Since the bull market is now six years old, 24/7 Wall St. is looking for what may be some of the overlooked or oversold opportunities out there for investors with a long-term horizon, beyond the next few trading sessions. The oil and gas sector has been pounded, so we took a look at some of the key analyst calls made in that sector.

Some key Wall Street analysts have recently issued fresh Buy ratings in the oil and gas sector, despite the recent woes tied to lower energy prices. So, did a market sell-off of 300 points just bring another opportunity?

If one broader market trend has turned out to be true over and over during this bull market, it is that investors buy their favorite stocks on every major pullback. 24/7 Wall St. reviews dozens of analyst upgrades and downgrades each morning of the week to find hidden value or overlooked ideas. Are there still opportunities and value in the battered energy corridor?

A few things worked against oil and gas companies late in the week. A strong payrolls report had investors spooked that rates will rise sooner than expected. Also, crude was down more than $1.00 and under the $50 per barrel magical marker line late on Friday. Oil was as high as over $52 at one point on Thursday. The market sell-off on Friday was also far from kind to the energy sector.

ALSO READ: Hedge Funds Increase Short Positions in Crude as Rig Count Falls

Also more than 16,000 job cuts in February have been tied to the energy sector alone. If you looked at the non-seasonally adjusted Bureau of Labor Statistics data from Friday, the number of employees tied to oil and gas extraction, under the mining category, fell from 199,200 in January to 197,100 in February — and that was versus 201,900 in December of 2014.

On average, most of the upside calls here were around 20% or so to the specific price targets. Here are six stocks that were featured with fresh Buy or Outperform ratings by Wall Street analysts in the past week.

Abraxas Petroleum

Canaccord Genuity upgraded shares of Abraxas Petroleum Corp. (NASDAQ: AXAS) to Buy from Hold on Friday. The firm raised its price target to $3.75 from $3.25 in the call. If you consider the prior closing price of $3.11, this implied upside of just over 20%. The stock closed up 3% to $3.21 on Friday, but it was hard to not notice that the consensus price target was just above $4.00.

Canaccord Genuity’s report said that Abraxas has positions in two of the leading resource plays in the United States via the Williston Basin and the Eagle Ford. It also talked up its “under the radar assets with strong upside” in the Powder River and Permian Basins. The firm’s upgrade was based on a strong operational ability and an increase in net asset value with a solid balance sheet, which it can use to accretively add to its asset base.

BP

Thursday, BP PLC (NYSE: BP) was reiterated as Outperform at Oppenheimer, but the firm’s price target was raised to $50 from $45. With shares down almost 2% at $40.40 late on Friday, this implies upside of close to 24% — before considering the more than 5% dividend yield. Oppenheimer signaled that BP cut its 2015 capital expenditures (capex) to $20 billion, or 20% below prior guidance and about 13% lower than the $22.9 billion from 2014.

ALSO READ: 12 Big Dividend Hikes Coming Very Soon

Another BP observation was $1 billion in planned cost cuts, on top of the expected cost deflation from its suppliers and contractors. Now Oppenheimer sees operating cash flow of $22.5 billion in 2015 and $27.3 billion in 2016, but after funding the $20 billion in capex and $5.9 billion in dividends each year, it sees a free cash flow deficit of $3.6 billion this year, and it is expected to be $1.3 billion free cash flow positive in 2016, prior to any asset sales or stock buybacks. That values BP at 11 times expected 2016 earnings per share.

Halliburton

Halliburton Co. (NYSE: HAL) was part of a mid-week review by UBS. It was listed as one of four oil services stocks the firm had as a Buy. Its shares were down almost 45% since July, and Halliburton is closer to completing the merger with Baker Hughes than previously. Our paraphrasing of the UBS report said:

The oil field services giant announced last year a $1 billion investment to develop huge potential oil fields in Ecuador, and it has entered into a long-term deal with Petroamazonas, an Ecuador-based company involved in the exploration and development of the country’s oil reserves. With oil prices being absolutely demolished recently, this top oil service company is a great stock to buy on sale.

Halliburton’s UBS price target was $50 and the consensus target is almost $48. Shareholders are also paid a 1.7% yield. Halliburton shares were trading at $42.50 late on Friday, implying nearly 20% in total returns expected to the UBS target.

ALSO READ: Oil Is Cheaper Today Than in 1970

Marathon Petroleum

Marathon Petroleum Corp. (NYSE: MPC) recently was featured as an addition to a list of top picks at Credit Suisse. The firm raised its price target to $125 from $105 at the end of February, compared to a consensus of $112.50. Shares were trading at $99 late on Friday, which implies upside of close to 30% if you include the 1.9% dividend yield.

Credit Suisse said the increase to its target was not a call on the current refining conditions (called strong and possibly remaining above consensus for much of 2015), but rather due to the latest management update, in which they telegraphed their own “self-help” could add $1.5 billion to $1.7 billion over the next few years on top of 2014 EBITDA, after about $5.4 billion in 2014.

Valero Energy Partners

There were two positive calls on Valero Energy Partners L.P. (NYSE: VLP) this past week. This $3 billion outfit has crude oil and refined petroleum products pipelines, terminals and other transportation and logistics assets. It was started as Buy at Evercore ISI on Tuesday with a $60 price target. RBC Capital Markets reiterated its Outperform rating on the same day, but it raised its target to $65 from $60 in the call.

The positive reports on Valero Energy Partners were both around certain investor presentations in SEC filings. Shares were down just under $52 late on Friday, so with a 2% yield this implies upside of over 27% to the higher target and upside of about 18% to the lesser bullish target.

Apache

The last of the six oil and gas related stocks with Buy or Outperform ratings is not in alphabetical order because the positive rating came with a big price target cut.

Apache Corp. (NYSE: APA) was maintained as Buy last Wednesday at the independent research firm of Argus. The prior close was $66.72, and the firm said it was keeping the Buy rating but slashing the price target to $79 from $112.

Apache shares were down at $63.35 late on Friday, implying upside of 25%. So what did they say about the target cut while keeping it as a Buy? Despite a 40% drop, earnings per share beat estimates handily, and the drop is due to lower commodity prices. Argus said:

Nevertheless, we believe that APA continues to have strong prospects following asset sales and acquisitions that have helped it to focus on profitable liquids production in North America — particularly in the Permian and Central regions, where production is growing rapidly. The company also has a relatively strong balance sheet and may take advantage of the decline in commodity prices to purchase additional acreage.

ALSO READ: 9 Companies That Refuse to Pay Dividends but Should

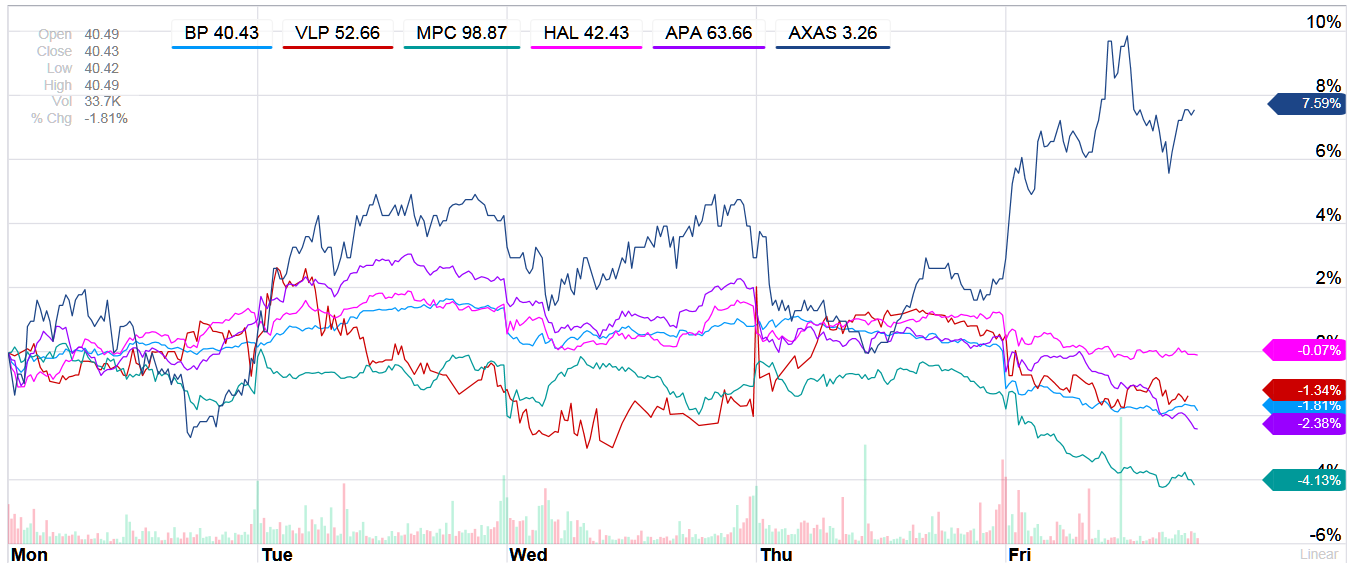

Below is a combined five-day chart from Yahoo! Finance of each of these oil and gas stocks (click to enlarge) to show how they did this past week.

Cash Back Credit Cards Have Never Been This Good

Credit card companies are at war, handing out free rewards and benefits to win the best customers. A good cash back card can be worth thousands of dollars a year in free money, not to mention other perks like travel, insurance, and access to fancy lounges. See our top picks for the best credit cards today. You won’t want to miss some of these offers.

Flywheel Publishing has partnered with CardRatings for our coverage of credit card products. Flywheel Publishing and CardRatings may receive a commission from card issuers.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.