The U.S. Energy Information Administration (EIA) released its weekly petroleum status report Wednesday morning showing that U.S. commercial crude inventories increased by 2.2 million barrels last week, maintaining a total U.S. commercial crude inventory of 429.7 million barrels. The commercial crude inventory remains in the lower half of the average range for this time of year.

Tuesday evening the American Petroleum Institute (API) reported that crude inventories rose by about 1.1 million barrels in the week ending April 20. Gasoline inventories fell by about 2.7 million barrels and distillate stockpiles decreased by 1.9 million barrels. For the same period, analysts expected crude inventories to decrease by about 2 million barrels and gasoline inventories to drop by 625,000 barrels. Diesel inventories are seen down about 861,000 barrels.

Total gasoline inventories increased by 800,000 barrels last week, according to the EIA, and remain in the upper half of the five-year average range. U.S. refineries produced 9.9 million barrels of gasoline a day last week, down by about 300,000 barrels compared to the prior week. Total motor gasoline supplied (the agency’s proxy for demand) averaged about 9.4 million barrels a day for the past four weeks, up about 1.3% compared with the same period a year ago.

Before the EIA report, benchmark West Texas Intermediate (WTI) crude for June delivery traded up slightly at around $67.75 a barrel, and it dipped to around $67.50 (down about 0.3%) shortly after the report’s release. WTI settled at $67.70 on Tuesday and opened at $67.75 Wednesday morning. The 52-week range on June futures is $44.54 to $69.55.

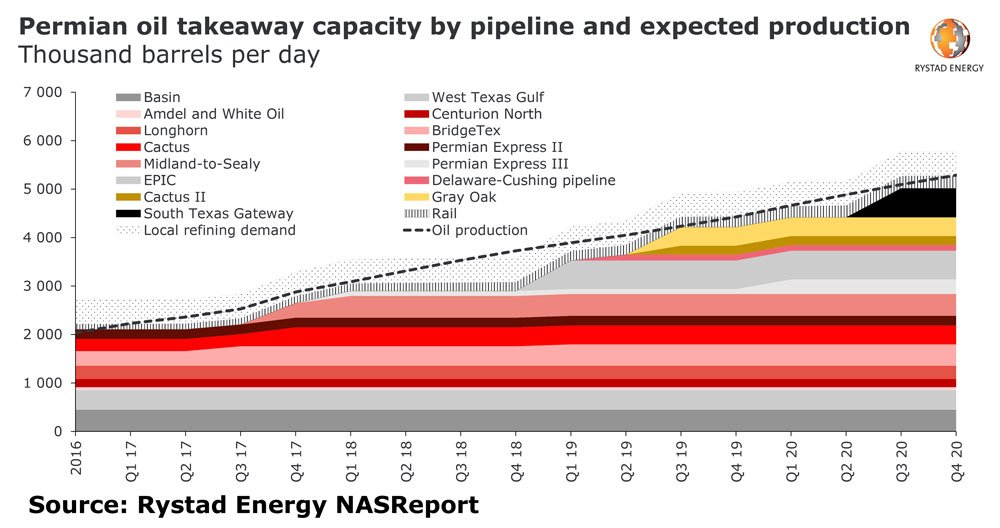

We’ve mentioned in passing an increasing concern for Permian Basin producers: crude oil pipeline takeaway capacity. Permian crude oil on Tuesday traded for a while at a discount of $10.75 per barrel to the spot price of WTI at Cushing. By the end of the day the discount had dropped to around $8.

The price differential widens as pipeline capacity for more oil shrinks. Right now, takeaway capacity for the Permian to Houston route is nearly full because crude oil in Houston is more valuable both to meet refinery and export demands. Moving crude from the Permian to Cushing and then down to Houston, because that’s where the pipeline capacity is, means producers must accept a discount at the wellhead in order to compete at the refineries and export terminals.

New pipelines from the Permian to Houston and Corpus Christi are coming online. A 450,000 barrel a day pipeline is nearing full shipping capacity after beginning operation late last year, and a 100,000 barrel a day expansion is set to come online this quarter. But most new capacity is not expected to be available until next year.

The following chart from Rystad Energy shows Permian production growth and available pipeline takeaway capacity through the end of 2020. The dotted line on the chart represents total Permian production.

Week over week, U.S. crude oil exports rose by 582,000 barrels a day last week and U.S. production rose by 46,000 barrels a day to 10.59 million barrels. Exports averaged 2.33 million barrels a day last week and have a cumulative daily average for the year of 1.59million barrels a day, a 107% increase over the year-ago export total.

Distillate inventories decreased by 2.6 million barrels last week and remain in the lower half of the average range for this time of year. Distillate product supplied averaged over 4 million barrels a day for the past four weeks, down by 2.5% compared with the same period last year. Distillate production averaged 5 million barrels a day last week, down by about 100,000 barrels a day compared to the prior week’s production.

For the past week, crude imports averaged about 8.5 million barrels a day, up by 539,000 barrels a day compared with the previous week. Refineries were running at 90.8% of capacity, with daily input averaging over 16.6 million barrels a day, about 328,000 barrels a day less than the previous week’s average. Exports of refined products rose by 1.03 million barrels a day last week to 6 million barrels a day.

According to AAA, the current national average pump price per gallon of regular gasoline is $2.782, up 5.1 cents from $2.731 a week ago and up more than 18 cents per gallon compared with the month-ago price. Last year at this time, a gallon of regular gasoline cost $2.408 on average in the United States.

Here is a look at how share prices for two blue-chip stocks and two exchange traded funds reacted to this latest report.

Exxon Mobil Corp. (NYSE: XOM) traded down about 0.7%, at $77.77 in a 52-week range of $72.16 to $89.30. Over the past 12 months, Exxon stock has traded down about 4.9%.

Chevron Corp. (NYSE: CVX) traded down about 0.8%, at $121.57 in a 52-week range of $102.55 to $133.88. As of last night’s close, Chevron shares are trading up about 13.8% over the past year.

The United States Oil ETF (NYSEARCA: USO) traded down about 0.7% to $13.58, in a 52-week range of $8.65 to $14.00.

The VanEck Vectors Oil Services ETF (NYSEAMERICAN: OIH) traded down about 0.4%, at $26.72 in a 52-week range of $21.70 to $29.53.

Get Ready To Retire (Sponsored)

Start by taking a quick retirement quiz from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes, or less.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Get started right here.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St.