Energy

Why President Obama's $10-a-Barrel Oil Tax Will Go Nowhere

Published:

Last Updated:

When the Obama Administration on Thursday proposed imposing a $10 per barrel tax on every barrel of oil produced in the United States., the reaction was muted because it didn’t really need to be louder. Virtually no one besides the president is likely to support the idea.

The industry hates it, of course, because it will raise pump prices for gasoline by 25 cents a gallon and the industry will look like the bad guys. Legislators from producer states hate it, and most consumers don’t want to pay more for anything, especially gasoline now that it has finally reached a level that most consumers can afford to pay without having to give up everything else.

As proposed, the fee would be phased in over five years and be paid by the oil companies. Ultimately, of course, motorists pay. The fees collected are targeted for the federal Highway Trust Fund and to fund investments in new transportation modes that do not include more burning of fossil fuels. According to the White House fact sheet:

By placing a fee on oil, the President’s plan creates a clear incentive for private sector innovation to reduce our reliance on oil and at the same time invests in clean energy technologies that will power our future.

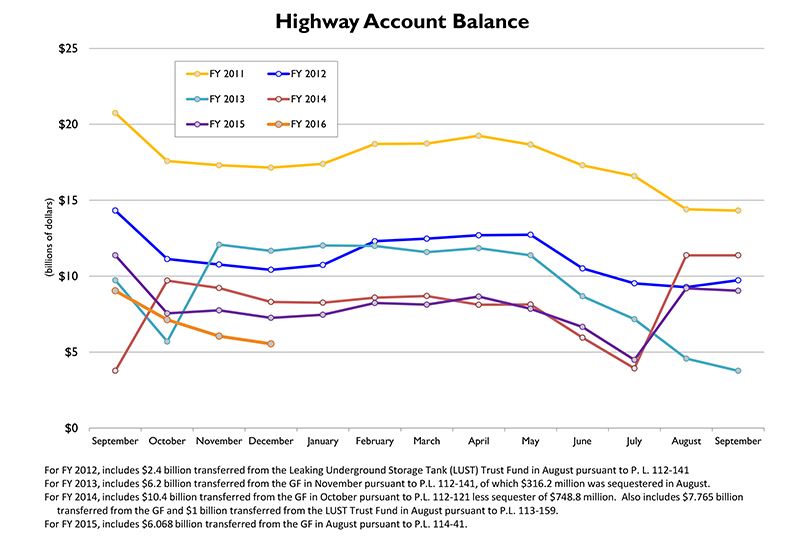

The current federal tax on gasoline stands at $0.184 per gallon and has not been increased since 1993. Since 1997 all funds raised from the federal gas tax have gone to the Highway Trust Fund, which was rescued from oblivion in December when its renewal was included in the federal budget deal. More fuel-efficient cars have cut into Highway Trust Fund collections as we can see in this chart from the U.S. Department of Transportation:

The short orange line in the chart shows the fund’s balance through the first quarter of federal fiscal year 2016.

The White House claims that today’s congested transportation system costs U.S. families $160 billion a year and U.S. businesses nearly $30 billion. A $10-a-barrel tax on 9 million barrels a day of production would raise nearly $33 billion a year. It is indeed a modest proposal, but like Jonathan Swift’s Modest Proposal of 1729, has little chance of being enacted.

Choosing the right (or wrong) time to claim Social Security can dramatically change your retirement. So, before making one of the biggest decisions of your financial life, it’s a smart idea to get an extra set of eyes on your complete financial situation.

A financial advisor can help you decide the right Social Security option for you and your family. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you.

Click here to match with up to 3 financial pros who would be excited to help you optimize your Social Security outcomes.

Have questions about retirement or personal finance? Email us at [email protected]!

By emailing your questions to 24/7 Wall St., you agree to have them published anonymously on a673b.bigscoots-temp.com.

By submitting your story, you understand and agree that we may use your story, or versions of it, in all media and platforms, including via third parties.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.