Energy

Meeting Global Climate Goals Means Bursting the Carbon Bubble

Published:

Last Updated:

Global proved reserves of fossil fuel far exceed the amount that can be produced and consumed while still giving the world a chance to meet international climate targets. Proved reserves of coal, for example, could be produced at current levels for another 132 years.

The amount of proved reserves of oil and natural gas remaining could be produced at current levels for another 50 and 51 years, respectively. Proved reserves, by definition, can be produced with 90% certainty with current technology and at current economics.

The data is included in a new report Friday from Carbon Tracker, an independent financial think tank that analyzes the impact of the energy transition on capital markets.

The more fossil fuel produced (and consumed), the lower the world’s chances of keeping climate warming below 2° Celsius by 2100. Carbon Tracker calculates that only 24 years worth of proved reserves can be produced if warming is to have a 50% chance of meeting a goal of keeping global temperatures from rising by 1.75° Celsius and just 13 years for a 50% chance if the goal is to keep the earth from warming by 1.5° Celsius. The Paris Agreement requires that countries limit warming to “well below” 2° Celsius and “pursue efforts” to limit warming to 1.5° Celsius.

The difference between the estimated production life of fossil fuel proved reserves and the amount that can be produced while still having a reasonable chance to meet climate goals is what Carbon Tracker calls the carbon bubble.

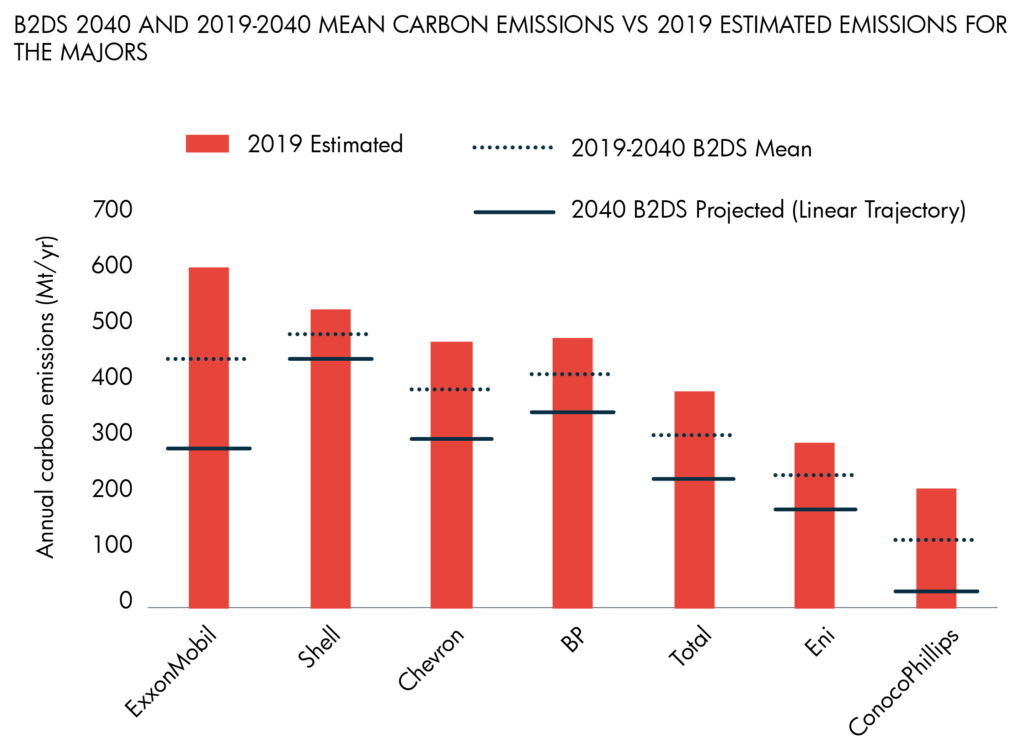

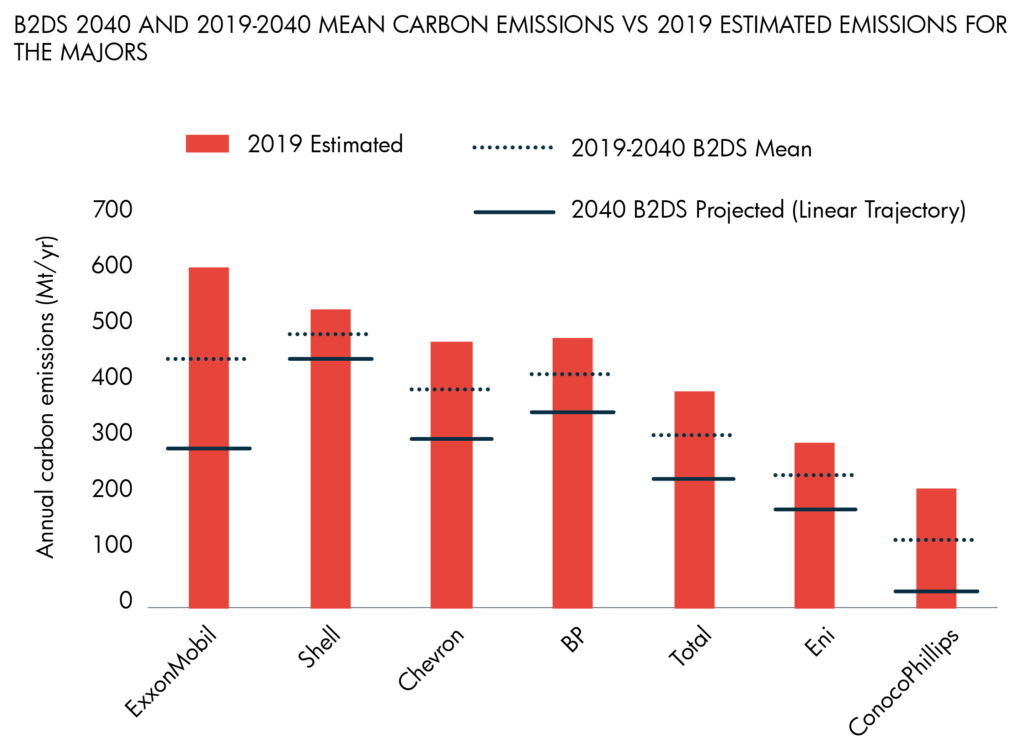

From this base, Carbon Tracker uses data from energy industry analysis firm Rystad Energy and the International Energy Agency to calculate the maximum amount of carbon emissions each of seven major oil and gas producers could produce relative to estimated 2019 emissions in order to reach a carbon budget consistent with a “below 2° Celsius scenario” (B2DS).

In the following chart, the red bar indicates the total estimated millions of metric tons of carbon emissions in 2019 for each company. The dashed line indicates required annual mean emissions in millions of metric tons for the 20 years to 2040 to meet the B2DS target, and the solid line indicates a linear trajectory of projected 2040 emissions needed to meet the target.

To meet international goals, these companies need to reduce emissions from oil and gas production by 40% over the next 20 years.

The dilemma for these producers is that if they can’t produce their proved reserves they risk destroying a huge chunk of shareholder value. Assets that can’t be produced (called stranded assets in energy industry parlance) have essentially no value.

Here’s the catch, according to Carbon Tracker: “Companies can pursue different trajectories to meet their production reduction to 2040, however, those that delay taking action carry a greater risk of being caught out.” In other words, if these companies don’t take meaningful steps to reduce their emissions they risk being throttled either by legislation that could ultimately ban production or by litigation from governments and individuals whose cities and homes are slowly being flooded by rising sea levels.

Carbon Tracker also notes that no company currently meets the targets set by the Paris Agreement. And as we noted last month, by 2030 the world’s 50 largest oil companies are on track to raise production by 7 million barrels a day.

Are you ready for retirement? Planning for retirement can be overwhelming, that’s why it could be a good idea to speak to a fiduciary financial advisor about your goals today.

Start by taking this retirement quiz right here from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes. Smart Asset is now matching over 50,000 people a month.

Click here now to get started.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.