No one expected the 2024 Social Security and Supplemental Security Income benefits to jump anywhere near 2023’s 8.7% increase. Those expectations were realized when the Social Security Administration (SSA) announced Thursday morning that the increase for 2024 will be 3.2%.

[in-text-ad]

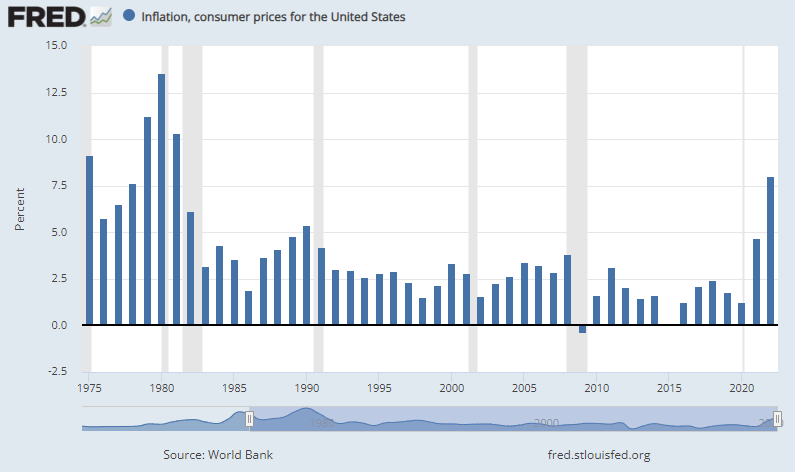

That number is closer to the long-term changes in the SSA’s cost-of-living allowance (COLA) over the past 15 years. In 2008, COLA rose by 5.8%, the biggest increase since 1981’s jump of 7.4%. The high for the past 50 years was 14.3%, posted in 1980 when the inflation rate for the year was 13.55%. U.S. inflation is running at 3.7% through September 2023. (See the cities where your Social Security gets eaten up fastest.)

Calculating COLA

COLA is based on the percentage increase in the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). The 2024 COLA is determined on CPI between the third quarter of last year and September of this year. Does it go without saying that if there is no increase, there is no change?

The Bureau of Labor Statistics in the Department of Labor determines CPI-W. By law, it is the official measure the Social Security Administration uses to calculate COLAs.

Making Social Security Solvent

The maximum amount of earnings subject to the Social Security payroll tax (12.4%) will rise from $160,200 to $168,600. That tax only applies to income between $168,600 and an upper limit of $250,000. People earning more than that do not pay the tax on a dollar more than $250,000.

According to a Congressional Budget Office report from last December, raising the cap to include earnings above $250,000 assures that the Social Security Trust Fund remains solvent through 2046. Congress would have to make this change, so that is unlikely to happen anytime soon.

Get Ready To Retire (Sponsored)

Start by taking a quick retirement quiz from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes, or less.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St.