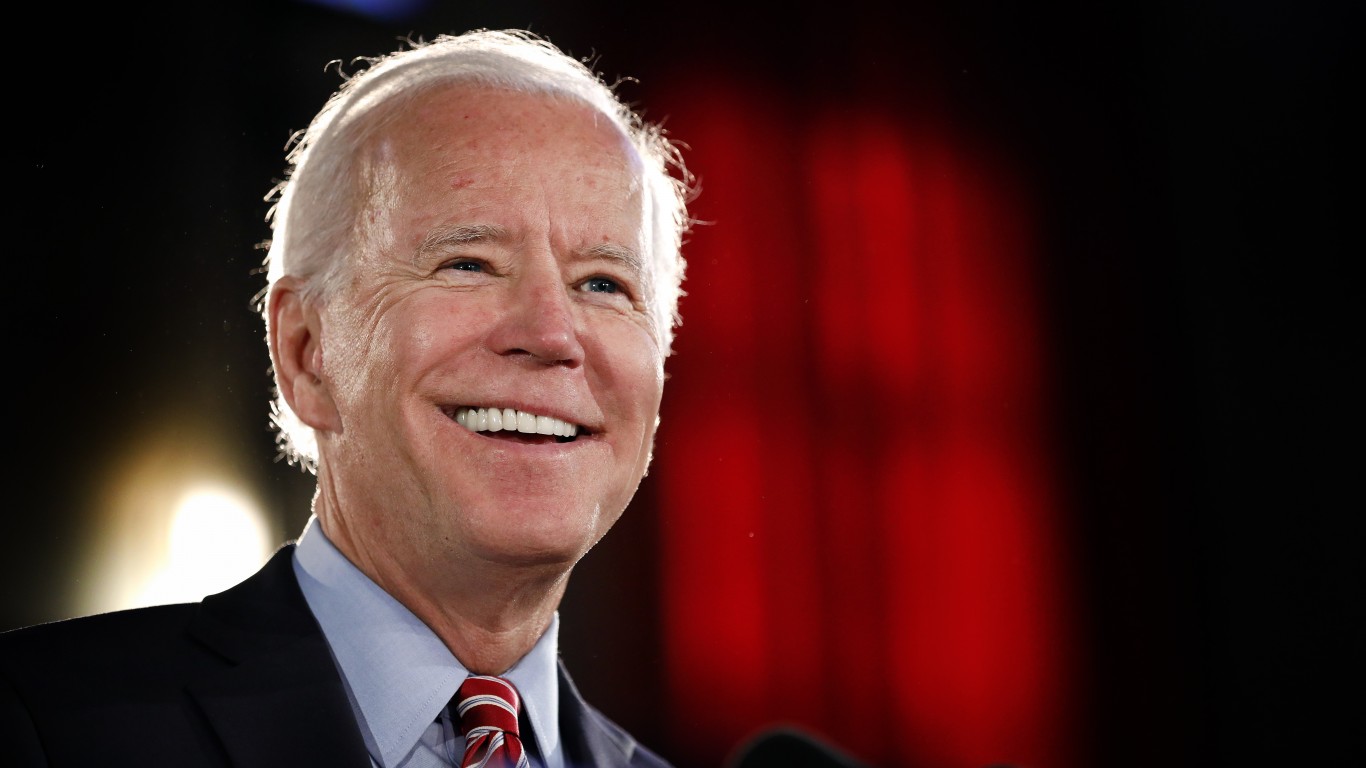

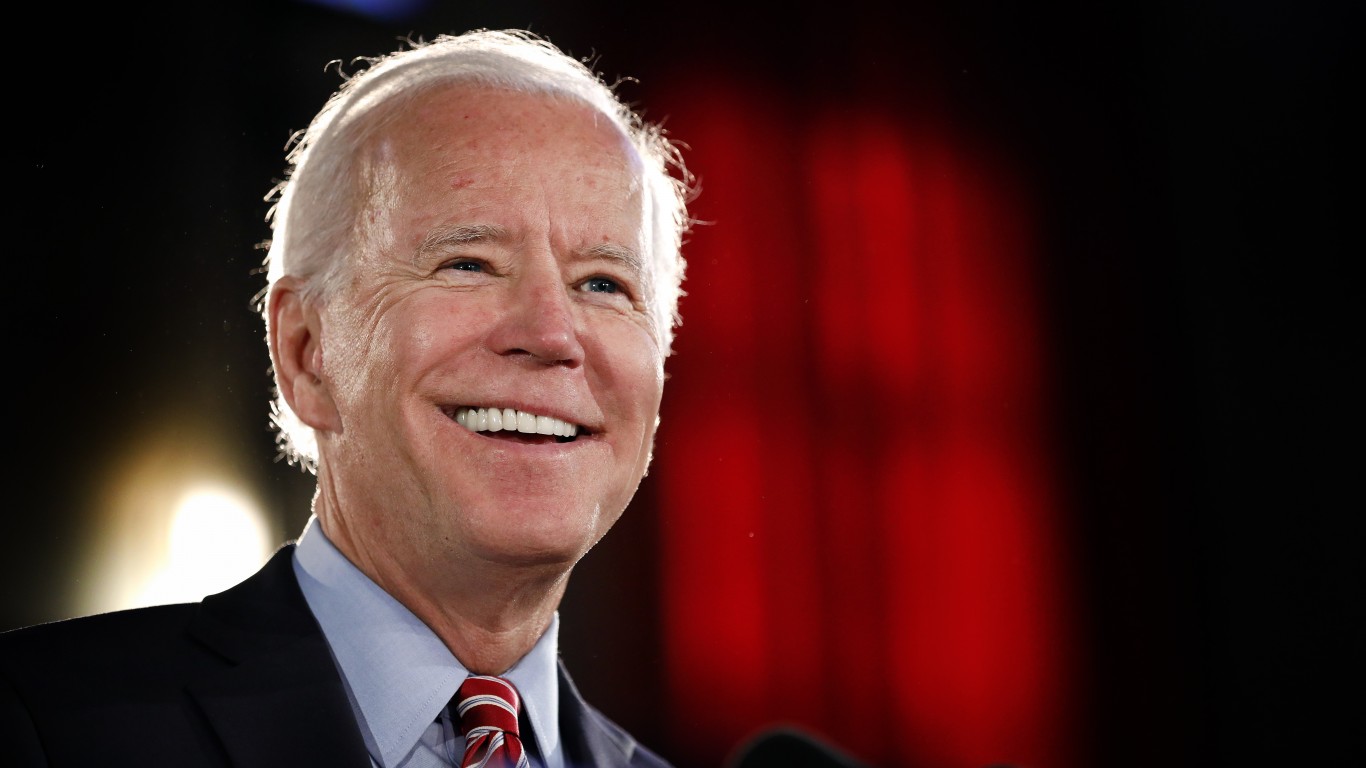

Biden's budget goes for fossil fuel's throat as oil prices near $70 a barrel

Published:

By David Callaway, Callaway Climate Insights

It's the official start of the Atlantic #hurricane season today.@NOAA predicts 60% chance of an above-normal season, with a likely range of 13 to 20 named storms, incl 6-10 hurricanes.

Names to look out for: pic.twitter.com/0efl0YRuZT— World Meteorological Organization (@WMO) June 1, 2021

Today marks the start of hurricane season. Ana, the first name on the list above, already formed in May and the next named storm for this season will be Bill.

Pondering the future of oil while filling up my wife’s car for $4.93 a gallon over the weekend, it seems more and more like last week’s trio of legal and shareholder climate victories over fossil fuel companies are the opening of a new front of conflict, rather than a tipping point in the war.

The Biden Administration is laying on the pressure in its $6 trillion U.S. budget, proposing to eliminate up to $35 billion in tax incentives that energy companies have enjoyed for years. Among them are the ability to shield up to 15% of the revenue from an oil well from taxes, and the ability to claim deductions on certain “enhanced drilling” practices that require more tools and effort to reach oil in difficult places.

But against this backdrop, the price of oil continues to rise toward $70 a barrel, which puts it back in the realm of profitability for most types of drilling, tar sands, fracking, etc. commonly used by fossil fuel companies. Indeed, the higher the price drifts, the more difficult it will be for companies to embrace the desire of governments and many shareholders to transition their business models to renewable energy.

That’s not to say they won’t, or aren’t already, as we lay out in detail in our subscriber insights today. But it will certainly reduce the sting of abolished tax breaks heading the industry’s way.

More insights below. . . .

. . . . It may be just coincidence that French oil giant Total (TOT) announced plans last week to change its name to TotalEnergies, and it didn’t stop the cries of greenwashing, but it does signal the beginning of a raft of corporate identity changes as fossil fuel dinosaurs begin the transition. Altria anyone? Read more here. . . .

. . . . Higher oil prices caused pain at the pump in the U.S. over the Memorial Day Weekend, but compared to Europe, Americans are still far better off, mostly because of lower fuel taxes. Hard not to notice how far ahead Europeans are in adopting electric vehicles, though. Read more here. . . .

. . . . A German trade publication reports that Volkswagen is considering an IPO for its battery division, as part of the company’s broad embrace of the potential for electric vehicles. While the idea may be just one of many financing alternatives the German automaker is mulling, it would make some sense given Volkswagen’s ambitious plans to build six giga-factories for cell production in Europe by 2030, producing enough batteries for up to five million electric cars. As we’ve noted before, the future of electric vehicles is all tied to advances in battery production. And the capital to make that happen. . . .

With the world’s coral reefs under threat from climate change, the journal Nature is featuring research on the response of these important ecosystems to the threats, and how their vulnerability influences public action and adaptability. The research includes quantifying global potential for coral evolutionary response to climate change, and coral reef survival under accelerating ocean deoxygenation.

Kohler Power is expanding its clean energy offering with Kohler Power Reserve energy storage systems. The new line offers customers a modular backup system to store and access the energy produced by their home’s solar systems. Kohler offers both AC- and DC-coupled units, allowing users to access the type of power source/output required for their homes without purchasing additional accessories. Additionally, the company says homeowners can access and manage their stored solar power through an app that provides insights into real-time power flow for the home.

The former owners of a steel plant in Italy were convicted Monday in a toxic pollution case that prosecutors say cost hundreds of lives. They were each sentenced to more than two decades in prison, ABC News reports. The men, identified in the report as brothers Fabio Riva and Nicola Riva, were the owners of the Ilva steel plant in the southern city of Taranto. ABC said they were convicted of criminal association aimed at provoking an environmental disaster, poisoning the food supply and willful omissions of workplace safety measures. Two other managers were also found guilty in the case and sentenced to more than two decades, among the 24 former managers convicted in the five-year trial, according to the report.

As of June 1, the Fire Information for Resource Management System reported four new large incidents in the U.S. and Canada, two large fires contained, and 15 large fires uncontained. Again, the southwestern region was the hot spot, with seven new large incidents and eight uncontained large fires. The National Interagency Coordination Center reports as of Tuesday morning, more than 134,000 acres had burned.

Credit card companies are pulling out all the stops, with the issuers are offering insane travel rewards and perks.

We’re talking huge sign-up bonuses, points on every purchase, and benefits like lounge access, travel credits, and free hotel nights. For travelers, these rewards can add up to thousands of dollars in flights, upgrades, and luxury experiences every year.

It’s like getting paid to travel — and it’s available to qualified borrowers who know where to look.

We’ve rounded up some of the best travel credit cards on the market. Click here to see the list. Don’t miss these offers — they won’t be this good forever.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.