Before the pandemic, demand for hotel rooms was growing at an annual rate of 30%. Vacation rentals were growing nearly as fast, at 26.4% annually.

As of July 2023, year-over-year demand growth for hotel rooms was negative, while demand for vacation rentals had slowed to 11.7%. As with all things related to real estate, the reason for the dramatic shift begins with the mantra, “Location, location, location.” (These are the oldest hotels in each state.)

Demand Growth

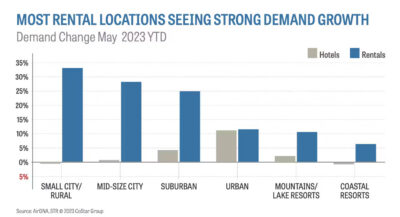

According to the latest annual study by AirDNA, short-term rentals in small cities or rural locations experienced demand growth of 24%. Demand for hotel rooms evaporated. In large urban centers, however, demand grew by 12% for short-term rentals and hotel rooms.

The following chart from AirDNA shows growth through May of this year.

Demand growth for hotel rooms in large cities is being driven partly by strict regulations related to short-term rentals. AirDNA cites a 2019 ordinance in Los Angeles that requires owners to live in the rental property for at least half the year. In addition, owners may rent their properties for just 120 days a year. Demand for short-term rentals has fallen by more than 6% in New York and Los Angeles and by nearly 6% in Boston.

Between May 2019 and May 2023, short-term rental demand rose by more than 10% in smaller cities like Fort Lauderdale. It was more than 8% in Phoenix, and nearly 8% in Tampa.

That growth is down to location and size.

Hotels lost ground in many of the areas they previously dominated but maintained their standing in urban areas and, to a lesser extent, mountain/lake resorts and coastal resorts. In urban areas, the ratio of sold to available rooms was 8.6 for 2022 and 2023 but dropped from 3.0 to 2.7 in mountains/lake resorts and 2.5 to 2.3 in coastal resorts. …

[B]edroom quantity also influences consumers’ lodging decisions. In May 2023 YTD, homes with three bedrooms accounted for 33% of total rental demand change, while 2-bedrooms accounted for 22% and 1-bedrooms accounted for 14%. For large groups, 3-bedroom vacation rentals may offer better deals than multiple hotel rooms. Also, larger rentals may be more suitable for families in search of long-term accommodation with more privacy.

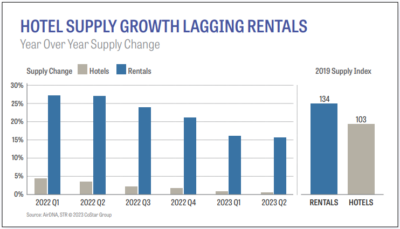

Lagging Supply

Not surprisingly, the supply of short-term rentals is growing much faster than the supply of hotel rooms. Over the 18-month period through June of 2023, the supply of short-term rentals grew by 15% year over year. Hotel supply rose by less than 5% during the same period.

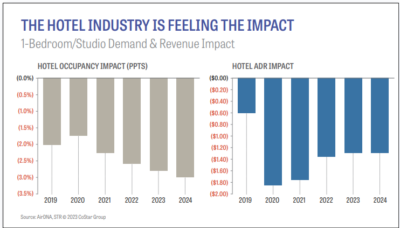

In one area, hotels are beating short-term rentals. The average daily rental rate is rising faster for hotels than for short-term rentals.

In urban areas, [the year-over-year average daily rate] change was 9.7% for hotels compared to 3.8% for rentals, while in mountains/lake resorts it was 8.6% for hotels and 1.3% for rentals. In urban areas and mountains/lake resorts, hotels are often located in highly desirable locations and include numerous amenities. Further, fiscal stimuli during the pandemic prevented mass permanent hotel closures.

According to the AirDNA study, the number of short-term rentals in the United States will reach 1.45 million by the end of this year. That is up from 1.14 million in 2019 (27%). The average daily rental rate will rise from $243 to $321, up 32%.

AirDNA expects the rental share of demand to continue growing, commenting, “Pandemic-related forces that shaped consumer preferences boosted demand for rental properties and may persist into the near future.”

The growth in demand for one-bedroom short-term rentals will affect the hotel industry’s occupancy rate and average daily room rate.

It’s Your Money, Your Future—Own It (sponsor)

Retirement can be daunting, but it doesn’t need to be.

Imagine having an expert in your corner to help you with your financial goals. Someone to help you determine if you’re ahead, behind, or right on track. With SmartAsset, that’s not just a dream—it’s reality. This free tool connects you with pre-screened financial advisors who work in your best interests. It’s quick, it’s easy, so take the leap today and start planning smarter!

Don’t waste another minute; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.