Economy

Gov. Signs Largest Property Tax Cut in Texas History: How It Benefits You

Published:

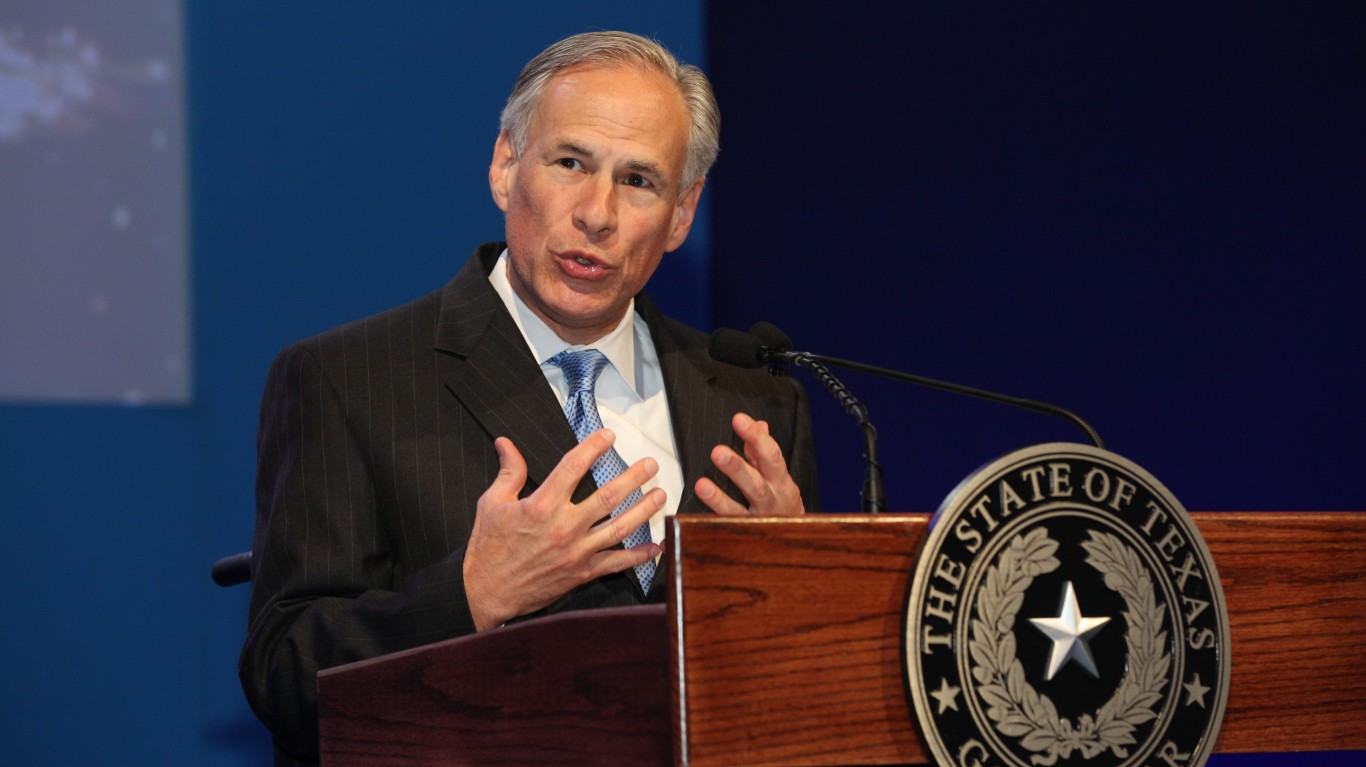

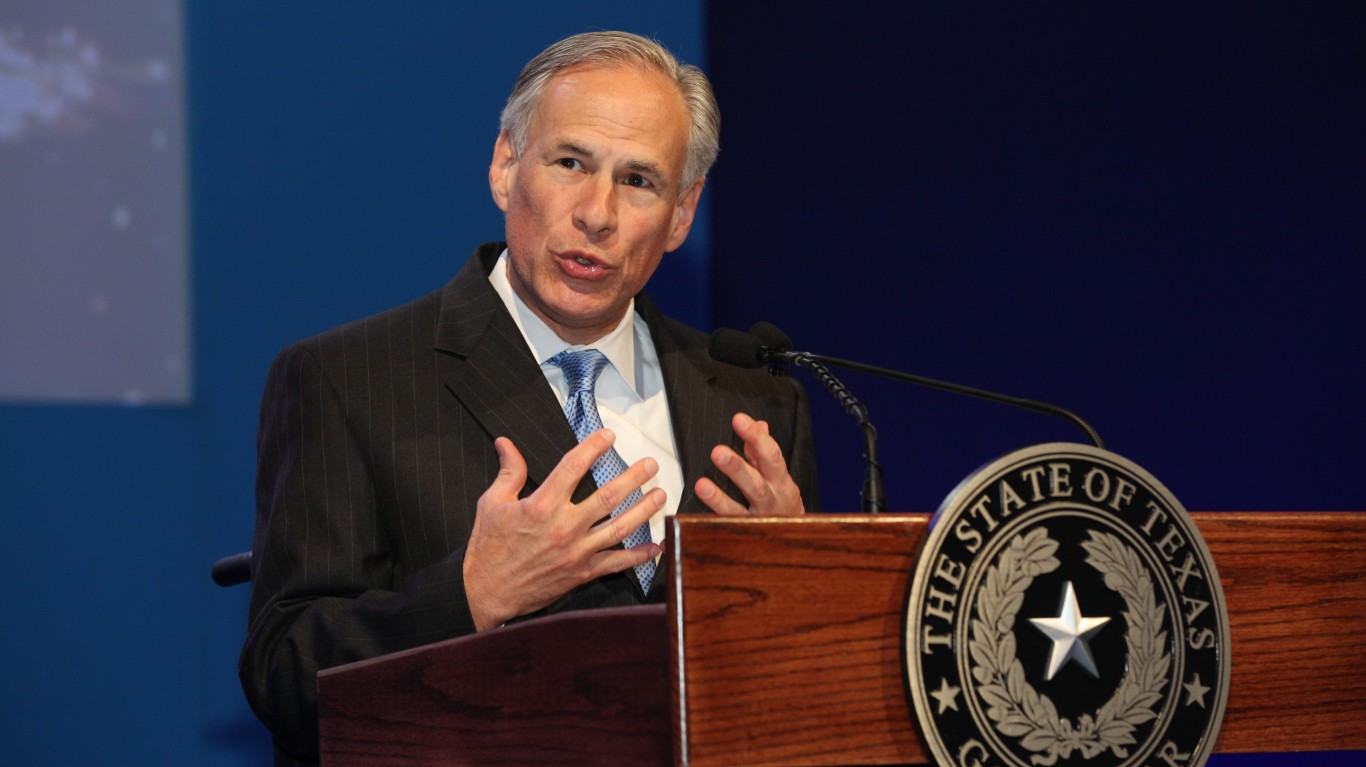

Texas Gov. Greg Abbott ceremonially signed the $18 billion property tax relief bill into law on Wednesday. The bill, which is the largest property tax cut in Texas history, will bring massive relief to Texans. Gov. Abbott originally signed the Texas property tax cut bill in late July.

Texas’ $18 billion property tax relief bill was passed on June 27 during the second special session of the state legislature and then officially signed into law by the governor last month. Gov. Abbott made reducing taxes for Texans an emergency item for the 88th Legislature in his 2023 State of the State address.

“Today, I am signing a law that will ensure more than $18 billion in property tax cuts — the largest property tax cut in Texas history,” Gov. Abbott said in a statement.

Lt. Gov. Dan Patrick, House Speaker Dade Phelan, Sen. Paul Bettencourt, Rep. Morgan Meyer and many other members of the Texas Legislature were present at the signing of the bill.

“We all came together to offer Texans the property tax relief they so desperately deserve, and I am proud to sign these new laws today,” Gov. Abbott said.

The money for the Texas property tax cut bill will come from the state’s record revenue surplus. The $18 billion bill is made up of Senate Bill 2 and Senate Bill 3.

Although the landmark Texas property tax cut bill has been approved by the governor, it still needs to be approved by voters, as it requires a constitutional amendment. Texas voters need to approve it with a simple majority on Nov. 7.

The largest property tax cut in Texas history will benefit residents in multiple ways. First, it will compress the tax rate by reducing the school property tax rate for all homeowners and business properties in the state. It will also raise the homestead exemption and create a pilot project to limit the growth of appraised values.

The homestead exemption is the amount of the home value that can’t be taxed to pay for public schools; the property tax bill raises this exemption from $40,000 to $100,000. It is estimated that the new homestead exemption limit and the school tax cuts could result in an average savings of $1,300 a year in property taxes.

The bill also includes extra cuts for seniors over the age of 65 and property owners with disabilities by raising the homestead exemption further to $110,000, resulting in an average savings of about $170 annually.

There is also a “circuit breaker” provision for non-homesteaded properties, both residential and commercial, such as rental houses, second homes, vacation properties, or commercial retail or business properties. This provision basically puts a 20% cap on appraisal increases for properties valued at $5 million or less.

Additionally, the new bill raises the franchise tax “no tax due” threshold to $2.47 million to offer relief to small business owners. Finally, it eliminates the complex filing requirements for those who do not owe tax.

This article originally appeared on ValueWalk

The last few years made people forget how much banks and CD’s can pay. Meanwhile, interest rates have spiked and many can afford to pay you much more, but most are keeping yields low and hoping you won’t notice.

But there is good news. To win qualified customers, some accounts are paying almost 10x the national average! That’s an incredible way to keep your money safe and earn more at the same time. Our top pick for high yield savings accounts includes other benefits as well. You can earn up to 3.80% with a Checking & Savings Account today Sign up and get up to $300 with direct deposit. No account fees. FDIC Insured.

Click here to see how much more you could be earning on your savings today. It takes just a few minutes to open an account to make your money work for you.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.