Compared with 2013, base production fell by 54,000 barrels a day in 2014 and another 26,000 barrels a day on asset sales and other adjustments. Chevron’s average sales price fell from an average of $109 a barrel to $99 in 2014.

The good news for Chevron in 2014 is that its tight (shale) oil production rose by 41,000 barrels a day and growth from its capital projects totaled 13,000 barrels a day. In the two-years between the first quarter of 2013 and the fourth quarter of 2014 Chevron reduced its drilling costs per foot by 20% and its completion costs by 28%, and it increased the number of wells drilled with a single rig by 21%.

In the Permian Basin, Chevron holds approximately 2 million net acres and a potentially recoverable resource base of 7 billion barrels of oil equivalent. The company’s royalty rate in the Permian is less than $5 a barrel, less than half that of its nearest rival in the top 10 net producers in the region.

ALSO READ: 12 Companies Expected to Raise Their Dividends Very Soon

Chevron has boosted its projection of production growth from tight oil plays from a 2012 projection of less than 150,000 barrels of oil equivalent per day to more than 250,000 barrels a day in its current outlook.

Two major projects in the Gulf of Mexico began production in 2014. The Jack/St. Malo field has four wells of a projected 10 already producing, with two more due online by the end of this year. By the end of 2015, the field is expected to produce around 100,000 barrels a day. Chevron owns a majority interest in both fields and is the operator. The Tubular Bells project is expected to produce about 50,000 barrels a day. Chevron has a working interest of about 43% in Tubular Bells, which is majority owned and operated by Hess Corp. (NYSE: HES).

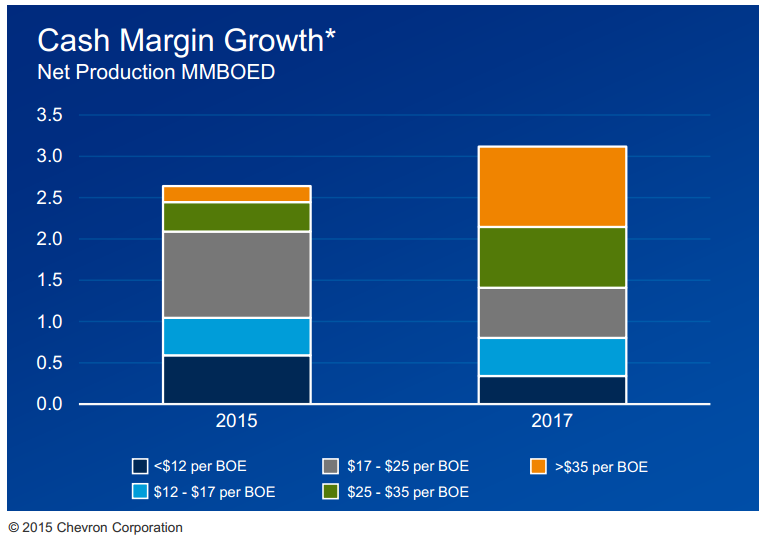

So why expand grow production 20% in the teeth of falling crude prices? In Chevron’s case, the argument is that by growing volume in higher margin barrels, the company can raise its cash flow and its average cash margin per barrel. The following chart, which Chevron included in its presentation, tells the company’s story.

Chevron used a crude oil average price of $60 a barrel in 2015 and $70 a barrel in 2017. Low-margin barrels (less than $25 a barrel) will comprise about 80% of Chevron’s 2015 net production, but only about half of 2017 net production.

Volume growth over the three-year period was going to happen in any case, following to the plans Chevron made in 2010 to develop its Gulf of Mexico projects. The Permian Basin projects developed since then are a bonus.

Chevron’s stock is down about 0.8% in the noon hour on Tuesday, at $103.14 in a 52-week range of $98.88 to $135.10. All the oil stocks traded lower Tuesday as the dollar gained strength and crude oil prices fell below $49 in advance of Wednesday’s inventory report.

ALSO READ: 6 Oil and Gas Stocks Analysts Want You to Buy

The #1 Thing to Do Before You Claim Social Security (Sponsor)

Choosing the right (or wrong) time to claim Social Security can dramatically change your retirement. So, before making one of the biggest decisions of your financial life, it’s a smart idea to get an extra set of eyes on your complete financial situation.

A financial advisor can help you decide the right Social Security option for you and your family. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you.

Click here to match with up to 3 financial pros who would be excited to help you optimize your Social Security outcomes.

Have questions about retirement or personal finance? Email us at [email protected]!

By emailing your questions to 24/7 Wall St., you agree to have them published anonymously on a673b.bigscoots-temp.com.

By submitting your story, you understand and agree that we may use your story, or versions of it, in all media and platforms, including via third parties.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.