The EIA’s latest forecast, issued Tuesday, calls for WTI crude oil prices to rise to an average price of $95.60 a barrel in 2014. The prior forecast called for an average price of $95.33 a barrel. In 2013 the average per barrel price was $97.91.

Brent crude is now forecast to average $104.88 a barrel in 2014 compared with an average of $108.64 last year.

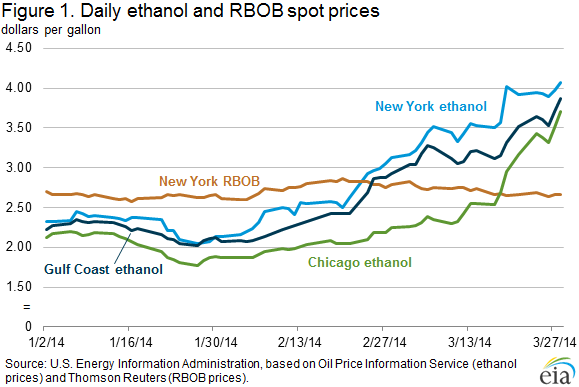

Pump prices for gasoline have been rising steadily for many weeks now and there are a number of reason given for the ever-higher prices. Production costs are higher, demand is down in both the U.S. and China, and, not least, the price of ethanol is rising. By the end of March the spot price of a gallon of ethanol exceeded the price of a gallon of reformulated (RBOB) gasoline by more than $1.00. Here’s the EIA chart:

There has been plenty of speculation recently that WTI crude oil prices could sink to $75 a barrel in the U.S. That is almost certainly not going to happen. A more realistic low price for crude is $95.

Credit Card Companies Are Doing Something Nuts

Credit card companies are at war. The biggest issuers are handing out free rewards and benefits to win the best customers.

It’s possible to find cards paying unlimited 1.5%, 2%, and even more today. That’s free money for qualified borrowers, and the type of thing that would be crazy to pass up. Those rewards can add up to thousands of dollars every year in free money, and include other benefits as well.

We’ve assembled some of the best credit cards for users today. Don’t miss these offers because they won’t be this good forever.

Flywheel Publishing has partnered with CardRatings for our coverage of credit card products. Flywheel Publishing and CardRatings may receive a commission from card issuers.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.