By Mark Hulbert, Callaway Climate Insights

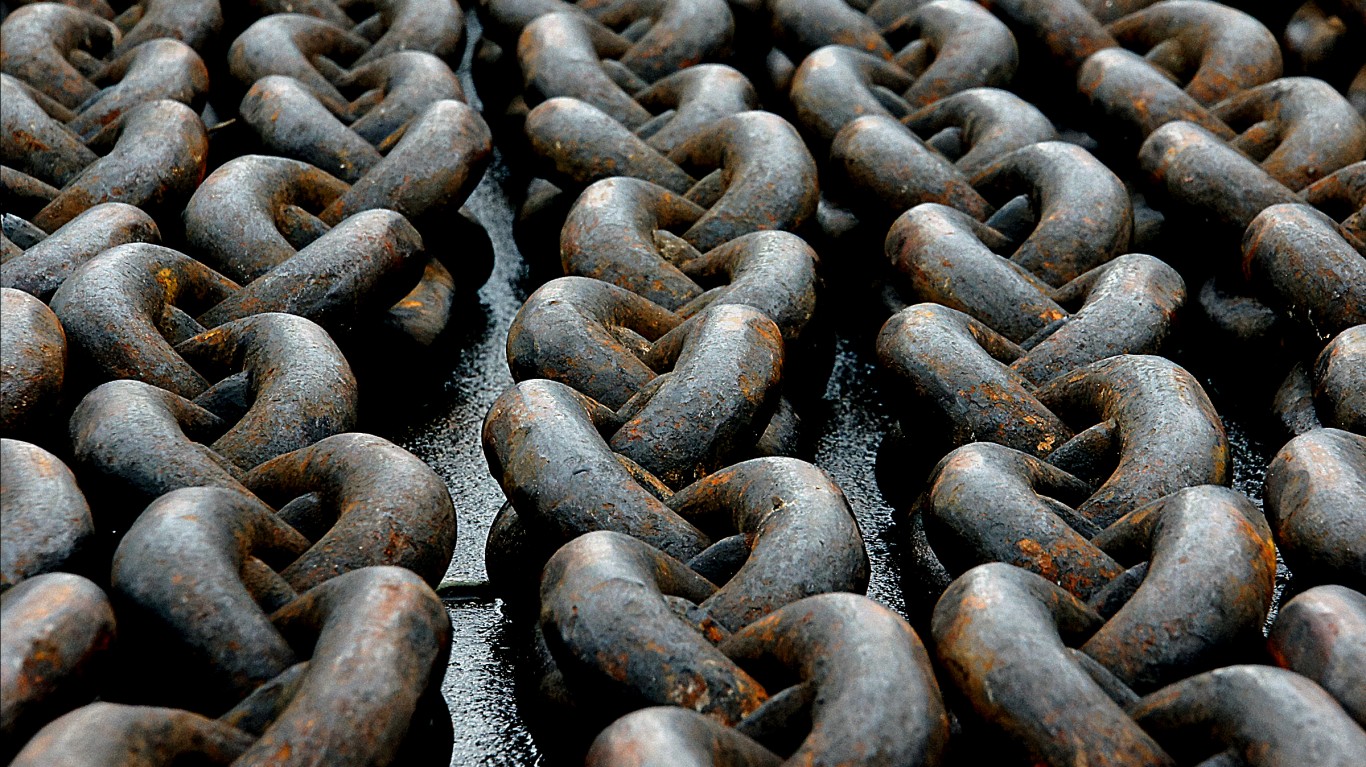

CHAPEL HILL, N.C. (Callaway Climate Insights) — The gap between exciting potential and depressing reality continues to widen for sustainability-linked bonds (SLBs).

I’m referring to bonds whose interest rates are dependent on the issuing company meeting specific sustainability targets. In theory they represent a huge step forward in the finance arena’s response to climate change. They are different from so-called green bonds, in which the issuing company agrees to only use the proceeds on green projects but makes no commitment to actually reducing its carbon footprint. With SLBs the issuers commit to certain externally-verifiable outcomes — and put a price tag on failing to do so.

SLBs represent a market-based way of holding companies’ feet to the fire. With an SLB the issuing company can potentially secure a lower cost of capital, and investors can get at least some assurance that the issuer’s commitments are more than just talk.

That oil and gas company committing to become carbon neutral by 2050? Offer them 30-year financing with a below-market interest rate if they make good on their commitment, but which jumps to a higher rate if they don’t meet their target. There should be a market-clearing price for such a transaction.

That’s the theory. The reality is far different, according to a just-completed study, which found that issuing companies more often than not have used SLBs to take advantage of well-meaning but gullible investors. . . .

To read this column, all our insights, news and in-depth interviews, please subscribe and support our great climate finance journalism.

Callaway Climate Insights Newsletter

Take Charge of Your Retirement: Find the Right Financial Advisor For You in Minutes (Sponsor)

Retirement planning doesn’t have to feel overwhelming. The key is finding professional guidance—and we’ve made it easier than ever for you to connect with the right financial advisor for your unique needs.

Here’s how it works:

1️ Answer a Few Simple Questions

Tell us a bit about your goals and preferences—it only takes a few minutes!

2️ Get Your Top Advisor Matches

This tool matches you with qualified advisors who specialize in helping people like you achieve financial success.

3️ Choose Your Best Fit

Review their profiles, schedule an introductory meeting, and select the advisor who feels right for you.

Why wait? Start building the retirement you’ve always dreamed of. Click here to get started today!

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.