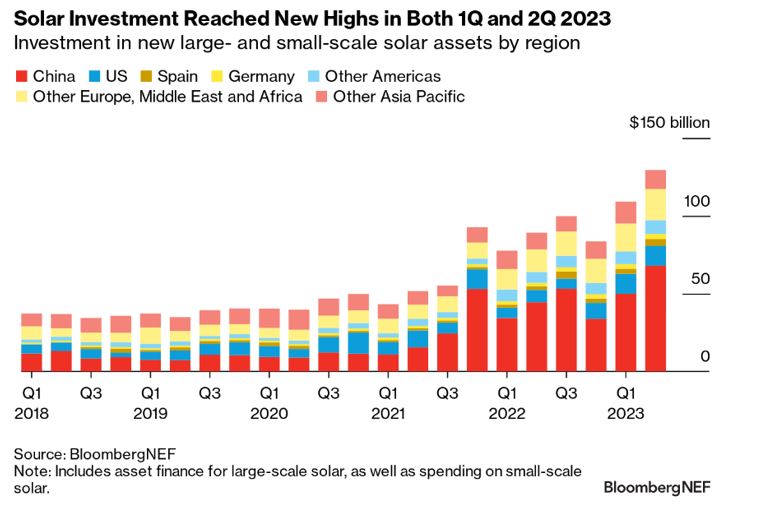

A new report from BloombergNEF (BNEF) released this week showed that global investment in renewable energy rose 22% year over year to $358 billion in the first six months of 2023. That is an all-time high for any six-month period.

The bulk of the investment, $335 billion, was invested in financing large- and small-scale projects. Venture capital and private equity investments accounted for $10.4 billion of the investment, up 25% year over year. New equity from public markets rose 25% to $12.7 billion in the first half of the year. (See how the most important issues to Americans rank.)

Solar projects grabbed the lion’s share of the investment, $239 billion, up 43% year over year. China accounted for about half of that total, while the United States invested $25.5 billion in solar projects to finish a distant second.

That is the good news. The bad news is that the rate of investment in renewable energy deployment needs to rise by 76% in order to meet the net-zero goal. From BNEF’s summary of the report:

According to BNEF’s New Energy Outlook, the world needs to spend a total of $8.3 trillion on renewable energy deployment between 2023 and 2030 to align with a global net-zero trajectory by 2050, keeping global warming well below 2°C. This is equivalent to $590 billion being invested via asset finance and small-scale solar per six-month period. The $335 billion spent on such activities in 1H 2023 is therefore well below what is required to get on track for net zero.

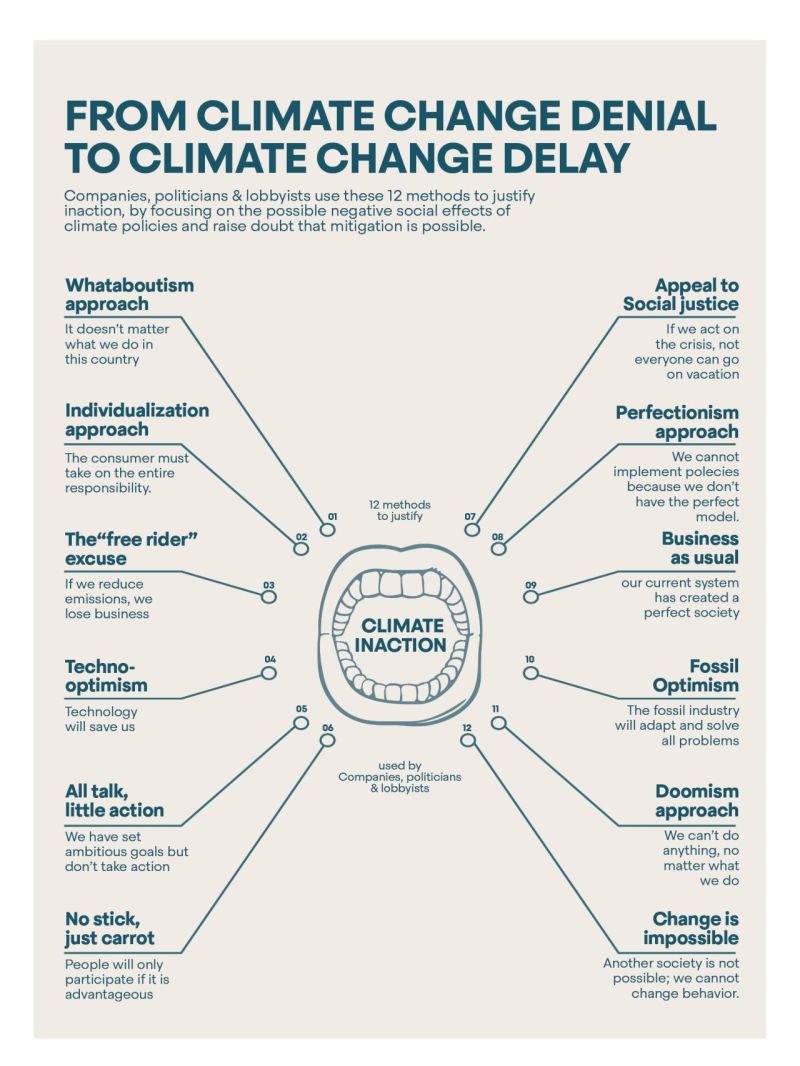

In an effort to help people understand just how the fossil-fuel industry tries to gum up the transition to renewable energy, Danish designer Kasper Benjamin Reimer Bjørkskov (@KBRH87) has produced this handy chart of the typology of climate denial. It shows “12 methods to justify climate inaction used by companies, politicians, and lobbyists.”

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.