Economy

Biden's energy Hail Mary, Australia's coal surprise, and our new website

Published:

By David Callaway, Callaway Climate Insights

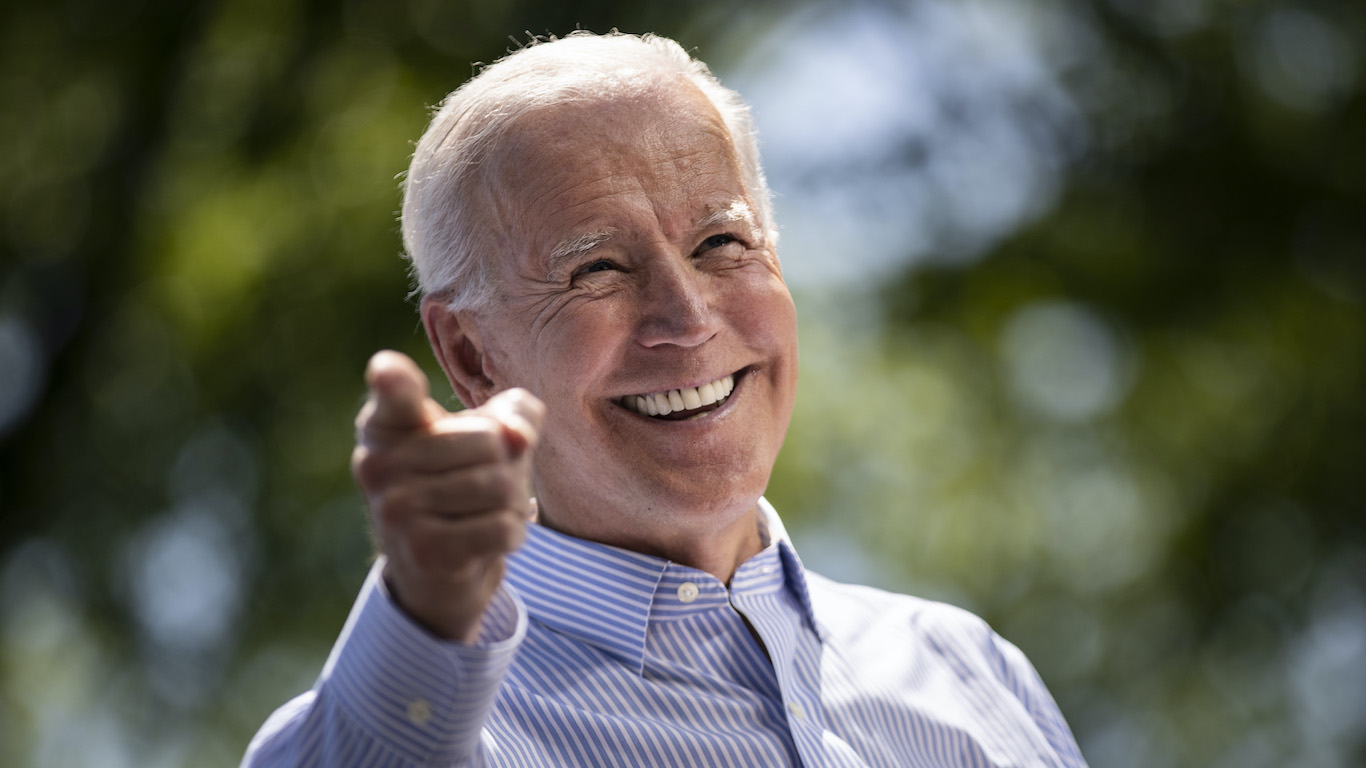

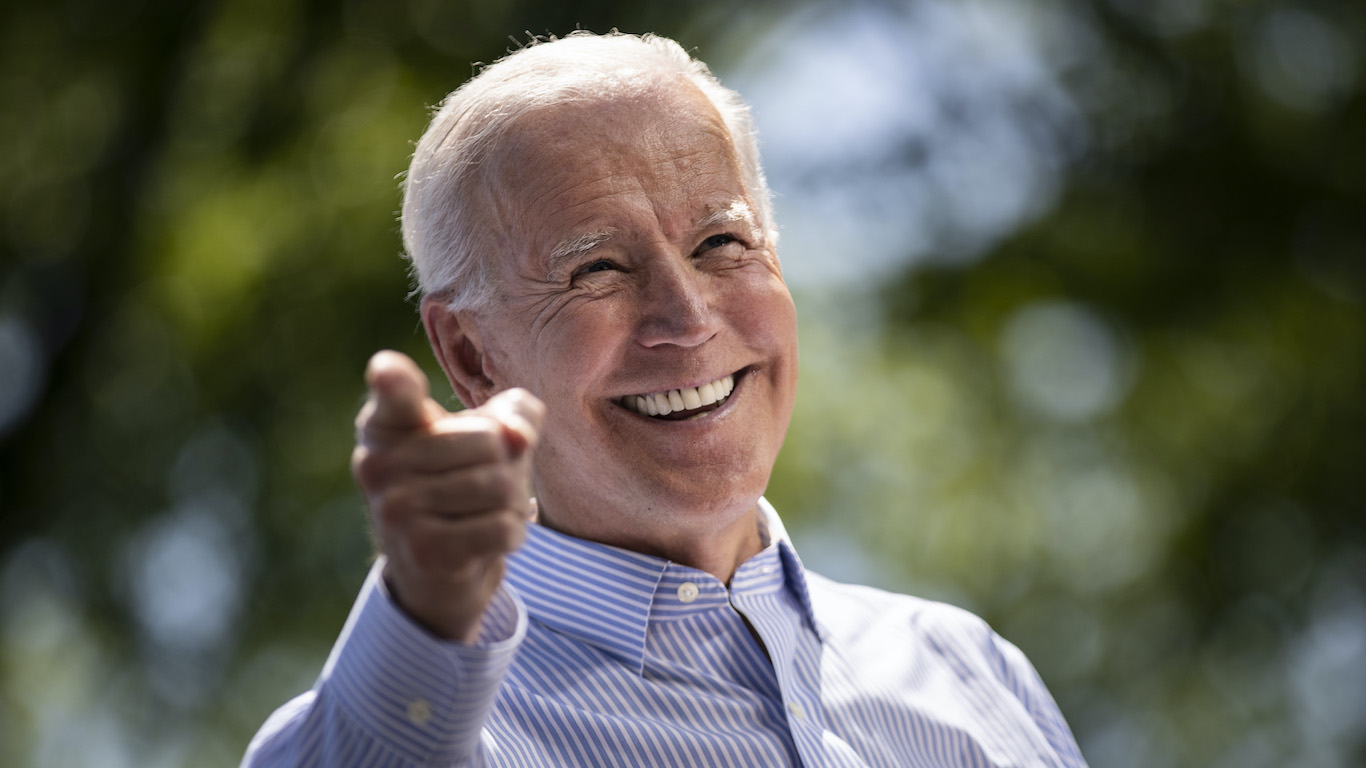

In the absence of any progress on President Biden’s Build Back Better plan in Congress, the administration is eyeing every trick play in the book to drum up consumer and climate support ahead of this fall’s midterm elections.

One such Hail Mary came this week as Democrats said they might scrap the 18.4 cents-per-gallon national gas tax to help lower pump prices and reduce energy inflation. Such a move would be another gift to the oil industry and hold back higher adoption of electric vehicles just as they are beginning to catch on in the U.S.

Even some tax-hating Republicans are against it, as the consumer savings would quickly be overwhelmed by even higher prices; just as they were back in November when the administration released 50 million barrels of crude oil from the strategic energy reserve.

Another idea is to use $9.5 billion from the infrastructure law last year to invest in clean hydrogen. This makes more sense, but the U.S. is far behind Europe in adopting green hydrogen and no material benefits could be expected before the midterms.

The Biden team operates on the idea that lowering gas prices — however it’s done — is a better way to win consumers than to continue pushing costly climate initiatives. By mixing those messages, though, it only looks more confused, and desperate.

More insights below, including what’s behind Australia’s surprise closing of its largest coal-fired plant. . . .

. . . . Sustainability-linked bonds, which allow companies to borrow money at lower rates by promising to hit specific climate targets, have boomed in recent years as a benefit for both the borrowing companies and investors, writes Mark Hulbert. But a new study that tracked how these bonds are set up found that many of them are at rates so low that companies can avoid hitting their targets and still save money, leaving gullible investors with less returns and no sustainability. Are these bonds just another form of greenwashing? . . .

. . . . Africa’s political and business leaders traveled to Brussels this week as the European Union sought to entice them away from the lure of Chinese economic spending with €150 billion in new project enticements, writes Stephen Rae from Brussels. EU Climate Commissioner Frans Timmermans said he particularly thinks Africa could be a starting gate for green hydrogen projects. The summit comes ahead of a key report later this month from the Intergovernmental Panel on Climate Change (IPCC) — the global science body on climate heating — which is expected to further detail the bleak future the African continent can expect from global warming, and the United Nations COP27 summit in Egypt later this year. . . .

. . . . Origin Energy’s plans to shut Australia’s biggest coal-fired power plant seven years ahead of schedule is a bigger deal then many think. The Land Down Under’s right-leaning government has been a longtime supporter of coal, which still accounts for more than half the nation’s electricity. After a year of growing coal usage worldwide, Origin’s admission that the economics of competing against renewable energy still don’t work will send a chill through the coal industry. Joe Manchin take note. Read more here. . . .

. . . . With every drop of water important in increasingly parched and hot California — and renewable power a state priority — a water and electricity utility in the center part of the state has come up with a double solution: solar panels built over canals. The panels generate power while their shadow brings down evaporation from the waterways. It’s the latest example of using technology creatively to amplify the benefits to more than one solution. Read more here. . . .

. . . . About one in 10 U.S. homes was impacted by climate change last year, according to a new report from CoreLogic. The property damage to more than 14.5 million homes added up to just under $57 billion, according to the report, with the vast majority coming from winter storms. Read the report here. . . .

. . . . Gas prices are at their highest levels in almost 10 years. But a decade ago there were only a handful of electric vehicles that could bypass the yo-yo of fossil fuel prices. Now the situation in different. With EV sales having tripled in the past three years, and set for a new record in 2022, economic pain at the pump such as we’re seeing right now may soon be a thing of the past. Giving way to a scramble for EV chargers, we imagine. Read more here. . . .

. . . . Back to the future? The defunct DeLorean car company is seeking new life, with an expected electric version of its iconic car At least that is what it seems with the defunct DeLorean company seemingly revving up to introduce an electric version of its iconic car. Led by a high-powered duo from EV company Karma, the new DeLorean effort will be based in San Antonio, Texas, instead of Northern Ireland. Read more here. . . .

The ongoing #LaNiña has peaked, according to @BOM_au which predicts a return to neutral conditions in autumn/spring.

But impacts on global weather and climate will continue.https://t.co/BqogpirziP

📷 Michelle Ali (Trinidad and Tobago) pic.twitter.com/MaNAjN25pM— World Meteorological Organization (@WMO) February 15, 2022

Calling it a “once in a millennium” occurrence, researchers have revealed a rogue wave recorded on Nov. 17, 2020, around 4.3 miles off the coast of Ucluelet on Vancouver Island in British Columbia was around 58 feet tall, making it about three times higher than surrounding waves. The wave was detected by an oceanic buoy belonging to Canadian-based research company MarineLabs. The event is the subject of a scientific report by Dr. Johannes Gemmrich and Leah Cicon, both of the University of Victoria, published last week in the journal, Scientific Reports. “Proportionally, the Ucluelet wave is likely the most extreme rogue wave ever recorded,” said Gemmrich, who studies large wave events along BC’s coastlines as part of his work as a research physicist at the University of Victoria. “Only a few rogue waves in high sea states have been observed directly, and nothing of this magnitude. The probability of such an event occurring is once in 1,300 years,” he said in a statement.

Sea level along the U.S. coastline is projected to rise, on average, 10 to 12 inches between now and 2050 — the same as was measured over the past 100 years, according to the 2022 Sea Level Rise Technical Report from NOAA and other federal agencies. Other key takeaways from the report include the prediction that sea level rise will create a profound shift in coastal flooding over the next 30 years by causing tide and storm surge heights to increase and reach further inland. By 2050, “moderate” (typically damaging) flooding is expected to occur, on average, more than 10 times as often as it does today, and can be intensified by local factors, according to the report. Additionally, the report says “failing to curb future emissions could cause an additional 1.5 to 5 feet of rise for a total of 3.5 to 7 feet by the end of this century.

Words to live by . . . .

“The ‘polluter pays’ principle is the only way to make the industrial sector pay for their use of raw materials, including the atmosphere, so I think it should be an essential underpinning.” — Jim Bruce, 93, the father of Canadian climate science, from an interview earlier this month with Canada’s National Observer.

Callaway Climate Insights Newsletter

Credit card companies are pulling out all the stops, with the issuers are offering insane travel rewards and perks.

We’re talking huge sign-up bonuses, points on every purchase, and benefits like lounge access, travel credits, and free hotel nights. For travelers, these rewards can add up to thousands of dollars in flights, upgrades, and luxury experiences every year.

It’s like getting paid to travel — and it’s available to qualified borrowers who know where to look.

We’ve rounded up some of the best travel credit cards on the market. Click here to see the list. Don’t miss these offers — they won’t be this good forever.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.