Most New Mexicans would have already received the rebate checks which started going out in June this year. The tax rebate check from New Mexico automatically went to those who filed their 2021 Personal Income Tax (PIT) return. If you have not received the rebate check yet because you haven’t yet filed the PIT, don’t worry, you still have time to claim the rebate.

Tax Rebate Check From New Mexico: Who Will Get It And How Much?

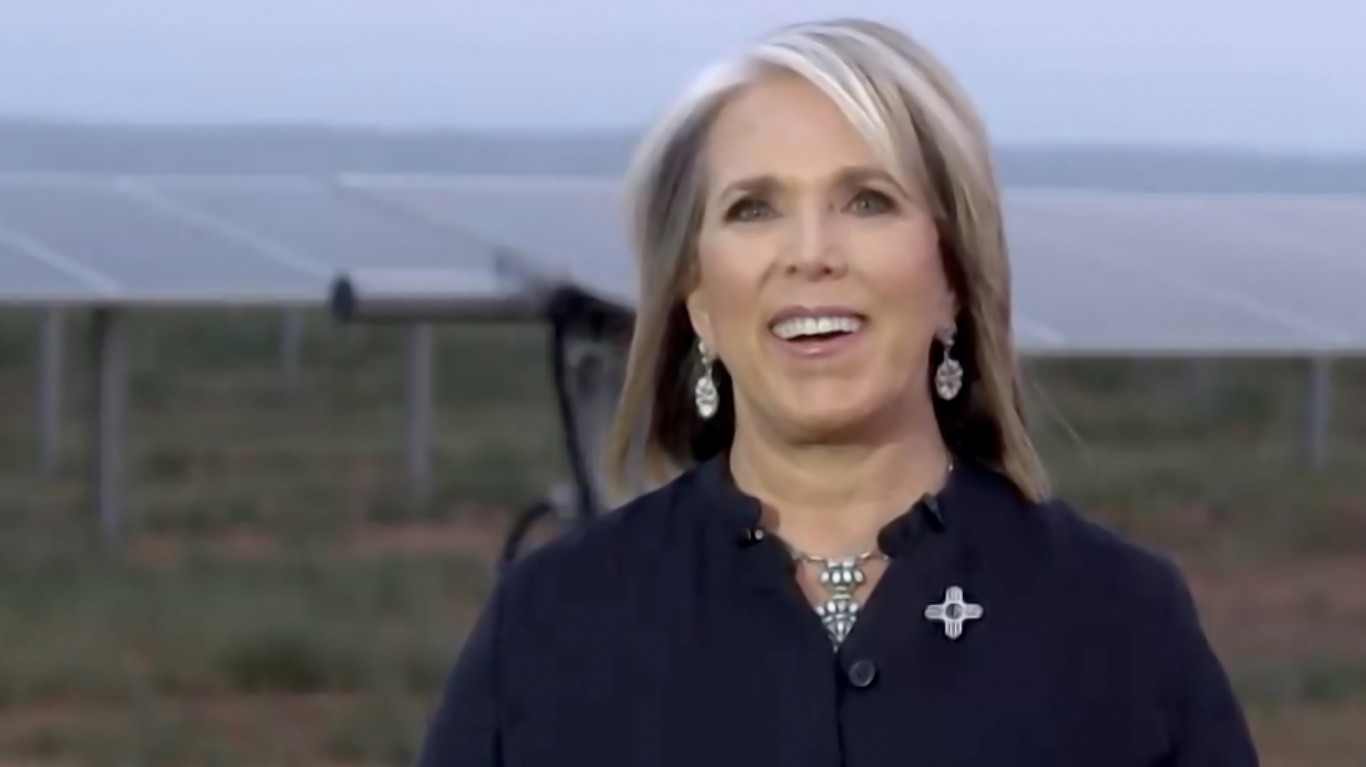

Gov. Michelle Lujan Grisham approved the tax rebate to help residents compensate for rising consumer prices. The state is using its fiscal year surplus because of high oil prices to give money back to eligible residents.

“Prices for basic necessities continue to be high across the nation” Gov. Grisham said when announcing the rebate. “Our state today is in a fantastic financial position, and it’s important to me that New Mexico’s families are sharing in that success.”

The rebate amount will automatically go to New Mexico residents who have filed their 2021 Personal Income Tax (PIT) return. Those receiving the check must not have been declared a dependent on another taxpayer’s return.

Eligible single filers (married individuals filing separately) will get $500, while couples filing jointly (heads of household and surviving spouses) will get $1,000 in the form of a tax rebate check from New Mexico.

New Mexico started mailing the rebate checks in June, while direct deposits were sent in mid-June. Most residents who qualified for the rebate would have received the rebate by now.

Those eligible but haven’t yet received the rebate payment likely haven’t yet filed a PIT return. If you are one of them, don’t worry, you can still claim the rebate by filing your PIT return by May 31, 2024.

What you need to do to claim the rebate

Once you file your PIT return by May 31, 2024, you don’t need to do anything else to claim the rebate. Those who received their 2021 refund by direct deposit will get the rebate through direct deposit, while others will receive a check in the mail.

If you are expecting a physical check but have moved to a new address, you will need to update your address. You can update the address either on your Taxpayer Access Point (TAP) account or submit Form RPD-41260, Personal Income Tax Change of Address Form to the Taxation and Revenue Department.

Unfortunately, if your banking information has changed since filling out your 2021 Personal Income Tax return, there is no way to update it. Such taxpayers will get a paper check in the mail. It must be noted that your rebate money could be chipped to pay any outstanding state taxes for the 2021 tax year only.

Visit the Taxation and Revenue Department website to get more information on the tax rebate check from New Mexico.

This article originally appeared on ValueWalk

It’s Your Money, Your Future—Own It (sponsor)

Retirement can be daunting, but it doesn’t need to be.

Imagine having an expert in your corner to help you with your financial goals. Someone to help you determine if you’re ahead, behind, or right on track. With SmartAsset, that’s not just a dream—it’s reality. This free tool connects you with pre-screened financial advisors who work in your best interests. It’s quick, it’s easy, so take the leap today and start planning smarter!

Don’t waste another minute; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.