In an announcement that should have surprised no one, Chevron Corp. (NYSE: CVX) said Thursday it would not counter a proposal from Occidental Petroleum Corp. (NYSE: OXY) to acquire Anadarko Petroleum Corp. (NYSE: APC). The announcement came ahead of tonight’s midnight expiration of the four-day period during which Chevron was contractually able to make a counteroffer. Chevron will receive a $1 billion breakup fee.

Anadarko is expected to terminate its previously approved deal with Chevron and accept the Occidental offer. Oxy had pushed its cash and stock offer to $38 billion, of which 78% ($59 per Anadarko share) was cash. Chevron’s first — and as it turns out, final — offer totaled about $33 billion, of which just 25% ($16.25 per share) was cash. Both offers included the assumption of Anadarko’s debt, raising the total enterprise value of Oxy’s deal to about $57 billion.

Chevron CEO Michael Wirth commented on his company’s decision:

Winning in any environment doesn’t mean winning at any cost. Cost and capital discipline always matter, and we will not dilute our returns or erode value for our shareholders for the sake of doing a deal. Our advantaged portfolio is driving robust production and cash flow growth, higher investment returns and lower execution risk.

He may have a point. Forbes contributor Robert Rapier mentioned earlier this week that energy research firm Rystad Energy “recently noted that Anadarko’s Permian wells produce less oil and gas per-foot drilled than either Chevron or Occidental.” That’s a big deal because it raises the production costs, raises the break-even price and lowers the per-barrel margin.

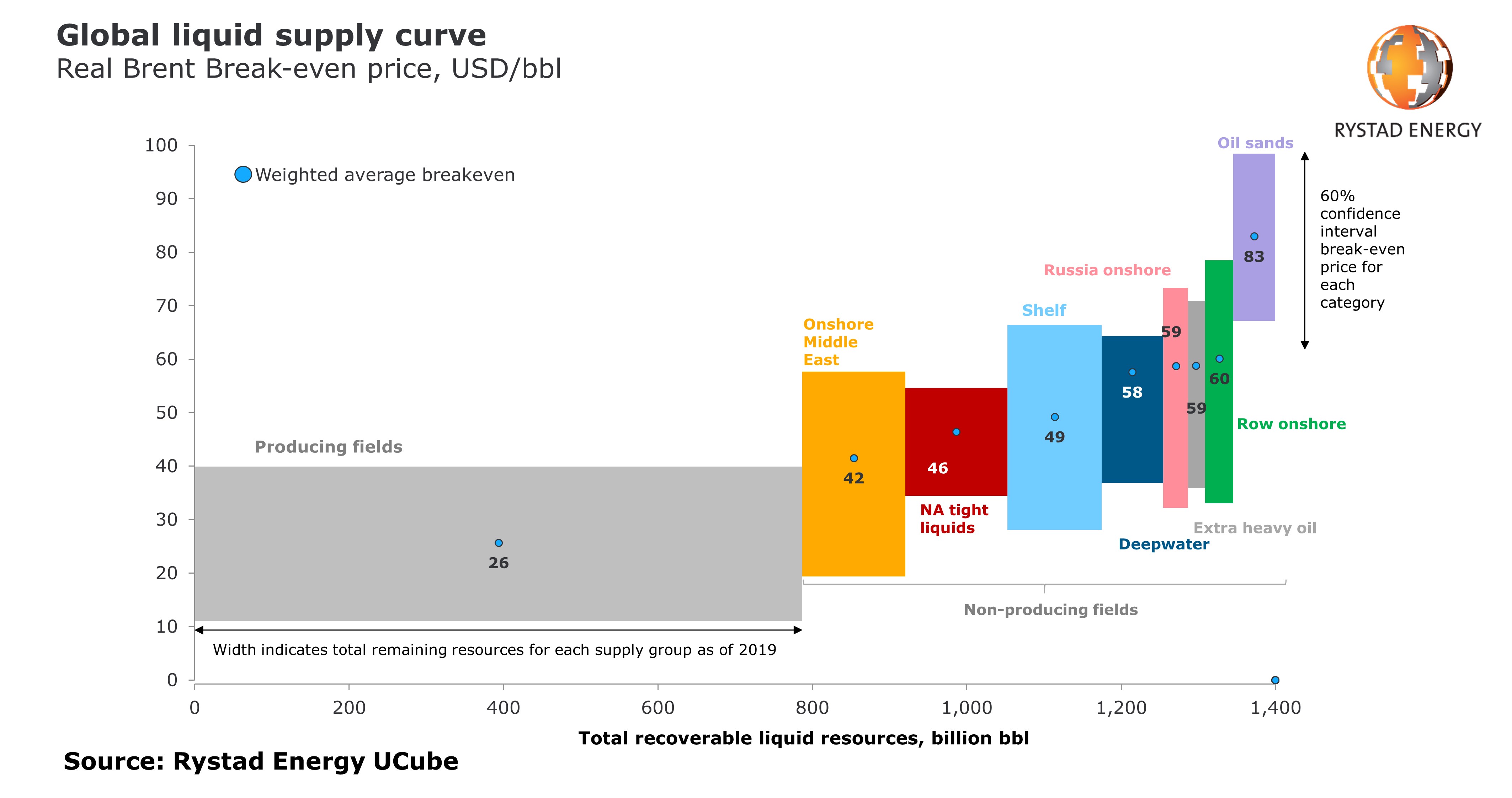

Thursday morning, Rystad posted a chart showing the average weighted break-even price for a barrel of Brent-equivalent crude. In the firm’s chart, reprinted here, the average break-even price for a barrel of shale crude (labeled “NA tight liquids) is $46, lower than any other region except the Middle East. Currently producing wells have the lowest cost of all ($26 a barrel) and account for more than half of the 1.4 trillion recoverable barrels in the world.

Chevron has just saved more than $8 billion in cash and added another billion from the breakup fee. Is it time for the company to go shopping again? Chevron is already the largest liquids producer in the Permian Basin, or, as CEO Wirth put it when he first announced the offer for Anadarko, “Trial and error may not be in our wheelhouse, but … technology and scale [are].”

The same could be said of any of the supermajor integrated oil companies. There are several likely acquisition targets for Chevron and the other supermajor energy companies: Exxon Mobil Corp. (NYSE: XOM), Royal Dutch Shell PLC (NYSE: RDS-A), Total S.A. (NYSE: TOT), Equinor ASA (NYSE: EQNR) and Eni SpA (NYSE: E). The only supermajor missing from this list is BP PLC (NYSE: BP), which paid $10.5 billion last year to pick up BHP Billiton’s U.S. onshore assets, so the British firm is likely not looking for another major deal.

Investment analysts at SunTrust Robinson Humphrey looked at six potential buyout targets. We matched those with our own data on Buy-rated exploration and production stocks and found that all six were top picks. One, EOG Resources Inc. (NYSE: EOG), has a market cap of $54.6 billion, even larger than Occidental’s $42.3 billion cap, and would not be a likely target for any but the largest of the supermajors.

The next-largest by market cap is Pioneer Natural Resources Co. (NYSE: PXD), which is valued at $25.6 billion. Pioneer is a huge player in the Permian Basin and the Eagle Ford in Texas, and the company owns more than 20,000 locations in the world’s second-largest oil reservoir in the Midland Basin. With a stellar balance sheet, the company is poised to remain a top player in the Permian as it expects to deliver solid production growth in 2019 and beyond. Pioneer pays a tiny 0.29% dividend, and shares traded Thursday morning at $151.86, down about 1.2%, in a 52-week range of $119.08 to $213.40. The consensus price target on the stock is $201.99.

Concho Resources Inc. (NYSE: CXO) has a market cap of $22.1 billion and is the largest acreage holder of the publicly traded Permian large-caps, and it provides investors peer-leading exposure to three of the best catalysts across the Delaware Basin, including the Wolfcamp XY, Wolfcamp D and Bone Spring Shale. Concho pays a 0.45% dividend, and shares traded Thursday morning at $110.81, up about 0.7%, in a 52-week range of $93.31 to $161.21. The consensus price target is $155.58.

With a market cap of $11.6 billion, Noble Energy Inc. (NYSE: NBL) has operations in the Permian and other U.S. basins, but its principal focus right now is a massive natural gas project in Israel. Noble pays a 1.78% dividend, and shares traded Thursday morning at $24.25, down about 1.2%, in a 52-week range of $17.11 to $37.76. The consensus price target is $33.69.

PDC Energy Inc. (NYSE: PDCE) has a market cap of $2.4 billion and is a diversified exploration and production outfit with assets in the Rockies, the Permian and the Utica Shale. The company’s recently acquired a 55,000 net acre position in the Permian. PDC is targeting 10% to 15% production growth in 2020, and progress continues with operating expense improving and well cost declining in the Delaware basin with longer laterals and modified completion design. PDC does not pay a dividend. Shares traded Thursday morning at $36.71, down about 0.7%, in a 52-week range of $26.59 to $66.20. The consensus price target is $57.67.

SRC Energy Inc. (NYSE: SRCI) is a small-cap ($1.4 billion) exploration and production company with net proved oil and natural gas reserves of 88 million barrels of oil and condensate, 771.9 billion cubic feet of natural gas and 89.1 million barrels of natural gas liquids in the Denver-Julesburg Basin. SRC also pays no dividend, and it traded down about 0.8% Thursday at $5.78. The 52-week range is $4.01 to $13.32, and the consensus price target is $8.64.

A couple of interesting observations about this list: the market cap of every one of these potential targets is lower now that it was two weeks ago and the price target on each is higher. That probably reflects a $5 per barrel crude oil price drop since late April that has cooled investor enthusiasm for oil company stocks and a slightly longer 12-month view taken by investment firms.

About three weeks ago, analysts at Stifel named five stocks with implied upside of 100% or more. In addition to Concho, the others were Chaparral Energy Inc. (NASDAQ: CHAP), Carrizo Oil & Gas Inc. (NASDAQ: CRZO), Parsley Energy Inc. (NYSE: PE) and QEP Resources Inc. (NYSE: QEP).

Is Your Money Earning the Best Possible Rate? (Sponsor)

Let’s face it: If your money is just sitting in a checking account, you’re losing value every single day. With most checking accounts offering little to no interest, the cash you worked so hard to save is gradually being eroded by inflation.

However, by moving that money into a high-yield savings account, you can put your cash to work, growing steadily with little to no effort on your part. In just a few clicks, you can set up a high-yield savings account and start earning interest immediately.

There are plenty of reputable banks and online platforms that offer competitive rates, and many of them come with zero fees and no minimum balance requirements. Click here to see if you’re earning the best possible rate on your money!

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.